Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

Massachusetts has among the highest standards of living in the US and the economy is booming, so why are people leaving? In 2020, the state lost thousands of residents to states like Florida, New Hampshire, and Maine.

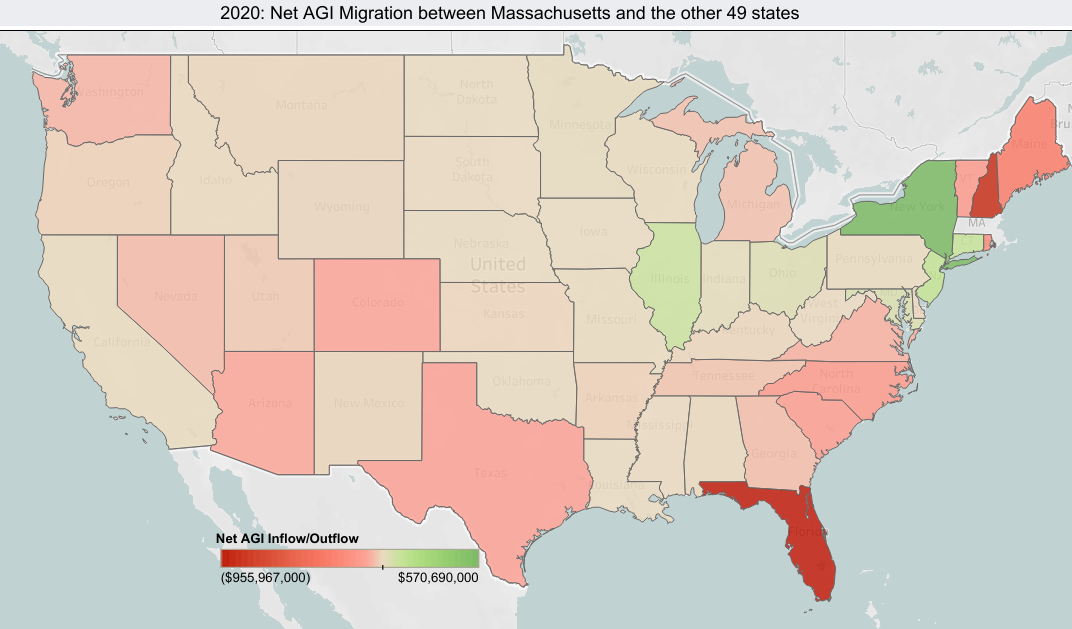

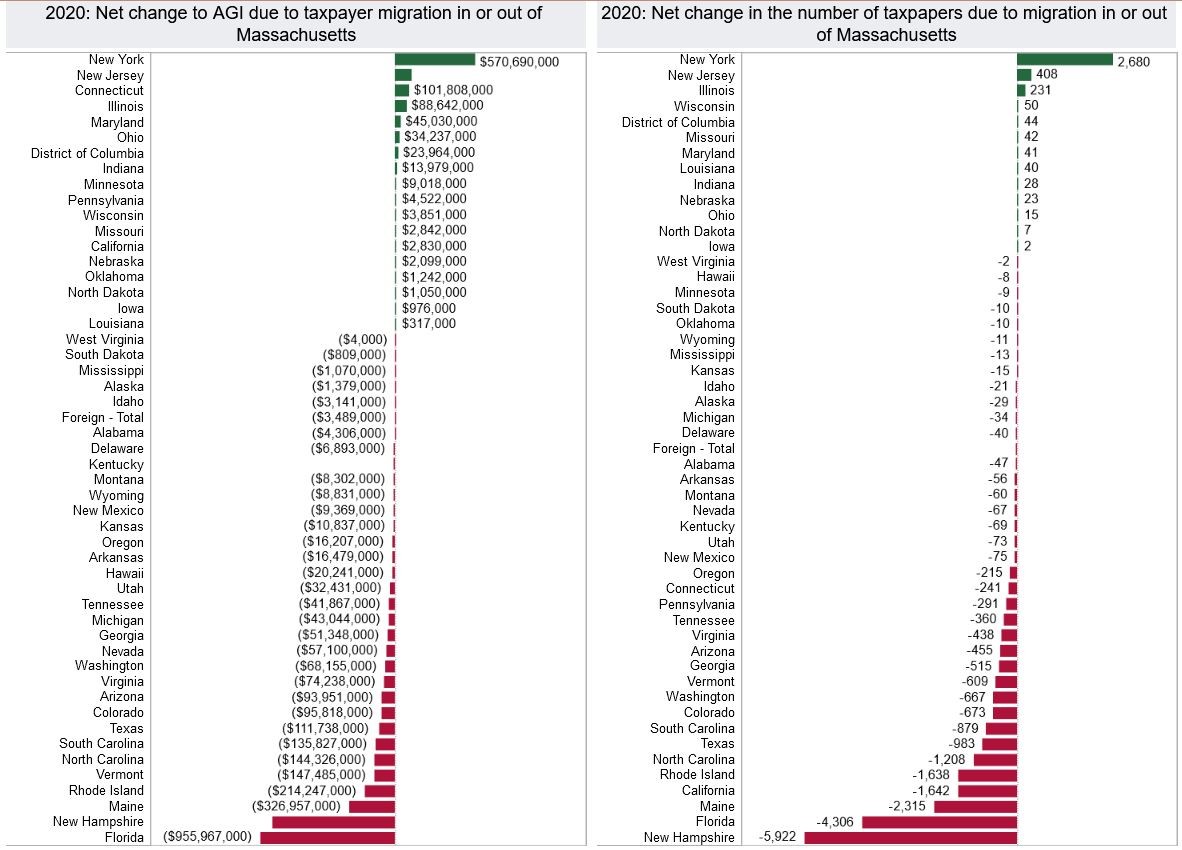

In 2020, Massachusetts had a net loss of over 20,000 residents and about $2.6 billion in adjusted gross income (AGI) to other states, according to IRS data made available by the Pioneer Institute’s IRS Data Discovery tool. The IRS tracks the changes based on the income tax returns Americans file every year.

The biggest destination states in 2020 were Florida, New Hampshire, and Maine, which all received significant net migration from Massachusetts. Net migration to New Hampshire was 5,922 people, Florida received 4,306 people, and Maine welcomed 2,315.

Figure 1: A map of the United States showing the net flow of AGI dollars in 2020 from Massachusetts to each other state respectively. Florida and New Hampshire receive the highest AGI amounts from Massachusetts and New York sends the most AGI dollars to Massachusetts. The map was generated using the Pioneer Institute’s IRS Data Discovery Tool.

These emigrants (people moving from MA) took their salaries with them. Florida received the most AGI dollars with $955 million. New Hampshire received $870 million in AGI, and Maine received $327 million.

The Discovery Tool also shows the average AGI for people who moved from MA. The astounding fact about these numbers is that the average net AGI per migrant to Florida is about $133,000. New Hampshire’s average is $109,000, and Maine’s is $110,000. The average AGI numbers are significantly higher than the MA median household income of $84,000 (US Census, 2020). This shows that Massachusetts’ emigrants to Florida, New Hampshire, and Maine have significantly above-average incomes.

The majority of the inflow of salary dollars (about 64 percent) from New York State come from New York County, better known as Manhattan. The average person moving from New York State to Massachusetts has a salary of $117,000, which is one of the highest averages of any state sending people to Massachusetts. The Commonwealth also received far more net AGI from New York than any other state at $570 million (see Figure 2).

Figure 2: A chart showing the net flow of AGI in 2020 to each state respectively (left) and the net flow of taxpayers to each state respectively (right). The chart was generated using the Pioneer Institute’s IRS Data Discovery Tool.

Complete the form below to download a FREE excerpt from “Back to Taxachusetts?”

