Tag Archive for: Massachusetts

John Phelan, CC BY 3.0

John Phelan, CC BY 3.0 Northwest Massachusetts’ Reliance on Industry Levies

Some towns in NW Massachusetts spend significantly more per capita than their neighbors, without using methods such as large state funding, deficit spending, and high taxes. These towns gain significant portions of their revenue from industry tax levies.

Part I: It May Be Better to Be Unemployed in Massachusetts than in Connecticut or New Hampshire

Connecticut, Massachusetts, and New Hampshire all rank among…

Study Finds Prevalence of Entrepreneurship Tied to Regulatory Environment, Portion of Immigrants

The prevalence of entrepreneurship is linked to both the regulatory environment and the portion of foreign-born immigrants in a jurisdiction, according to a new study published by Pioneer Institute.

Losing Local Labor: Retaining Workers Remains a Massachusetts Challenge

Joe Selvaggi talks with Pioneer Institute's Research Associate Aidan Enright about Pioneer's annual report on the Massachusetts labor force and discuss which trends could portend trouble for the state’s future.

Sunshine Week 2024

Partly Sunny with a Chance of Transparency

As Pioneer Institute…

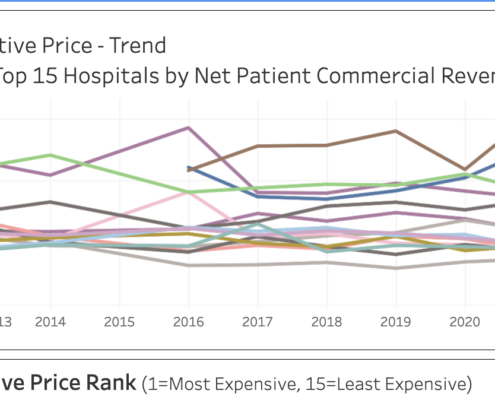

Boston Children’s, MGH Among Massachusetts Hospitals with Highest Relative Commercial Prices

Pioneer Institute's new tool, the Massachusetts Hospital Relative Price Tracker, displays relative price and facilitates relative price comparisons among hospitals. The average price among all hospitals will have a relative price of 1.0. A relative price of 1.5 means that a hospital charges 50 percent higher than the average of all Massachusetts hospitals. Similarly, a relative price of 0.84 means that a hospital’s prices are 16 percent below average. Relative price data is collected and reported by the Commonwealth’s Center for Health Information and Analysis (CHIA) and is an aggregate measure used to evaluate price variations among different hospitals. It is recalculated annually based on data collected from commercial payers and includes information on private commercial insurance and commercially managed public insurance products such as Medicare Advantage and Medicaid Managed Organizations/Accountable Care Partnership Plans.

Study: Ed Reform Has Improved Academic Performance and Equity

Over the past 30 years, rigorous standards, assessments, and accountability for outcomes have propelled Massachusetts public schools to become the nation’s best. Taking away the high-stakes component of MCAS would weaken the accountability system and lead stakeholders to de-emphasize the assessment data that drives high-quality instruction, according to a new study published by Pioneer Institute.

Baystate Budget Blues: Declining Revenue Causes Concern

Joe Selvaggi engages in a conversation with Pioneer Institute’s Eileen McAnneny, Senior Fellow for Economic Opportunity, to analyze the status of the 2024 budget. They compare actual revenue and spending with pre-July 1 estimates, investigating potential reasons for any surpluses or shortfalls. They also dive into policy implications for legislators as they approach fiscal 2025.

Pioneer Statement on Continuing Slide in Massachusetts’ Revenue

The Commonwealth’s tax collections continue to slide, totaling $3.594 billion in January, $268 million below what the state collected in January 2023, and short of the revised benchmark by $263 million. Massachusetts state government must live within its means by reducing FY2025 spending. The days of fiscal surpluses, unprecedented increases in year-over-year spending, and flowing federal aid have come to an end.

Admissions lotteries would harm vocational-technical schools

Expanding the number of seats available in vocational-technical high schools is a good investment for Massachusetts. But it’s critical they are expanded in a way that promotes equity without endangering the academic and occupational excellence that continues to drive burgeoning demand for these schools.

My Musings on Massachusetts’ Fiscal Picture

Since the start of FY2024 on July 1, 2023, the state has experienced six straight months of revenues falling short of expectations. The single biggest factor is the unprecedented growth of the state budget since FY2021. The $15 billion increase in state spending contextualizes the seemingly modest projected revenue growth of 1.6 percent for FY2024 by highlighting that the base is very inflated.

Better Civics Education Is the Massachusetts Way

The fight for more comprehensive civics education in the Bay State has persisted for years. The Legislature's recent override of Gov. Maura Healey’s cut to the state’s modest civics instruction budget suggests that in many in Massachusetts — including parents, teachers, and lawmakers — support strengthening the state’s civics and history curriculum, particularly with mounting evidence of declined student performance across the country.

A nuclear winter is coming for biopharma

The life sciences sector in Massachusetts — which has been flying so high for so long — is about to experience a very hard landing. With the adoption of prescription drug price controls in the Inflation Reduction Act (IRA), drug research and development — the heart of the life sciences sector in Massachusetts — is about to experience a nuclear winter.

Pioneer Study: Specifics on School Pandemic Relief Spending Hard to Come By

With the deadline for spending $2.9 billion in federal pandemic relief funds now less than a year away, it’s difficult to know exactly how Massachusetts school districts are spending the money and what impact those expenditures are having on students, according to a new study published by Pioneer Institute.

