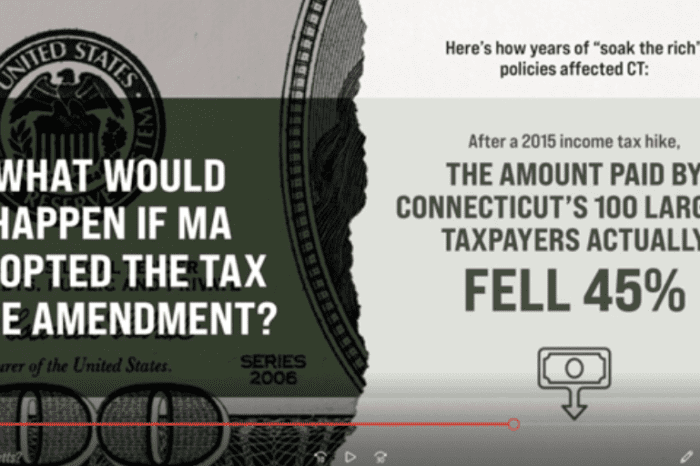

How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

COVID-19’s Impact on Rental Housing

The Massachusetts Legislature is currently debating a rental housing bill. What impact will it have on the many landlords for whom rental income is their only source of income?

Which industry’s workforce has been hurt the most from the COVID-19 outbreak?

Unemployment claims have reached all-time highs in the U.S. recently…

Will the COVID-19-related economic recession cause a spike in crime?

Intuitively, it makes sense that people replace legitimate business…

State Ranking: Michigan, Hawaii, Rhode Island, Pennsylvania, and Nevada have been hardest-hit by COVID-19 jobless claims so far. Massachusetts ranks as 9th hardest-hit.

The U.S. Department of Labor reported today that in the week ended April 4, the advance number of seasonally-adjusted initial jobless claims was 6,606,000. This follows 6,867,000 initial claims filed in the week ended March 28 and 3,307,000 in the week ended March 21.

COVID-19 unemployment surge is on pace to wipe out the MA Unemployment Reserve Fund within three months

The unprecedented surge of COVID-19- related unemployment claims that began two weeks ago is on pace to wipe out the MA unemployment Reserve Fund within three months, which will force state leaders to turn to the federal government for a bailout loan.

Report: MA Likely to See Sharp Spike in Unemployment Rate

The COVID-19 recession could cause Massachusetts’ unemployment rate to skyrocket to 25.4 percent by this June, according to a new policy brief published by Pioneer Institute. The authors recommend that the state join others in lobbying Congress for large block grants to avoid a severe fiscal crisis.

Pioneer Launches Report Series Highlighting Massachusetts Job Growth and Business Trends Since 1998

In “Some Big, Broad Economic Trends in Massachusetts,” Pioneer analysis of two decades of data shows fluctuating employment changes across the state, as well as firm size information and the largest employers. The report is part one of aa series that aims to provide deeper insight into COVID-19's economic impact.

New Policy Brief on Federal Relief Act’s Impact on Massachusetts

Greg Sullivan and Charlie Chieppo review the impact of the Coronavirus Aid, Relief, and Economic Security Act on Massachusetts' budget.

Congress should fix aid, provide block grants

This op-ed by Greg Sullivan and Charlie Chieppo appeared in the…

Public Statement: Extend Massachusetts’ Income Tax Filing Deadline

Massachusetts must extend the tax filing deadline, just as the federal government and 34 of the 41 states that tax income have done.

Why Are We So Scared And Impatient?

This op-ed by Barbara Anthony appeared in WGBH News on March…

Financial Disclosures – As Important Now as Ever

News sources report that certain senators sold stocks just before the market crashed when the economic impact of Coronavirus came to light. Now more than ever, financial disclosures must be accessible to the media and to the public.