More Emigration than Ever

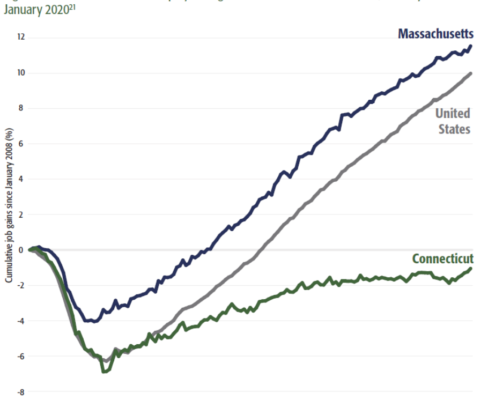

Massachusetts has not had a net inflow of domestic migrants for any year available on the Data Discovery website, which has records as far back as 1993. The only other years when net migration outflow was above 20,000 people were 2004, 2005, and 2017. Notably, those were also years when Massachusetts had a very prosperous economy.

Since 2015, AGI outflow to Florida, New Hampshire, and Maine at least doubled, while inflow stayed steady. That shows that the high level of outflow from Massachusetts is a relatively new phenomenon that has appeared over the past five years.

Why Some People Are Leaving

Massachusetts has the best schools, healthcare, and quality of life of any state in the country. So why would someone want to leave? It might be taxes, high cost of living, the ability to work remotely, or personal preference (including politics, climate, etc).

It is no secret that the cost of living in Massachusetts has been increasing dramatically. The World Population Review ranks Massachusetts as the state with the fourth highest cost of living. Massachusetts is also ranked as the third most expensive state in which to buy a house.

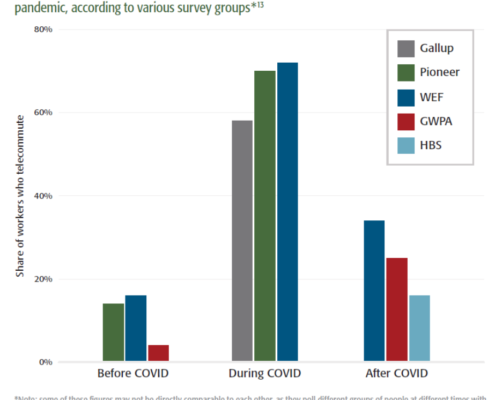

Additionally, remote work has become a new reality for many Massachusetts employees. It is now possible to earn a salary in Massachusetts while living in New Hampshire. Remote work may explain why New Hampshire is such a popular destination for Massachusetts emigrants.

Taxes are likely to be one other factor for people moving from one state to another. Is it a coincidence that Florida and New Hampshire both have zero personal income tax? In a recent press release, the Pioneer Institute Executive Director, Jim Stergios said “Massachusetts is hemorrhaging money and talent to low-tax states.”

Tax Policy Changes

Emigration from Massachusetts might actually reflect that the economy is doing really well! Most people are still willing to pay the high cost of living to stay, and income tax revenues for 2022 show that the economy is strong. Nevertheless, the state should take action to mitigate the impacts of emigration through tax policy changes.

One major policy change Massachusetts enacted in 2021 was to tax the incomes of people working in Massachusetts even if they are not residents. This includes people moving to New Hampshire who still work in Massachusetts. New Hampshire objected to this tax policy and brought it to the Supreme Court, where it was rejected.

Massachusetts is also about to hold a statewide vote to increase taxes on people earning over $1 million in a single year. Pioneer recently put out a number of publications on how the tax increase could hurt the economy and have an unintended impact on small business owners and retirees (the publications include a book, a podcast, and a video interview). The state should avoid increasing such taxes to make the state more competitive, especially at a time when income tax revenues are at an all-time high.

Related Posts:

—–

Cover Image Credit: formulanone, published on Wikipedia at the link here.

About the Author: Joseph Staruski is a government transparency intern with the Pioneer Institute. He is currently a Master of Public Policy Student at the University of Massachusetts, Amherst. He was previously an opinions columnist with the Boston College student newspaper, The Heights, and an Intern with the Philadelphia Public School Notebook. He has a BA in Philosophy and the Growth and Structure of Cities from Haverford College. Feel free to reach out via email, LinkedIn, or write a letter to Pioneer’s Office in Boston.