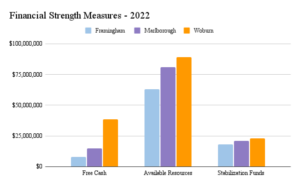

Large Free Cash Fund in Woburn Demonstrates Quality Financial Management

In 2020, Woburn had the third most free cash of any municipality in Massachusetts. Since then, Woburn has continued performing well financially, exceeding both Framingham and Marlborough, the other sub-regional urban centers in Middlesex county, in almost every measure of financial strength.

As of 2022, Woburn had significantly more free cash than Marlborough and Framingham, and also surpassed the two municipalities in available resources and stabilization fund amounts. The only measure in which Woburn did not come out on top was excess levy capacity – it actually had less than the other two.

Fig. 1. Source: MassAnalysis.

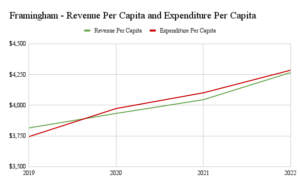

While other factors come into play because Framingham has a larger population than the others, it is helpful to look at the revenue and expenditures per capita for the three municipalities to understand how Woburn could create its extensive free cash fund.

Fig. 2. Source: MassAnalysis.

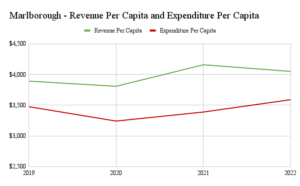

Fig. 3. Source: MassAnalysis.

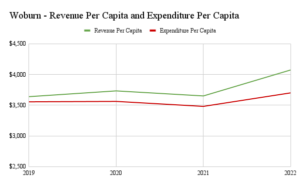

Fig. 4. Source: MassAnalysis.

By definition, “[f]ree cash is a revenue source that… includes actual receipts in excess of revenue estimates and unspent amounts in departmental budget line items for the year just ending, plus unexpended free cash from the previous year.” Evidently, Woburn’s and Marlborough’s expenditures per capita have not surpassed their revenue per capita, while Framingham’s has, although marginally. So, Framingham has not had receipts in excess of revenue estimates, as its revenue has actually been less than its expenditures, which has likely hurt Framingham’s free cash fund.

If Marlborough’s expenditures per capita have not exceeded its per capita revenue like Woburn, how is its free cash amount considerably lower? The city had a Capital Improvements Plan that outlined 57 city projects from 2018 to 2022, with a total projected cost of $142.3 million. To pay for this, the city planned to use pay-as-you-go funding for over $9.8 million of the cost, which undoubtedly put a dent in its free cash fund.

Meanwhile, Woburn has spent little of its free cash in recent years. In 2020, the City Council voted to use $3.5 million from their free cash fund to support the city’s budget to mitigate residential tax increases. Despite this sum being taken out, the free cash fund for the City of Woburn increased by over $4 million between 2019-20, then by another $7 million from 2020-21.

Similar to Marlborough, Woburn’s free cash fund will likely take a hit in the coming years, as the city has published an outline for a 2024-28 Capital Improvements Plan that will cost over $92 million. The plan claims that over $15 million of plan costs will be paid from pay-as-you-go funds, which includes free cash use.

Woburn’s free cash fund, and its financial strength in general, has paid off. In 2019, Woburn received a AAA bond rating from the S&P Agency for the first time, reflecting “its opinion the City’s management is very strong, with strong financial policies and practices that are well-embedded and have translated to strong financial and budgetary performances over the past few years.” This has been maintained in the years since. It has been extremely helpful, as Woburn’s Mayor Scott Galvin has emphasized that “[t]he prestigious AAA rating will pay immediate dividends for Woburn, as the timing coincide[d] with the issuance of $7.6 million in bonds for the recently completed Woburn Public Library restoration and addition project, the new Hurld Wyman Elementary School and the new Fleming Field Park at Horn Pond, and AAA-rated communities borrow funds at lower interest rates that saves taxpayer dollars.”

Overall, Woburn has strong financial management, as can be discerned from the difference in the free cash flow among the city and others within its county and sub-category. The city will continue to benefit from this, as its bond rating will likely remain high if the municipality continues on a prudent course.

About the Author: Sarah Delano is a Roger Perry Government Transparency Intern at the Pioneer Institute for the summer of 2023. She is a senior studying Political Science at the University of Massachusetts-Amherst.