Tag Archive for: taxes

Suffolk County Residential and Commercial Taxation Changes Since 2018

Massachusetts is a relatively rich state, with an average assessed…

What makes these five so-called “W” towns so appealing?

Learn about what makes these five Massachusetts "W" towns so desirable to live in, but also the costs associated with them.

The Necessity of Transparent Tax Revenue Reporting: MA Provides a Shining Example

Revenue collections, predicted revenue, and expenditures are among the most important data points states report. Without accurate predictions and regular reporting, the legislature and governor's office may go over or under budget, potentially leaving citizens and policymakers in the dark about the fiscal health of the state.

For this reason, all states regularly report those numbers and update estimates based on trends, overall economic conditions, and expected changes as a result of new state policies. However, even among the New England states, the transparency and accessibility of such reporting varies greatly and, as a result, limits analysts’ ability to meaningfully compare state revenues and judge performance in real time.

Pioneer Institute Statement on the State Legislature’s FY2024 Tax Relief Package

The recent advancement of a tax bill H. 4104, that is expected to be enacted by the Legislature this week after languishing for more than 20 months, puts Massachusetts taxpayers one step closer to realizing some tax relief. However, it may be too little to tackle the Commonwealth’s affordability and competitiveness challenges.

Farmers Welfare Bill: Rethinking Costly and Environmentally Distortive Subsidies

Joe Selvaggi discusses the cost and consequences of the $1.5 trillion decade-long subsidies in the farm bill with Chris Edwards, Chair of Fiscal Studies at the Cato Institute. These subsidies have the potential to negatively impact incentives for consumers, producers, and those concerned about the environment.

Predatory Tax Ruling: Supreme Court Closes Door on Home Equity Theft

Joe Selvaggi talks with Pacific Legal Foundation’s state legal policy deputy, attorney Jim Manley, about home equity theft, a practice that has taken 350 properties in Massachusetts, dispossessing homeowners of more than $50 million in equity.

Senate Tax Package Misses the Mark on Competitiveness

The Senate tax package, S.2397, is heavy on provisions that reduce the tax burden for certain taxpayers, thereby helping those that qualify for the expanded credits and deductions. The bill, however, is light on provisions that will improve the Commonwealth’s competitiveness.

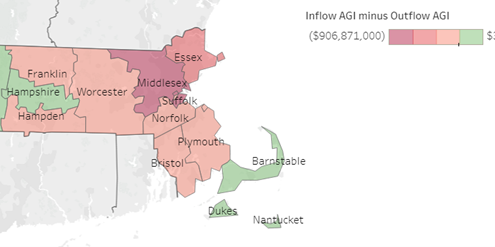

New IRS Data Shows Out-Migration Worsening, Underscoring the Need for Massachusetts Leaders to Focus on State’s Competitiveness

Massachusetts’ net loss of adjusted gross income (AGI) to other states grew from $2.5 billion in 2020 to $4.3 billion in 2021, according to recently released IRS data. Over 67 percent of the loss was to Florida and New Hampshire, both states with no income tax.

Losing Talent and Treasure: Uncompetitive Tax Regime Drives Upper-Income Exodus

Joe Selvaggi talks with Pioneer Institute's Economic Research Associate Aidan Enright about his new paper "Debunking Migration Myths." With this research, Aidan examines the link between Massachusetts' tax regime and the outflow of high earners to states with more competitive rates.

Grading State Governors: Do Higher Taxes Equate To Higher Value?

This week on Hubwonk, host Joe Selvaggi talks with Cato Institute’s Chris Edwards about the new report he co-authored entitled, "Fiscal Policy Report Card on America’s Governors 2022." They discuss how Massachusetts Governor Charlie Baker’s fiscal stewardship compares with other states, and explore whether higher tax rates and spending correlate with better state performance and resident satisfaction.

How did tax hikes work out for Connecticut?

Pioneer Institute's Charlie Chieppo shares data on the economic impact of tax increases in Connecticut - which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

The Taxman Cometh: Who Will Pay When the Newly Funded IRS Knocks?

