An Examination of the Commonwealth Rainy Day Fund

Generally, a stabilization fund is established by an entity to set excess money aside for times of need. In the public context, the funds help governments to withstand economic shocks or recessions or pay for large capital projects. These funds, both specific and general, exist at all levels of government.

Massachusetts established its Commonwealth Stabilization Fund (or “Rainy Day” Fund) in 1987 and it has seen the Bay State through turbulent times since, becoming a cornerstone of the state’s financial stability.

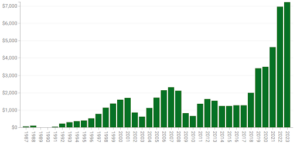

Figure 1: Stabilization Fund ending balance, in millions of dollars. Data is sourced from the Comptroller’s transparency website, CTHRU.

Figure 1 shows the final balance of the fund in each fiscal year. For most of the fund’s history, It followed a pattern of steady growth during good times, and contraction during leaner times (like recessions and pandemics). In recent years, however, the fund has deviated from this pattern, growing explosively since 2018. The Stabilization Fund reached a high of $6.9 billion in FY2022 after a historically large $2.3 billion was added during that year. This steep rise represents a 345 percent increase over five years.

For comparison, the fund had an ending balance of only $2 billion as recently as 2018. The largest year-over-year increase occurred last year, as the fund increased by 154 percent between FY2021 and ‘22. That deposit put the fund at 74.5 percent of its capacity, which is 15 percent of the budgeted funds for that fiscal year. That’s the highest it’s been to the ceiling in 20 years. Due to this incredible growth, analysts predicted that the fund would reach its ceiling within the next fiscal year.

Figure 2: Stabilization Fund net change, in millions of dollars. Data is sourced from the Comptroller’s transparency website, CTHRU.

As Figure 2 illustrates, net inflows to the fund slowed dramatically in FY2023. A mere $256 million was deposited, a fraction of the $873 million that was projected to be added, since discretionary transfers have yet to be made. This was still enough to catapult the Rainy Day Fund to another all-time high of $7.2 billion. In response to this, legislators are attempting to increase the ceiling for the fund – notably Speaker Mariano’s tax relief plan including a provision to increase the cap to 22.5 percent of annual budgeted funds.

Funding Sources

Where’s all this money coming from? The Stabilization Fund receives money from two sources – yearly appropriations and statutorily required transfers. According to the Massachusetts Comptroller’s official website, CTHRU, these statutorily defined sources include “…interest earned by the Stabilization Fund, excess capital gains taxes above the annual threshold, income tax withholding on certain transfers of Lottery prizes, and 10% of the tax on the gaming profits generated by the Springfield and Everett casinos.”

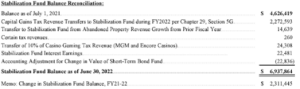

Figure 3: The Stabilization Fund balance reconciliation for FY 2022. Table is sourced from the Statutory Basis Financial Report.

Figure 4 shows that these statutorily required revenue sources – from interest, for example – comprise only a fraction of the amount transferred into the fund. In 2022, the fund actually lost $93,919 from its external sources, meaning that the entirety of the $2.3 billion by which it increased that year was generated entirely from appropriations.

Figure 4: Amount of non-transfer revenue contributed to the Stabilization Fund, by year. Data is sourced from Pioneer’s MassOpenBooks website.

Among these internal transfers, the capital gains tax is primarily responsible for the explosive growth in recent years. In FY2022, $2.27 billion of the $2.31 billion inflow was from the capital gains tax; in FY2021, $1.10 billion of the $1.13 billion inflow was from the capital gains tax as well. This decreasing trend is forecast to continue into the next fiscal year, with just $583 million expected to be transferred.

A flush stabilization fund has proven to be a benefit for the citizens and taxpayers of Massachusetts. It provides a large safety net, to be deployed in the future when needed. Additionally, the likelihood of reaching the ceiling brings the promise of tax relief – whether by triggering a tax rebate (by moving excess into the Tax Reduction fund), or by tax-relief legislation.

Peter Mentekidis is a Roger Perry Transparency Intern with the Pioneer Institute. He is a rising senior at Providence College, with a major in Quantitative Economics and a minor in Philosophy. Feel free to contact via email, LinkedIn, or writing a letter to Pioneer’s office.