Tag Archive for: millionaires tax

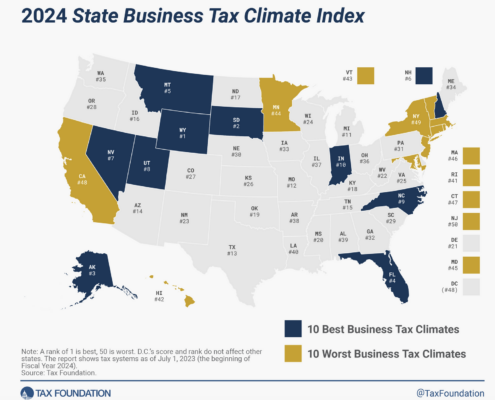

Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

Black Box Budget: Late, Loaded, and Lacking Transparency

Joe Selvaggi talks with Pioneer Institute’s Senior Fellow in Economic Opportunity Eileen McAnneny about the features and flaws of the recently passed 2024 Massachusetts state budget now waiting for Governor Healey’s approval.

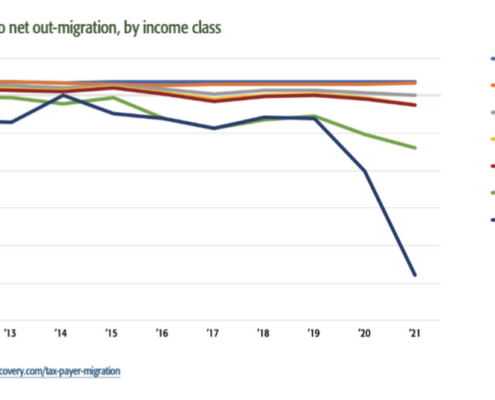

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

New IRS Data Shows Out-Migration Worsening, Underscoring the Need for Massachusetts Leaders to Focus on State’s Competitiveness

Massachusetts’ net loss of adjusted gross income (AGI) to other states grew from $2.5 billion in 2020 to $4.3 billion in 2021, according to recently released IRS data. Over 67 percent of the loss was to Florida and New Hampshire, both states with no income tax.

Other People’s Money: Fair Share’s Populist Promises and Problems

This week on Hubwonk, host Joe Selvaggi talks with Boston Globe columnist Jeff Jacoby about November’s Massachusetts Ballot Question 1, the so-called Fair Share Amendment. They examine both the merits and timing of a graduated state income tax, as well as the effects on society of creating separate categories of taxpayers, and the dangers of setting the many against the few.

Survey of Business Sentiment: MA Income Tax Hike Would Lead to Employer Exodus

Nearly three quarters (73 percent) of Massachusetts business leaders think business associates will leave the state if a constitutional amendment appearing on the November ballot to hike taxes is successful, according to a survey conducted by Pioneer Institute.

Hubwonk360 Video: If we tax them, will they leave?

In this brief, six-minute video, Pioneer Institute Executive Director Jim Stergios and Director of Government Transparency, Mary Z. Connaughton, walk through an amendment to the Massachusetts constitution that could dramatically increase the income tax on retirees and small businesses.

Pioneer Supports Legal Challenge to Misleading Tax Ballot Language, Releases Video

Pioneer Institute supports the diverse and bipartisan group that filed a complaint with the Massachusetts Supreme Judicial Court (SJC) challenging the summary language meant to provide an accurate description of the tax hike amendment to voters. The language was approved by the Attorney General and Secretary of the Commonwealth when a similar amendment was proposed in 2018, and unless the lawsuit is successful, will likely appear on the Massachusetts ballot in November.

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

Study Finds SALT Deduction Cap, Graduated Income Tax Will Combine to More Than Double Tax Burden on Some Households

A provision of the federal Tax Cuts and Jobs Act of 2017 strictly limiting deductions for state and local taxes (SALT) will greatly exacerbate the adverse effects of a proposal to create a constitutionally mandated graduated income tax, according to a new study published by Pioneer Institute.

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

Tax Flight of the Wealthy: An Academic Literature Review

A new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets. The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal.

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

A wealth tax, a SCOTUS case, and a likely Mass. exodus

0 Comments

/

Op-ed in The Boston Globe: A case New Hampshire filed with the US Supreme Court last October against the Commonwealth of Massachusetts could have a huge impact on state finances nationwide. It also raises the stakes as the Massachusetts Legislature considers amending the state constitution to eliminate the state’s prohibition against a graduated income tax and to hike taxes on high earners.

Inadequate Inflation Adjustment Factor Will Subject Increasing Numbers of People to So-Called “Millionaires” Tax

Would take particular toll on those relying on home value appreciation…

Proposition 80 Won’t Generate $1.9 Billion Annual Projected Revenue

Passage of November 2018 ballot measure will make Massachusetts…

Proposition 80 Will Increase Out-Migration of High Earners and Businesses

Passage of November 2018 ballot measure would jeopardize Massachusetts’…

Study: New Federal Tax Law Would Exacerbate Economic Damage of Prop 80

This report earned media coverage on WGBH radio, WBZ radio,…

Op-ed: Connecticut example argues against millionaires’ tax

This op-ed appeared in The Boston Business Journal on February…

New Study Looks to Connecticut as Cautionary Tale for Impact of Proposed Ballot Initiative Hiking Taxes

Hear Greg Sullivan discuss this report on Bloomberg Radio.

Raising…