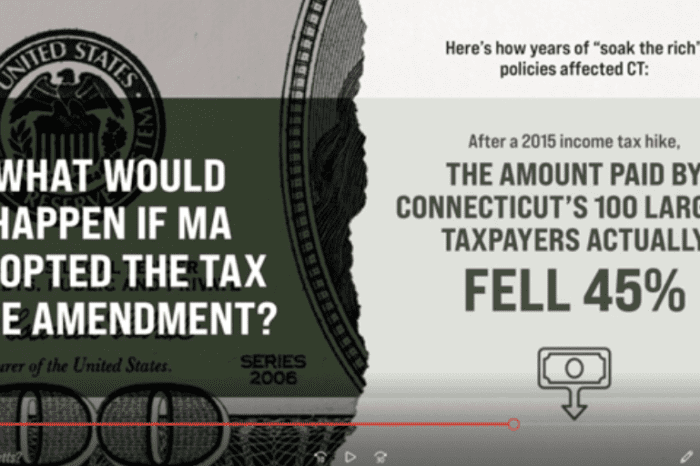

How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

Public Statement on Massachusetts’ Emergency Order Aiming to Curb the Spread of the Coronavirus

Governor Baker’s issuance of an emergency order is a wake-up call to recognize the extraordinary actions needed at this moment to stem the upsurge in coronavirus infections. It is also a reminder to be vigilant about our liberties.

Pioneer Report Offers Framework for Improving Greater Boston’s Global Competitiveness

Pioneer’s new report, Greater Boston as a Global Competitor, provides useful metrics to help Massachusetts formulate a strategy to become an even more attractive place for innovators and talent.

Pioneer Institute Announces New Economics Data Tool: MassEconomix

A new addition to Pioneer Institute’s Mass Watch data tool suite, MassEconomix, provides time-series data on job and business growth for all of Massachusetts. Pioneer has partnered with the Business Dynamics Research Consortium (BDRC), which is housed at the University of Wisconsin’s Institute for Business and Entrepreneurship, to acquire an employment database known as “Your-economy Time Series”, or YTS. This database provides a year-by-year look at companies and jobs that have existed in the Commonwealth since 1997.

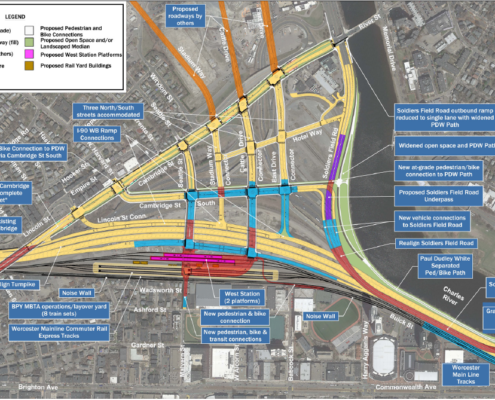

Pioneer Urges MassDOT to Reconsider At-Grade Throat Option for I-90 Allston Multimodal Project

Pioneer's new Public Comment calls on the Massachusetts Department of Transportation to revise its Scoping Report on the I-90 Allston Multimodal Project and recommend an additional option to the Federal Highway Administration.

New Study: Excessive Occupational Licensing Hurts State Economy, Reduces Tax Revenue

Overly burdensome occupational licensing requirements not only slow down the Massachusetts economy and cost the state tens of thousands of jobs, but also reduce state and local tax revenue, according to a new study published by Pioneer Institute

Study Proposes “Marshall Plan” for Attracting and Retaining Talent Needed to Modernize the MBTA

Better hiring practices and internal organization, external resources…

Study Calls for Easing MBTA Procurement Restrictions and Beefing Up Project Management Capacity

Reforms needed if T is to achieve increased capital spending…

Co-author of Landmark Longfellow Bridge Study Optimistic about State Infrastructure Maintenance Investments

BOSTON - Reconstruction of the Longfellow Bridge is now complete,…

Study: Boston-Area Communities Should Loosen Restrictions for Accessory Dwelling Units

Additional units could help ease housing shortage

BOSTON—A…

Study: Methodology of Noted “Millionaire’s Tax” Researcher Excludes Vast Majority of Millionaires

The work of a Stanford University Professor whose research has…

Inadequate Inflation Adjustment Factor Will Subject Increasing Numbers of People to So-Called “Millionaires” Tax

Would take particular toll on those relying on home value appreciation…

Proposition 80 Won’t Generate $1.9 Billion Annual Projected Revenue

Passage of November 2018 ballot measure will make Massachusetts…