MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Milton Shuts the Door

on Multifamily Housing Plans

The MBTA Communities Act, passed in 2021, provides that the 177 communities serviced by the MBTA must create multifamily zones to spur housing development close to public transportation. But the issue is an emotionally charged one, with passions high on both sides. And Milton residents in February rejected a plan to create such housing ‚ choosing a loss of some state funding over an approximately 25 percent increase in their housing stock, along with the possibility of greater congestion.

on Multifamily Housing Plans

My Musings on Massachusetts’ Fiscal Picture

Since the start of FY2024 on July 1, 2023, the state has experienced six straight months of revenues falling short of expectations. The single biggest factor is the unprecedented growth of the state budget since FY2021. The $15 billion increase in state spending contextualizes the seemingly modest projected revenue growth of 1.6 percent for FY2024 by highlighting that the base is very inflated.

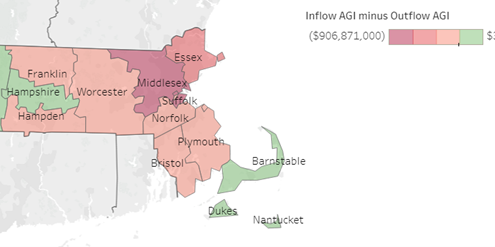

Harsh Tax Policies in NY Make MA Seem Palatable as Some Residents Look to Relocate

While many Massachusetts residents relocated to either New Hampshire or Florida in 2021, a considerable amount of New Yorkers migrated into Massachusetts. Their motivation to relocate seems largely tied to the harsh taxes in New York, which surpass the rates in Massachusetts.

Massachusetts’ “Stinger” Tax, Explained

Massachusetts recognizes S Corporations as flow-through entities. However, it levies an additional "stinger" tax on shareholders of these types of entities, depending on their revenue and industry. The state should reform S Corporation tax policy because the current system is uncompetitive and nonneutral. And, in addition to the new surtax on earnings over $1 million, the stinger tax could make business owners consider relocating, which would take revenue and surtax from the state.

Changes to the Confounding Massachusetts Estate Tax

Policymakers on Beacon Hill have many visions of tax relief for this fiscal year, and all of them include changing the estate taxes. What are those changes, and what would their impact be?

An Examination of the Commonwealth Rainy Day Fund

Established in 1987, the Commonwealth Stabilization Fund has been a key component of the financial stability of Massachusetts. As of recently, it's seen spectacular growth. Why?

GDP by Industry: Middlesex County v. Suffolk County

Middlesex and Suffolk counties have contributed far more to the state's GDP than any other county in Massachusetts. However, the two differ in which industries are responsible for the greatest shares of their GDP.

The Curious Case of the Missing Stabilization Funds

Stabilization funds are a key component of a municipality's financial strength, yet many towns (including Boston!) report no stabilization funds. Why is this?

HDIP: Unintended Consequences Adding to the Housing Crisis

See how the HDIP affected the state's housing crisis. Housing prices in Gateway Cities, such as Chelsea, Revere, Everett, and Lawrence, are skyrocketing.

Large Free Cash Fund in Woburn Demonstrates Quality Financial Management

Woburn has consistently had quality financial management in recent years, demonstrated by the fact that the city had the third highest free cash fund in the state in 2020. The city’s financial success has benefited its taxpayers, as the city’s bond rating has been promoted to a AAA rating by the S&P agency standards.

PFML v. FMLA: To Pay or Not to Pay Leave-Takers

Congress passed the Family and Medical Leave Act in 1993 to ensure citizens’ job security should they need to take an extended leave, but it did not require any replacement wages to be paid for that time period. Then, Massachusetts passed their Paid Family and Medical Leave law in 2018 which set out requirements for employer and employee contributions to a PFML fund so that employees could get paid in addition to keeping their jobs should they need to take leave for certain reasons.

Online Sports Betting as a Form of Tax Revenue

The legalization of sports betting in Massachusetts has been successful so far in terms of bringing in tax revenue. Although there's a chance for a dip in volume this summer, it will continue to be a strong source of revenue for the commonwealth.