This week on Hubwonk, host Joe Selvaggi talks with Heritage Foundation senior research fellow Rachel Greszler about the $80 billion investment in the Internal Revenue Service, focusing on the promise to limit enhanced enforcement to high earners and whether the IRS will likely need to expand its net.

New Report: Massachusetts Maintains Reasonable Debt Relative to GSP

0 Comments

/

Massachusetts has more debt than any New England state. Can we afford to pay it off or will we hand it down to future generations?

Looming Budget Crisis Reveals MBTA’s Dependency on Federal Funds

The MBTA is about to lose federal funding at a critical moment when ridership has not yet recovered. Will the state make up the difference?

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

Barnstable County: What Towns Tax the Most?

The housing market has been the center of American economic growth…

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

Massachusetts Tax Revenues Surpass Pre-Pandemic Levels

Pandemic recovery and then some! Massachusetts revenues are higher than anyone was expecting, but where is all the money coming from? And what does this mean for the Massachusetts economy?

Fair Share Flimflam: Misleading Ballot Summary Could Distort Voter Choice

Joe Selvaggi talks with Attorney Kevin Martin, appellate litigator at Goodwin Proctor, about the complaint filed with the Massachusetts Supreme Judicial Court regarding the summary language on the 2022 "Fair Share Tax” ballot initiative. Kevin explains how the language misleads the public about the impact of their vote on revenue, spending, and our state’s constitution.

Study: Tax Up For A Vote In November Would Ensnare Over Three Times More Taxpayers Than Previously Estimated

Analyses from the Massachusetts Department of Revenue (MADOR, 2016) and Tufts University’s Center for State Policy Analysis (2022) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022, according to a new study from Pioneer Institute.

Study: “Millionaire’s Tax” Would Have Far-Reaching Effects on “Pass-Through” Businesses

A proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns, according to a new study published by Pioneer Institute.

The Far-Reaching Impact of a Massachusetts Surtax: Anecdotal Evidence and Data Analysis

This report shows that a proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns.

Building Budgets Bigger: Unpacking Who Pays the Trillion Dollar Plus Tax Bill

Hubwonk host Joe Selvaggi talks with Kyle Pomerleau, senior fellow on federal tax policy at American Enterprise Institute about the Build Back Better Act now in Congress, to understand how those new taxes will affect individuals, business, and the economy.

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

Study Finds SALT Deduction Cap, Graduated Income Tax Will Combine to More Than Double Tax Burden on Some Households

A provision of the federal Tax Cuts and Jobs Act of 2017 strictly limiting deductions for state and local taxes (SALT) will greatly exacerbate the adverse effects of a proposal to create a constitutionally mandated graduated income tax, according to a new study published by Pioneer Institute.

The SALT Cap: An Accelerator for Tax Flight from Massachusetts

After the authors of the proposed graduated tax in Massachusetts submitted their proposal for legislative approval in 2017, the federal government placed a $10,000 limitation of deductibility of state and local taxes on federal tax returns. This unforeseen change in the federal tax code had the effect of turning what would have been a 58 percent increase in average state income tax payments among Massachusetts millionaires, from $160,786 to $254,355, into what is essentially a 147 percent increase when the federal SALT limitation is included in the calculation. This substantial change should be taken into consideration by voters when they contemplate approving the surtax proposal.

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Proponents of a state constitutional amendment to add a 4 percent surtax on all households with annual income above $1 million frequently cite 2015 data from the Institute on Taxation and Economic Policy, which argues that the Massachusetts tax code is regressive, but a new study published by Pioneer Institute debunks many of the underlying assumptions used in ITEP’s 2015 report.

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida

Massachusetts had a net outflow of $20.7 billion in adjusted gross income (AGI) between 1993 and 2018. The biggest beneficiaries of the wealth that fled the Commonwealth were Florida, which captured 47.5 percent of it, and New Hampshire, which captured 26.1 percent. Between 2012 and 2018, Florida saw a net AGI inflow of $88.9 billion. Affluent taxpayers are responsible for an outsized proportion of state tax revenue. The data also show a strong correlation between state taxes and migration. States like Florida and New Hampshire that have no state income tax have seen a net inflow of AGI from higher-tax states like Massachusetts.