Study: U.S. Immigration System Limits Benefits Foreign Students Could Provide

Slow, inefficient system that discourages entrepreneurship puts U.S. at a competitive disadvantage

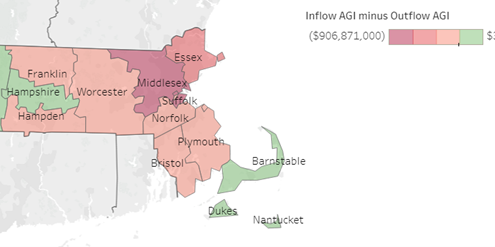

Latest IRS Migration Data Show Exodus from Massachusetts Continues

Massachusetts shed more than double the amount of adjusted gross income (AGI) in 2022 than any year prior to 2020, making it fifth among states in net AGI out-migration behind only California, New York, Illinois and New Jersey, according to data released Thursday by the Internal Revenue Service.

Study Finds Prevalence of Entrepreneurship Tied to Regulatory Environment, Portion of Immigrants

The prevalence of entrepreneurship is linked to both the regulatory environment and the portion of foreign-born immigrants in a jurisdiction, according to a new study published by Pioneer Institute.

Study Finds Supply Shortage at the Heart of Greater Boston Housing Crisis

Construction costs, land use regulation and zoning among…

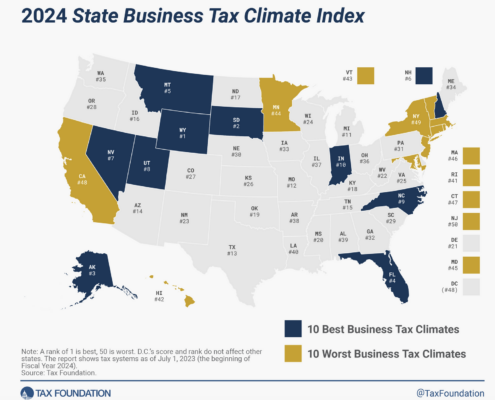

Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

Poll: MA Voters Oppose Legislative Proposals to Change Tax Rebate Law

A strong majority of registered Massachusetts voters oppose a plan recently announced by state legislative leaders that would change the way tax rebates are distributed in Massachusetts under a state law approved by voters in 1986, according to a new poll sponsored by Pioneer Institute and the Massachusetts High Technology Council.

Study: Immigrant Entrepreneurs Benefit N.E. Economy, Despite Facing Obstacles to Growth

BOSTON – Immigrants in Massachusetts and New England are more likely to be self-employed, but the businesses they own tend to be in different industries than those owned by the U.S. born, according to a new study published by Pioneer Institute.

Public Statement on the House’s Proposed Tax Reform and Budget

Pioneer Institute applauds key tax reform provisions advanced by the Speaker and House leadership, including a reduced short-term capital gains tax rate and implementation of a single sales factor apportionment. But leadership must do more to bolster the state’s economic competitiveness and slow out-migration of wealth and business owners that endangers the commonwealth’s economic future.

Report: Immigrant Entrepreneurs Provide Economic Benefits, but Face Significant Obstacles

Immigrants have started a quarter of all businesses in Massachusetts despite making up just 17 percent of the state workforce, and those establishments appear to be more innovative than those founded by native-born Americans. Despite these contributions, shrinking federal visa caps and red tape are among the factors making it more difficult for immigrants to come to the U.S., according to “Immigrant Entrepreneurs and the Barriers They Face: An Academic Literature Review,” published by Pioneer Institute.

Pioneer Institute Statement on Question 1

Yesterday, voters came closer than many expected to rejecting the largest tax increase in Massachusetts history, even though opponents were dramatically outspent by the unions that bankrolled the amendment to the state Constitution.

Study: Legislators Must Answer Key Questions Before Setting Policy for App-Based Rideshare/Delivery Workers

After Massachusetts’ Supreme Judicial Court declared an initiative that was to appear on the November ballot unconstitutional, the issue of how to classify app-based rideshare/delivery workers is back in the hands of the state Legislature. A new study published by Pioneer Institute distills from the research literature eight questions legislators must answer before determining how to address this fast-growing industry.

Pioneer Institute Expects That Massachusetts Taxpayers Will Be Refunded $3.2B Due To State Revenue Cap

Pioneer Institute projects that the state will refund approximately $3.2 billion to taxpayers due to a state law sponsored by Citizens for Limited Taxation and voted on by taxpayers in 1986 that caps the amount of revenue the state can collect in any given year.

Survey of Business Sentiment: MA Income Tax Hike Would Lead to Employer Exodus

Nearly three quarters (73 percent) of Massachusetts business leaders think business associates will leave the state if a constitutional amendment appearing on the November ballot to hike taxes is successful, according to a survey conducted by Pioneer Institute.

