COVID-19 unemployment surge is on pace to wipe out the MA Unemployment Reserve Fund within three months

By Gregory Sullivan and Charles Chieppo

April 8, 2020

The unprecedented surge of COVID-19- related unemployment claims that began two weeks ago is on pace to wipe out the MA unemployment Reserve Fund within three months, which will force state leaders to turn to the federal government for a bailout loan. The recently passed Coronavirus Aid, Relief, and Economic Security Act anticipated this and provided interest-free loans to state unemployment funds across the country. While the federal loans will prevent a catastrophic shutdown of unemployment programs, they are not a cash rescue and will have to be paid back either through higher unemployment insurance rates on employers or the state issuing bonds to refinance the loans.

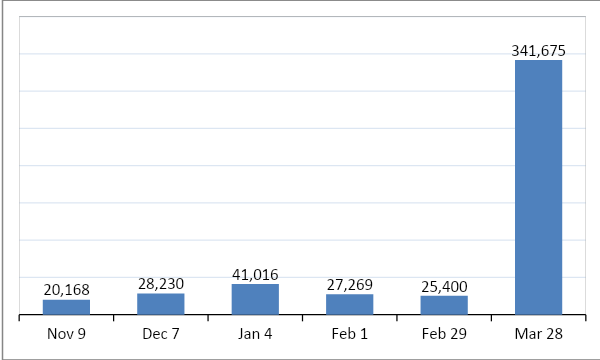

Figure 1. Initial MA jobless claims in successive 4-week periods ended on Nov 9, Dec 7, Jan 4, Feb 1, Feb 29, and March 28, 2020

Source: U.S. Department of Labor, Unemployment Insurance Weekly Claims Data.

Jon Hurst, president of the Retailers Association of Massachusetts, said he would like to see the federal government guarantee that unemployment insurance rates won’t increase should the state need to borrow from the federal government to cover benefits.

The state unemployment reserve fund balance has already fallen from $1.63 billion on February 29 to $1.40 billion on March 31, a drop of 14 percent. The U.S. Department of Labor reports that non-seasonally adjusted initial unemployment claims in Massachusetts rose from 4,712 in the first week of March to 7,449 in the second week, to 148,452 in the third week, and 181,062 in the fourth week.

But that does not begin to tell the story of what is coming. According to economists at tradingeconomics.com, the United States is expected to receive 12.9 million new unemployment claims over the next two weeks, on top of the 9.9 million new claims that were filed over the past two. If Massachusetts experiences a similar increase in the continuing surge over the next two weeks, it would add more than 350,000 additional jobless claims to the 329,514 it received over the past two. If this happens, and the beleaguered Massachusetts Department of Unemployment Assistance manages to process this staggering volume of requests for unemployment benefits while practicing social distancing, the number of individuals collecting unemployment here will have grown from 74,923 on February 29, 2020 to more than 750,000, 10-times the number from a month earlier. But even if no additional new claims come in over the next few weeks, the Massachusetts unemployment reserve fund is going to run out of money very quickly.

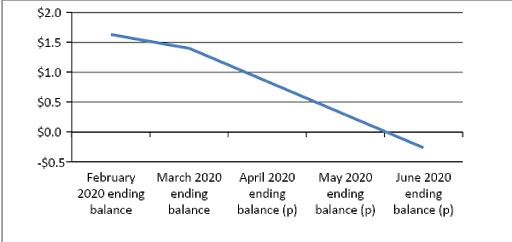

Below is a back-of-the-envelope projection of how long it will take the Massachusetts Unemployment Reserve Fund to run out. The short answer is that if no further initial unemployment claims are submitted over the coming weeks and months, the reserve will be depleted within three months. If jobless claims continue to mount, the period would be proportionately shorter.

The longer answer is that the balance of the reserve fund on March 31 was $1.4 billion. During the preceding 12 months, the fund took in an average of $146.9 million per month in net UI employer contributions and paid out an average of $107.8 million per month in benefits to an average of 58,780 individuals. Given that 329,514 additional individuals applied for unemployment in the last two weeks of March, the total number of people collecting unemployment in the short term will conservatively be more than 375,000. If the average monthly benefit of the new recipients is approximately the same as those who were collecting over the preceding 12-months, the unemployment fund will see its total monthly UI benefit pay-out grow from $107.8 million to more than $675 million. At the same time, employers will no longer be making contributions to the unemployment fund for the 329,514 newly jobless workers, who comprise nearly 10 percent of the total Massachusetts workforce of 3.7 million.

