Online Sports Betting as a Form of Tax Revenue

When the U.S. Supreme Court effectively legalized state-sponsored sports betting in May 2018, Massachusetts sports fans were itching to take part. Former Governor Charlie Baker and House Speaker Ron Mariano were vocal about passing sports betting legislation, citing the lost tax revenue as residents crossed state borders to place bets on the 2022 Super Bowl. Governor Baker signed a bill legalizing it in August 2022, making Massachusetts the 36th state to do so.

Tax Rates and Spending

In-person (retail) betting at licensed casinos launched on January 31, 2023, with its online component following on March 10, 2023. Casinos and other betting companies are on the hook for taxes on their overall monthly revenues, as are gamblers, who have to report any winnings to the IRS and the state. Tax rates on retail and online betting amount to 15 and 20 percent, respectively. This is much lower than in neighboring New Hampshire and Rhode Island. State lotteries have a monopoly on sports betting in those states and each has a 51 percent tax on retail and online gambling receipts.

Richard McGowan, a Boston College professor who studies the gambling industry, told WBUR “the lower rates in Massachusetts may help the state compete against peers with more established sports betting industries”.

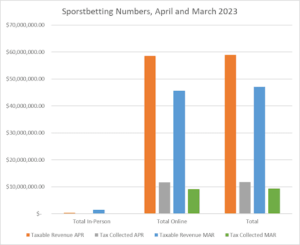

Breakdown of sports betting numbers in April and March

Source: Massachusetts Gaming Commission

So where does the money go? Not surprisingly, the state’s General Fund is the largest beneficiary with 45 percent of gambling revenues allocated to it. Other allocations include 27.5 percent to the Gaming Local Aid Fund, 17.5 percent to the Workforce Investment Trust Fund, 9 percent to the Public Health Trust Fund, and 1 percent to the Youth Development and Achievement Fund.

Tax Revenue

When online betting officially launched in March of this year, a lucrative market opened to the Massachusetts gaming industry. In its first month, online betting made up over 96 percent of legalized sports betting, with the Commonwealth hauling in over $9 million in tax revenue.

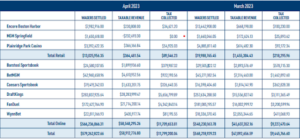

Sports wagering data from licensed vendors

Source: Massachusetts Gaming Commission

By comparison, retail sports betting brought in just over $210,000, which is fairly consistent with prior months. Clearly, online betting did not cannibalize retail’s market share. Some believed that online numbers from March would be an outlier due to the high volume of bets placed during the NCAA March Madness tournament and advertising slowing down, but the April numbers say otherwise.

April has brought in impressive numbers, as online sports betting brought in over $11.5 million in tax revenue. Even though projections had the state making 60-70 million dollars in sport betting tax revenue per year, the Massachusetts Gaming Commission has reported over $20 million in revenue in just 52 days. These numbers aren’t likely to decline anytime soon, as more sites, like Fanatics, get licenses. This will likely add to the 950,000 sports betting accounts already created, as more and more citizens take advantage of this opportunity.

Sports wagering month over month

Source: Massachusetts Gaming Commission

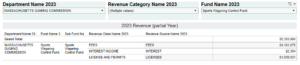

Regulation has also been an area of concern for legislators, but the Mass Gaming Commission has ensured that sports betting regulation will be properly funded. With the legalization of sports betting in 2022, the Sports Wagering Control Fund was created. The fund was created to give the MGC the proper resources to regulate sports-betting online and in person, and it has collected over $5 million in fees, interest and licensing and permitting, according to MassOpenBooks. This fund will help ensure fair gaming practices, as well as making sure in-state gambling is done legally and bringing in tax revenue.

Sports Wagering Control Fund breakdown

Source: MassOpenBooks

Takeaways

Online sports betting has been operating in Massachusetts for just under three months, but the early numbers tell us that it will continue to grow. There may be a dip following the end of the Bruins’ and Celtics’ seasons, but expect the numbers to pick up in the fall when the Patriots’ and college football seasons start up. Looking at Governor Baker’s and Speaker Mariano’s statements from 2022, the state can now see what it was missing out on before it tapped this novel source of tax revenue.

About the Author:

Teddy Wynn is a Roger Perry government transparency intern with the Pioneer Institute. He recently graduated from Hamilton College, earning a Bachelor’s degree in World Politics. Feel free to reach out via email, Linkedin, or write a letter to Pioneer’s Office in Boston.