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness

If adopted, a constitutional amendment to hike state taxes that will appear on the ballot in November could erase the hard-earned progress Massachusetts has achieved toward economic competitiveness over the last 25 years and may not result in any additional education and transportation funding, according to a new book from Pioneer Institute, entitled Back to Taxachusetts?: How the proposed tax amendment would upend one of the nation’s best economies, which is a distillation of two dozen academic studies.

Study Documents The Design Challenges, Contracting Issues, And Delays Facing New MBTA Fare Collection System

This new study unearths previously unseen communications between the MBTA and its contractors, showing that the MBTA’s efforts to modernize its fare collection system, including allowing payments with credit cards and bringing “tap and go” technology to Commuter Rail and ferry lines, was riddled with technological challenges and difficulties overseeing contractors as early as 2019, culminating in a 3-year delay to the project’s full implementation.

Study: Legislature Likely to Reduce Spending on Education and Transportation from Other Revenue Sources, Replace Cuts with Surtax Money

Revenue from a ballot initiative to amend the state Constitution and raise income taxes on households and businesses by adopting a graduated income tax structure would supposedly provide resources for transportation and public education, but a new study published by Pioneer Institute finds that, were the tax amendment to pass, the money would be fungible and much of it likely spent on general budget measures.

Study Finds Bus Rapid Transit Can Offer Cost-Effective Benefits

Bus rapid transit (BRT) incorporates unique features such as dedicated lanes to provide reliable and cost-effective service while reducing congestion and its detrimental environmental impacts, according to a new study published by Pioneer Institute.

Pioneer Supports Legal Challenge to Misleading Tax Ballot Language, Releases Video

Pioneer Institute supports the diverse and bipartisan group that filed a complaint with the Massachusetts Supreme Judicial Court (SJC) challenging the summary language meant to provide an accurate description of the tax hike amendment to voters. The language was approved by the Attorney General and Secretary of the Commonwealth when a similar amendment was proposed in 2018, and unless the lawsuit is successful, will likely appear on the Massachusetts ballot in November.

Study Raises Concern That Annual T Fare Evasion Costs Could Rise By More Than $30 Million Under AFC 2.0

According to the Federal Transit Administration (FTA), the MBTA’s $935.4 million fare collection system (AFC 2.0) that is scheduled to be implemented in 2023 will reduce fare evasion by $35 million over a decade. But the T announced in 2021 that evasion could actually increase by up to $30 million under AFC 2.0, and now a Pioneer Institute study warns that insufficient fare enforcement could drive that figure even higher under the new system.

Study: Tax Up For A Vote In November Would Ensnare Over Three Times More Taxpayers Than Previously Estimated

Analyses from the Massachusetts Department of Revenue (MADOR, 2016) and Tufts University’s Center for State Policy Analysis (2022) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022, according to a new study from Pioneer Institute.

Public Statement on Massachusetts High Technology Council’s Challenge to the Graduated Income Tax Ballot Language

The Massachusetts High Technology Council is right to insist on transparency in the language of a tax hike amendment scheduled to appear on the Massachusetts state ballot next year.

Study: “Millionaire’s Tax” Would Have Far-Reaching Effects on “Pass-Through” Businesses

A proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns, according to a new study published by Pioneer Institute.

Study Warns that New Hampshire Tax Policies Would Exacerbate Impacts of a Graduated Income Tax

Drawing on migration patterns between Massachusetts and states like Rhode Island and Tennessee, Pioneer Institute is releasing a study showing a direct correlation between personal income tax rates and household domestic migration patterns between 2004 and 2019. The study suggests that instituting a graduated income tax will shrink the tax base and deter talented workers and innovative employers from coming to and staying in the Bay State.

Study Finds SALT Deduction Cap, Graduated Income Tax Will Combine to More Than Double Tax Burden on Some Households

A provision of the federal Tax Cuts and Jobs Act of 2017 strictly limiting deductions for state and local taxes (SALT) will greatly exacerbate the adverse effects of a proposal to create a constitutionally mandated graduated income tax, according to a new study published by Pioneer Institute.

Study Suggests How to Advance Fairness, Predictability of “Payment in Lieu of Taxes” Programs Aimed at Nonprofits

A new white paper by Pioneer Institute calls for increased transparency over the basis for payment in lieu of taxes (“PILOT”) agreements between municipal governments and nonprofit organizations, while also encouraging nonprofits to publicize and expand the community benefits they provide.

Public Statement on Implementation of the Charitable Giving Deduction

Despite being awash in cash, the state Legislature just overrode Gov. Charlie Baker’s veto of a provision to delay by yet another year a tax deduction for charitable donations. Rep. Mark Cusack, House chair of the Joint Committee on Revenue, said “it doesn’t mean no, just not now.” If not now, when?

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Proponents of a state constitutional amendment to add a 4 percent surtax on all households with annual income above $1 million frequently cite 2015 data from the Institute on Taxation and Economic Policy, which argues that the Massachusetts tax code is regressive, but a new study published by Pioneer Institute debunks many of the underlying assumptions used in ITEP’s 2015 report.