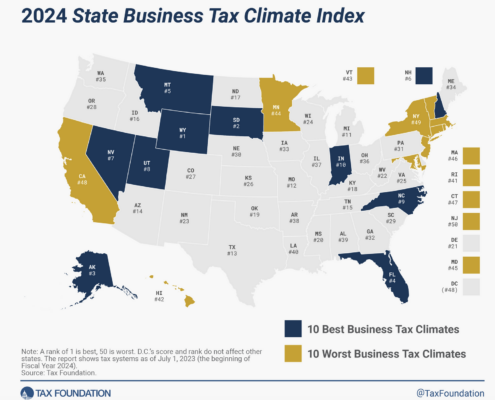

Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

Massachusetts Residents Score a ‘D’ in Poll Based on U.S. Citizenship Test

When asked a series of questions about how the federal government works that are based on the U.S. citizenship test, Massachusetts residents answered on average 63 percent of them correctly, earning a collective grade of “D” in a poll commissioned by Pioneer Institute and conducted by Emerson College Polling. The result is just over the 60 percent score required to pass the actual citizenship test.

Poll: MA Voters Oppose Legislative Proposals to Change Tax Rebate Law

A strong majority of registered Massachusetts voters oppose a plan recently announced by state legislative leaders that would change the way tax rebates are distributed in Massachusetts under a state law approved by voters in 1986, according to a new poll sponsored by Pioneer Institute and the Massachusetts High Technology Council.

Virtual Policy Briefing: Exploring the Intersection of Vocational-Technical Education and the Life Sciences Sector

Massachusetts is the nation’s leader in vocational-technical schooling and home to the most dynamic life sciences sector in America. We invite you to join us for a webinar on the nexus between the Bay State’s educational, life science, and competitive human capital needs in the 21st-century global economy.

Pioneer Institute Objects to Ballot Petitions on Rent Control and MCAS

Pioneer Institute today filed with Attorney General Andrea Campbell letters expressing opposition to certification of two ballot initiative petitions, one relating to rent control and the other proposing the elimination of MCAS testing as a condition for graduation from a public high school, because both initiative petitions, as drafted, are unconstitutional.

Black Box Budget: Late, Loaded, and Lacking Transparency

Joe Selvaggi talks with Pioneer Institute’s Senior Fellow in Economic Opportunity Eileen McAnneny about the features and flaws of the recently passed 2024 Massachusetts state budget now waiting for Governor Healey’s approval.

A History of Massachusetts’ Peculiar Beach Access Laws

Massachusetts rivals Maine for the lowest percentage of publicly owned and accessible coastal land. What seems a geographic coincidence is actually the product of contentious property rights disputes going back nearly 400 years, to the days of Puritan law.

Can Massachusetts Reverse the Decline in U.S. History and Civics Performance?

Massachusetts — home to so much history, including seminal events such as the Boston Tea Party — has much to be proud of in its own students’ history and civics performance. Even as policymakers have supplanted typical curricular standards with “engagement” mandates that students participate in progressive activism, national attitudes towards Massachusetts’ civic education have remained envious.

PFML v. FMLA: To Pay or Not to Pay Leave-Takers

Congress passed the Family and Medical Leave Act in 1993 to ensure citizens’ job security should they need to take an extended leave, but it did not require any replacement wages to be paid for that time period. Then, Massachusetts passed their Paid Family and Medical Leave law in 2018 which set out requirements for employer and employee contributions to a PFML fund so that employees could get paid in addition to keeping their jobs should they need to take leave for certain reasons.

Online Sports Betting as a Form of Tax Revenue

The legalization of sports betting in Massachusetts has been successful so far in terms of bringing in tax revenue. Although there's a chance for a dip in volume this summer, it will continue to be a strong source of revenue for the commonwealth.

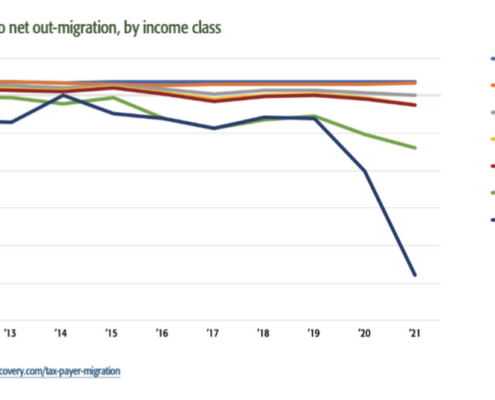

Massachusetts is Losing Taxpayers to More Tax-Friendly States

This post explores the difference among tax policies in Massachusetts, New Hampshire, and Florida in order to explain the increasing amount of Massachusetts residents who are migrating from the state. Tax-friendly policies are very alluring to Massachusetts residents, seeing as the state is actually increasing the personal income tax rate rather than try to lower taxes, as both New Hampshire and Florida have done.

Healthcare: Suffolk County’s Biggest Driver for Labor and Employment

Suffolk County employment and labor trends have seen steady growth over the past 15 years. The rise of establishments and employment in the health care sector has directly contributed to these trends. Suffolk County has now surpassed Worcester and Essex counties in labor force and employment numbers.

The Confounding Massachusetts Estate Tax

The estate tax has become an increasingly significant source of revenue for the Bay State in recent years. Why is this: and is it a good thing?

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

Massachusetts’ Misguided Middle-Class Health Insurance Subsidy Expansion

A proposal on Beacon Hill to expand insurance subsidies up to 500 percent of the federal poverty level, could push the small business insurance market into a death spiral, without reducing the number of uninsured and hurting those with preexisting conditions.

Study Finds Massachusetts Workforce Has Become More Female, Older, More Diverse

The Massachusetts labor force has transformed in recent decades, with some of the biggest changes being the advancement of women, workers getting older and more diverse, and a divergence in labor force participation rates based on levels of educational achievement, according to “At a Glance: The Massachusetts Labor Force,” a white paper written by Pioneer's Economic Research Associate Aidan Enright.