A Tale of Two Massachusetts: Wealth and Labor Differences Between East and West

This blog compares the income, wealth, and property values of western Massachusetts to those of eastern Massachusetts, highlighting the west's potential for growth.

Unemployment: A Massachusetts vs. New England Comparison

Massachusetts has seen a trend of above average unemployment rates in comparison to other New England states in recent years. This may be attributed to the greater average unemployment benefit payouts, and duration of benefits, which Massachusetts has had.

Hampden County Resilience: Thriving Despite Manufacturing Decline

Hampden County has experienced decline in its manufacturing sector, a former backbone of its economy. However, the county has still experienced this in spite of this, showing growth in new sectors.

The MassLottery: A Bay Stater’s Favorite Pastime

The Massachusetts lottery made $5.9 billion in 2021, making it the fourth-highest source of revenue for the state. This confirms a long-standing trend: that Massachusettans love to play the lottery.

Healthcare: Suffolk County’s Biggest Driver for Labor and Employment

Suffolk County employment and labor trends have seen steady growth over the past 15 years. The rise of establishments and employment in the health care sector has directly contributed to these trends. Suffolk County has now surpassed Worcester and Essex counties in labor force and employment numbers.

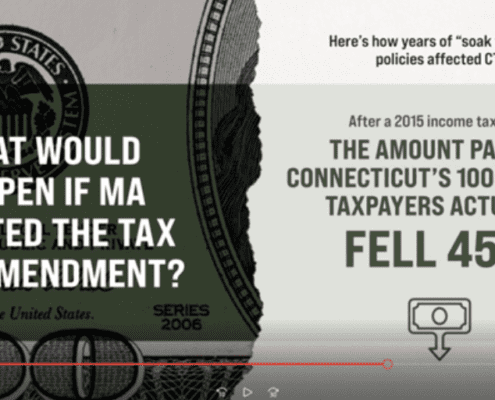

How did tax hikes work out for Connecticut?

Pioneer Institute's Charlie Chieppo shares data on the economic impact of tax increases in Connecticut - which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

How would a tax increase impact the MA economy?

Pioneer's Charlie Chieppo explains how an income tax hike in Massachusetts will impact retirees and small business owners - not just "the super rich."

Globe columnist Shirley Leung makes our argument on the tax hike amendment

In today's Boston Globe, business columnist Shirley Leung raises important questions about who exactly will be impacted by the tax hike amendment that will appear on the Massachusetts ballot in November. The answer is retirees and small business owners - and we have the data to prove it.

What’s going on with the economy in Cambridge?

Dubbed the city of squares, Cambridge, a leading innovation center,…

New Report: Massachusetts Maintains Reasonable Debt Relative to GSP

Massachusetts has more debt than any New England state. Can we afford to pay it off or will we hand it down to future generations?

New Hampshire Tax Burden Dramatically Less than Massachusetts

New Hampshire collects less than half the amount of taxes per capita as Massachusetts. How do they do it, and which strategy produces better outcomes?

Looming Budget Crisis Reveals MBTA’s Dependency on Federal Funds

The MBTA is about to lose federal funding at a critical moment when ridership has not yet recovered. Will the state make up the difference?

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

Hubwonk360 Video: If we tax them, will they leave?

In this brief, six-minute video, Pioneer Institute Executive Director Jim Stergios and Director of Government Transparency, Mary Z. Connaughton, walk through an amendment to the Massachusetts constitution that could dramatically increase the income tax on retirees and small businesses.

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

Property Crime Rates and Motor Vehicle Theft in Eastern Massachusetts Cities

An article published in May by WBUR shined a light on the recent…

This file is licensed under the Creative Commons Attribution 2.0 Generic license.

This file is licensed under the Creative Commons Attribution 2.0 Generic license. Healthcare Employs More on Cape Cod Than Any Other Sector

Despite being a major tourist destination, the largest employment sector on Cape Cod is not related to tourism: it is healthcare!

With Declining Enrollment, Public Colleges in Massachusetts Cut Back Adjunct Faculty Positions

The number of adjunct faculty positions is declining at public colleges and universities in Massachusetts.