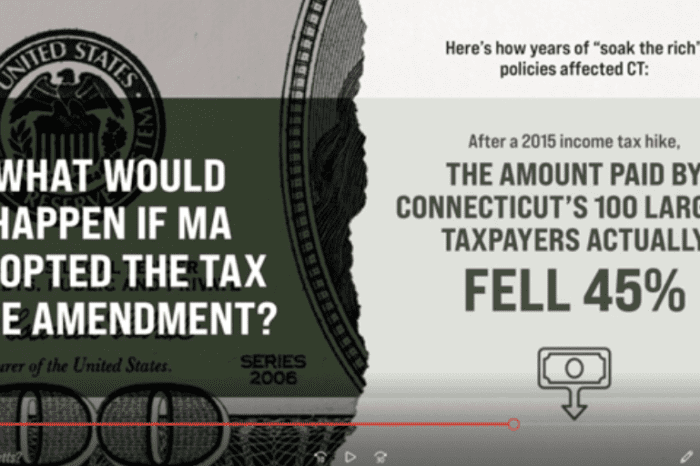

How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

Proposition 80 Will Increase Out-Migration of High Earners and Businesses

Passage of November 2018 ballot measure would jeopardize Massachusetts’…

Study: New Federal Tax Law Would Exacerbate Economic Damage of Prop 80

This report earned media coverage on WGBH radio, WBZ radio,…

Op-ed: Connecticut example argues against millionaires’ tax

This op-ed appeared in The Boston Business Journal on February…

New Study Looks to Connecticut as Cautionary Tale for Impact of Proposed Ballot Initiative Hiking Taxes

Hear Greg Sullivan discuss this report on Bloomberg Radio.

Raising…

Report: Economic Freedom Up Slightly Across U.S.

Massachusetts ranks 13th in North American index

BOSTON - Massachusetts…

Study: Proposition 80 Would Give MA 2nd Highest Combined State & Federal Capital Gains Tax Rate in U.S.

Read coverage of this report in the Boston Herald: "Study: ‘Millionaire’s…

Leveling the Playing Field for the Taxi Industry

As a Massachusetts state legislative committee considers a contentious…

Study: State Ridesharing Regs Should Focus More on Consumer Preferences, Less on Protecting Cab Companies

BOSTON - Legislation recently approved by the Massachusetts House…

Pioneer Calls for Creation of $20 Million Middle Cities Infrastructure Fund

Read news coverage in The Enterprise of Brockton.

Convention…

Study: Continuing Decline Over Last Decade In Massachusetts’ “Middle Cities”

Read news coverage of this report in The Springfield Republican, The…

The Boston Globe: Create work with on-the-job training

The value of work cannot be overstated. If you love what you’re…

A Challenge to Economic Freedom: Declining Labor Participation

Even with lower unemployment rates in Massachusetts and the U.S.,…