Harsh Tax Policies in NY Make MA Seem Palatable as Some Residents Look to Relocate

A previous post discussed that a disproportionate number of taxpayers migrated away from Massachusetts to Florida and New Hampshire and concluded that it could be attributed to differences in the states’ tax policies. However, the commonwealth has also gained many taxpayers from other states that have even harsher tax policies.

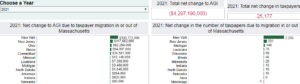

While the Bay State had net losses in both adjusted gross income (AGI) and the number of taxpayers in 2021, it still saw a net inflow of 2,256 filers from New York, according to Mass IRS Data Discovery. The inflow of former New York taxpayers alone caused a gain of nearly $330.8 million in net AGI in Massachusetts.

Fig. 1. Source: Mass IRS Data Discovery (2021).

The second-highest inflow of taxpayers to Massachusetts was from New Jersey, which lost only 331 taxpayers, resulting in an over $117.7 million increase in AGI in the Bay State.

Why did New York lose so many more taxpayers than the state that was second in line? The answer likely lies, once again, in tax policy and cost of living. New York’s high tax rates make Massachusetts’ rates more palatable, even as many in the latter plea for more affordable rates themselves.

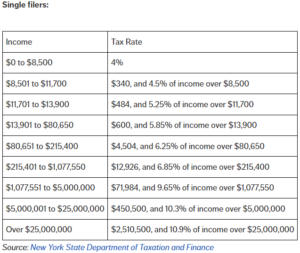

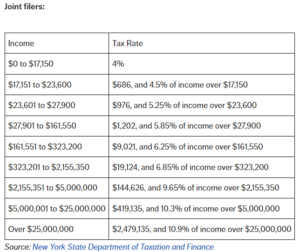

According to AARP, New York has nine personal income tax brackets, which range from 4 percent to 10.9 percent. The rates applied to each income bracket are illustrated in Figures 2 and 3 below. Note, each tax rate applies to only the amount of income within the range listed. For instance, if an individual made $90,000, then the first $80,650 would be taxed at 5.85 percent while the remaining $9,350 would be taxed at the higher 6.25 percent rate.

Fig. 2. Source: AARP.

Fig. 3. Source: AARP.

In addition to the state tax, New York City has a local tax of 4 percent while Yonkers has one of 4.5 percent and a special tax of 0.38 percent. New York’s property tax is 1.4 percent of the home’s assessed value, on average, whereas the state’s average sales tax is 8.52 percent, where 4 percent is levied on the sale of goods and groceries and local sales tax rates can reach up to 4.875 percent.

For reference, the personal income tax in Massachusetts is a flat 5 percent, which will have an additional levy of 4 percent on earnings above $1 million beginning this year. It also has a 6.25 percent sales tax rate with no local taxes, and an average property tax of 1.14 percent of the home’s assessed value. New York’s tax rates surpass Massachusetts’ on all levels!

Further, New York was the second-highest ranked state on World Population Review’s cost of living index with a rating of 148.2. Massachusetts was not too far behind, coming in fourth with a rate of 135. New York’s rating on the housing cost index was 230.1, while Massachusetts’ was 177.6.

Thus, while Massachusetts is expensive, it is somewhat more affordable to those living in New York. So, while Massachusetts residents ponder moving to tax-friendly states like New Hampshire and Florida, New Yorkers seem to be flocking to Massachusetts for some fiscal relief.

About the Author: Sarah Delano is a Roger Perry Government Transparency Intern at the Pioneer Institute for the summer of 2023. She is a senior studying Political Science at the University of Massachusetts-Amherst.