At that rate, the $1.4 billion reserve fund will be depleted by more than $500 million per month, and would be gone within three months. If jobless claims continue to come in, per the projections of some economists, the monthly UI benefit payout could increase to more than $800 million, which would deplete it in two months or less.

Figure 2. Projected depletion of Massachusetts Unemployment Reserve Fund (billions)

Source: United States Department of the Treasury Feb – Mar 2020; Pioneer Institute projection Apr – Jun 2020

An even more daunting consideration is that the economy could take a year or more to fully recover. Should this happen, as the aforementioned economists have warned, the Massachusetts unemployment fund could become a major financial drain on state finances requiring billions in loans to replenish.

Anticipating difficult financial times ahead, Congress provided $150 billion in financial assistance to state governments in the Coronavirus Aid, Relief, and Economic Security Act. The fund will be allocated proportionally by population, and Massachusetts is expected to receive approximately $2.67 billion. In addition, Congress has temporarily increased the federal matching rate on Medicaid from January 1, 2020 until the COVID-19 public health emergency ends. Congress has also provided an extra $600 per week in unemployment benefits to each recipient for up to four months, extended benefits to previously ineligible categories of workers, and extended benefits for an additional 13 weeks after the regular unemployment period ends, through December 31, 2020. These federally-funded supplements to the current unemployment system will help individuals and families cope with financial strain, stimulate our local economy, and restore some of the income tax revenue that otherwise would be lost since unemployment benefits are taxable in Massachusetts.

The $1,200 rescue checks that most federal taxpayers will be receiving through the Coronavirus Aid, Relief, and Economic Security Act are advance tax credits for the federal 2020 tax year and as such are not taxable income for federal and state income tax purposes, so they will not supplement Massachusetts state income tax revenues. While the expanded unemployment benefits included in the relief legislation are very important, the legislation did not address the ballooning costs to the state of paying the first 30 weeks of benefits for a flood of new unemployment claims.

The Center for Financial Economics at Johns Hopkins forecasts that the U.S. employment rate could reach 20 percent over the next six months. Nobel Prize-winning economist Paul Krugman tweeted: “{I} agree with {the Center for Financial Economics}: that balance sheet damage will hinder recovery even when the virus subsides. But 20% unemployment in 6 months sounds wildly optimistic: we may well be there in two weeks.* Goldman Sachs projected that unemployment would hit 15 percent by mid-2020.

Everyone is hoping that the U.S. economy will have a “V-shaped” recovery after the COVID-19 crisis abates, but some economists express skepticism that this will happen. The Center for Financial Economics at Johns Hopkins called hopes of a quick return to past lows “comical.” Mark Zandi, chief economist at Moody’s Analytics, forecasts that the U.S. won’t get back to full employment until well into 2023. The Congressional Budget Office wrote that the unemployment rate underlying the cost estimate for Coronavirus Aid, Relief, and Economic Security Act was 12 percent in the second quarter of 2020 and 9 percent at the end of 2021.

On Thursday, April 9, the U.S. Department of Labor will release its weekly report on initial unemployment claims that could contain continuing bad news for Massachusetts state finances. But even if the COVID-19 crisis is quickly resolved and the economy rebounds quickly, the unprecedented recent surge of unemployment claims is virtually certain to substantially deplete the Commonwealth’s unemployment reserve fund and require state leaders to face some tough choices.

Gregory W. Sullivan is the Research Director at the Pioneer Institute, overseeing the divisions PioneerPublic and PioneerOpportunity. He also previously served as Inspector General of the Commonwealth of Massachusetts for 10 years and in the Massachusetts House of Representatives for 17 years. Mr. Sullivan has a Master’s degree in public administration from the Kennedy School at Harvard University and a second Master’s degree concentrating in finance from the Sloan School at MIT.

Charles D. Chieppo is the Senior Media Fellow at the Pioneer Institute. Previously, he was Policy Director of the Massachusetts Executive Office for Administration and Finance and director of Pioneer’s Shamie Center for Restructuring Government.