Study: New Federal Tax Law Would Exacerbate Economic Damage of Prop 80

This report earned media coverage on WGBH radio, WBZ radio, and Fox 25 TV, Bloomberg radio; The Boston Globe, the Associated Press, MassLive/The Springfield Republican, Newburyport News, Gloucester Times, Salem News, Lawrence Eagle-Tribune, Greenfield Recorder, CommonWealth magazine, and The Lowell Sun.

Cap on state and local tax deductions to hit Massachusetts hard

BOSTON – Recent passage of the federal tax overhaul legislation will exacerbate the negative economic impact of Proposition 80, the proposed constitutional amendment scheduled to appear on Massachusetts’ November ballot that would add a 4 percent surtax on annual taxable income over $1 million, according to a new study published by Pioneer Institute.

“The combined effect of Proposition 80 and the Tax Cuts and Jobs Act’s $10,000 limit on deductions for state and local taxes will double the Commonwealth’s effective state tax rate for high-income taxpayers,” said Pioneer Executive Director Jim Stergios. “That is not a good calling card for Massachusetts.”

Pioneer Institute’s analysis of data promulgated by the Internal Revenue Service on components of federal tax returns filed by Massachusetts taxpayers demonstrates that the average amount of state income tax paid by a taxpayer with a taxable income greater than $1 million would more than double (after adjustment for the decreased value of the federal tax itemized deduction) from $153,152 to $318,095.

The proposed constitutional amendment would make Massachusetts’ top marginal income tax rate the nation’s fifth highest.

Practically speaking, the Commonwealth’s top marginal income tax rate would likely rank even higher than fifth if Proposition 80 is adopted, because Massachusetts doesn’t allow deductions for a number of expenses, including home mortgage interest, and limits other deductions such as employees’ contributions to pension plans, that are allowed in California, Maine, Iowa, and Minnesota – the four states with the highest income tax rates.

Massachusetts is also the only state that has a separate, higher tax rate for gains realized from the sale of securities within a year of purchase. If Proposition 80 is adopted, that rate would rise to 16 percent, highest in the nation.

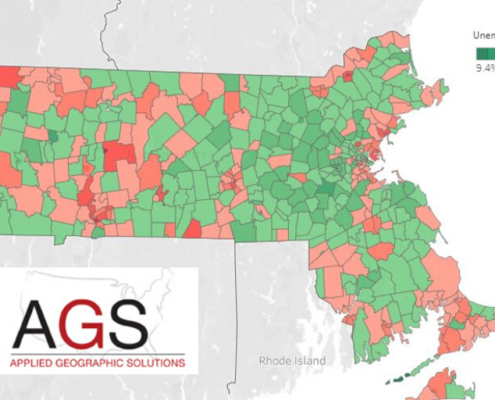

Nationally, the eight states with no income tax saw an in-migration of about $65 billion in adjusted gross income (AGI) between 2011-12 and 2014-15. The eight states with the highest income tax rates saw an out-migration of more than $44 billion over that period.

Between 1992-93 and 2014-15, Massachusetts had a net outflow of $15.9 billion in AGI. Nearly three quarters went to Florida and New Hampshire, both of which have no state income tax.

Every taxpayer whose AGI is in the top one-thousandth of 1 percent who leaves Massachusetts for a state with no income tax would save – and the Commonwealth would lose – about $13.5 million annually.

“The idea that Proposition 80 will generate free money for the Commonwealth with no down side flies in the face of evidence from Massachusetts,” said Pioneer Executive Director Jim Stergios. “Over the past two decades, the net outflow of wealth to Florida and New Hampshire has already been pronounced. Passage of Proposition 80 will speed the exodus of wealth from Massachusetts and could turn the Commonwealth into Connecticut, with stagnant revenues and a reputation for being unfriendly to business.”

Click on image to view full graphic:

About Pioneer

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.