Tag Archive for: out-migration

Pioneer Statement on Decline in State Revenues

The Commonwealth’s finances have stumbled hard in recent months, and based on a report the Department of Revenue (DOR) sent to the Legislature in January, the trend shows no signs of easing. Massachusetts needs a renewed emphasis on fiscal discipline and pro-growth policies to make the state economically competitive again.

My Musings on Massachusetts’ Fiscal Picture

Since the start of FY2024 on July 1, 2023, the state has experienced six straight months of revenues falling short of expectations. The single biggest factor is the unprecedented growth of the state budget since FY2021. The $15 billion increase in state spending contextualizes the seemingly modest projected revenue growth of 1.6 percent for FY2024 by highlighting that the base is very inflated.

Senate Tax Package Misses the Mark on Competitiveness

The Senate tax package, S.2397, is heavy on provisions that reduce the tax burden for certain taxpayers, thereby helping those that qualify for the expanded credits and deductions. The bill, however, is light on provisions that will improve the Commonwealth’s competitiveness.

Massachusetts is Losing Taxpayers to More Tax-Friendly States

This post explores the difference among tax policies in Massachusetts, New Hampshire, and Florida in order to explain the increasing amount of Massachusetts residents who are migrating from the state. Tax-friendly policies are very alluring to Massachusetts residents, seeing as the state is actually increasing the personal income tax rate rather than try to lower taxes, as both New Hampshire and Florida have done.

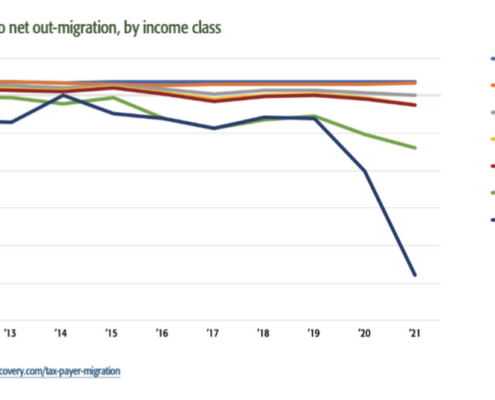

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

New IRS Data Shows Out-Migration Worsening, Underscoring the Need for Massachusetts Leaders to Focus on State’s Competitiveness

Massachusetts’ net loss of adjusted gross income (AGI) to other states grew from $2.5 billion in 2020 to $4.3 billion in 2021, according to recently released IRS data. Over 67 percent of the loss was to Florida and New Hampshire, both states with no income tax.

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

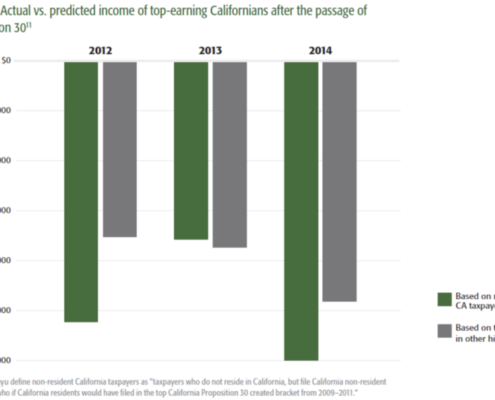

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.