MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

State Report Card on Telehealth Reform: Progress Slowed in 2024 Leaving Patients Without Access

Connecticut, Louisiana and Tennessee missed the mark; Colorado…

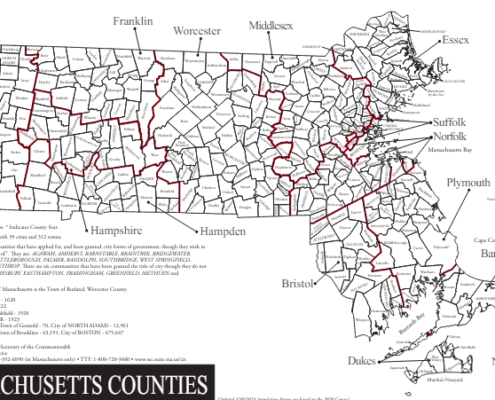

Mapping Mass Migration: Massachusetts Remains a Top Destination for Immigrants

This week's edition of Mapping Mass Migration will cover foreign migration into Massachusetts in 2023 and since 2010, including an examination of the most and least attractive destinations for immigrants by state, a demographic breakdown of immigrants arriving in Massachusetts, and an analysis of how these trends have changed over time.

Mapping Mass Migration: New Census Data Shows Continued Out-Migration from Massachusetts to Competitor States

"Mapping Mass Migration" is Pioneer's new newsletter covering…

The House Call – Mayor Wu Wants to Overhaul Boston’s Arcane Development Approvals Process? Here Are Three Reform Options

Pioneer Institute is debuting The House Call, a monthly newsletter covering housing-related news and market trends in Massachusetts. The first issue explores reform options for Boston's arcane development approvals process and major reform items from the state's November 2024 economic development bill. Read our December issue today!

Massachusetts Job Market Bears Watching

The Bureau of Labor Statistics' most recent national jobs report…

McAnneny October Monthly Musings – Ballot Initiatives

Election season is upon us. In a few short weeks, voters will…

Is Massachusetts at a Turning Point – 10 Data Points That Give Me Pause

Massachusetts tops the charts in many studies. Best public…

Wrap Up of the Massachusetts Legislative Session – Or Is It??

The Massachusetts Legislature meets for two years beginning in…

Average Weekly Wages of Healthcare Workers Across a Decade

From 2012-22 the healthcare and social assistance sector has seen the smallest growth in average weekly wages of any large industry in Massachusetts. This potentially has dire consequences on the employment crisis that this industry already faces.

Tracking Dunkin Prices Across Boston

While Dunkin is a staple of daily life for many people in Boston, its prices across locations are not necessarily consistent. Factors such as the level of foot traffic may cause prices to be higher or lower at different locations. So, where is the best bargain?

Massachusetts’s Debt and Liability in 2023

In the last decade, Massachusetts has accrued billions of dollars in debt. However, despite a large amount of debt, both overall and per capita, the state's debt as a percentage of GDP is normal amongst its neighbors.

The Largest Groups Driving Massachusetts’s Migration

With Massachusetts losing billions in taxable income every year due to out-of-state migration, it is important to understand the demographics causing the biggest losses.

Massachusetts Affordability and Competitiveness Ranking is in Freefall

Each year, CNBC ranks the 50 states on 10 broad categories of…

Average Weekly Wage Change for two Massachusetts Counties with Differing Densities

Each industry in a county varies differently in wage growth and decline. This blog analyzes how wages changed in major industries for the most urban and most rural economy in Massachusetts.

Suffolk County Residential and Commercial Taxation Changes Since 2018

Massachusetts is a relatively rich state, with an average assessed…

Migration to Massachusetts in 2022: Where Are People Going?

With thousands moving to Massachusetts every year, they bring income and assets that can affect the local economy. However, people from different regions of the country tend to favor different parts of Mass more or less, though the more urban area around Boston is al

The Economic Development Bill Starting to Take Shape; It Makes Big Bets on Life Sciences, Clean Technology and Applied AI

The Massachusetts Senate debated S.2856, its version of the biennial…

Massachusetts is Losing Thousands of Taxpayers a Year. Where Are They Going?

Massachusetts is facing a net loss of taxpayers and AGI. Learn about where these taxpayers are migrating to, and potential reasons for that migration.

Unemployment in Massachusetts by Race

Unemployment rates vary based on racial groups. Most minority groups face higher unemployment rates in Massachusetts than the majority White population.

The Housing Crisis has a Hand in Massachusetts Out-migration Trends

Recently published IRS data shows that net out-migration from…

Latest IRS Migration Data Show Exodus from Massachusetts Continues

Massachusetts shed more than double the amount of adjusted gross income (AGI) in 2022 than any year prior to 2020, making it fifth among states in net AGI out-migration behind only California, New York, Illinois and New Jersey, according to data released Thursday by the Internal Revenue Service.

Cape Cod Restricts Fourth of July Parties: What’s the Economic Impact?

With Fourth of July parties getting out of hand in recent years, Dennis Police established measures to limit the number of beachgoers this year. This may have an impact on Dennis economically, but it is a choice Dennis feels is worth making.

Part II: Push and Pull Factors for Massachusetts Businesses

High UI tax rates make it expensive for businesses to operate in Massachusetts. Learn what affects a company's decision to operate in Massachusetts.

Mayor Wu’s Office to Residential Conversion Pilot Program Prioritizes Downtown Revitalization over Housing Production, Fiscal Responsibility

In July 2023, in response to a soft post-COVID office market…

Northwest Massachusetts’ Reliance on Industry Levies

Some towns in NW Massachusetts spend significantly more per capita than their neighbors, without using methods such as large state funding, deficit spending, and high taxes. These towns gain significant portions of their revenue from industry tax levies.

Part I: It May Be Better to Be Unemployed in Massachusetts than in Connecticut or New Hampshire

Connecticut, Massachusetts, and New Hampshire all rank among…

Massachusetts Legislature Procrastinates Once Again

There are less than seven weeks left to the Massachusetts Legislature’s…

Cape Cod: The Struggles of Year-Round Residents

Barnstable County contains all 15 Cape Cod municipalities. In…

Thoughts on Outmigration and Competitiveness

?Thoughts on Out Migration and Competitiveness

A…

Commentary On The Senate Ways And Means Committee FY2025 Budget

The Senate Ways and Means Committee (SWM) released its FY2025 budget on May 7th. This spending plan totals $57.9 billion, an increase of $1.8 billion over the FY2024 General Appropriations Act (GAA). Like the Governor’s and House’s versions of the budget, the SWM budget is based on the consensus revenue estimate of $41.5 billion in tax revenue - a decrease of $208 million from last year’s consensus figure.