Tag Archive for: income tax

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

New Hampshire Tax Burden Dramatically Less than Massachusetts

New Hampshire collects less than half the amount of taxes per capita as Massachusetts. How do they do it, and which strategy produces better outcomes?

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

Massachusetts Tax Revenues Surpass Pre-Pandemic Levels

Pandemic recovery and then some! Massachusetts revenues are higher than anyone was expecting, but where is all the money coming from? And what does this mean for the Massachusetts economy?

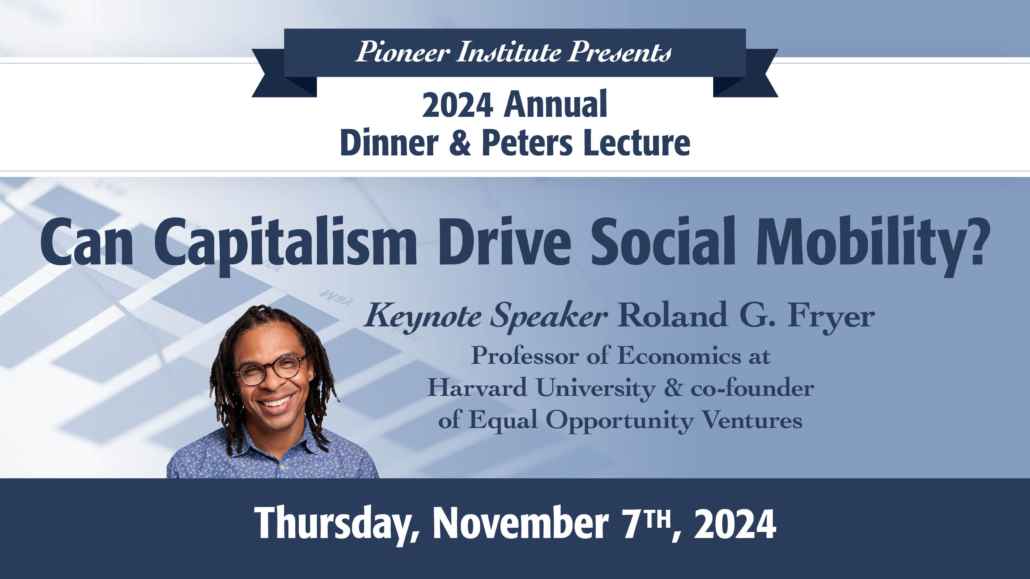

Fair Share Flimflam: Misleading Ballot Summary Could Distort Voter Choice

Joe Selvaggi talks with Attorney Kevin Martin, appellate litigator at Goodwin Proctor, about the complaint filed with the Massachusetts Supreme Judicial Court regarding the summary language on the 2022 "Fair Share Tax” ballot initiative. Kevin explains how the language misleads the public about the impact of their vote on revenue, spending, and our state’s constitution.

Pioneer Supports Legal Challenge to Misleading Tax Ballot Language, Releases Video

Pioneer Institute supports the diverse and bipartisan group that filed a complaint with the Massachusetts Supreme Judicial Court (SJC) challenging the summary language meant to provide an accurate description of the tax hike amendment to voters. The language was approved by the Attorney General and Secretary of the Commonwealth when a similar amendment was proposed in 2018, and unless the lawsuit is successful, will likely appear on the Massachusetts ballot in November.

The Great Understatement: Far more taxpayers and businesses than previously estimated will be affected by the proposed surtax

This report finds that analyses from the Massachusetts Department of Revenue (MADOR, 2016) (and more recently, Tufts University’s Center for State Policy Analysis (2022)) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022. The proposed tax would impact multiples of the number of people previously estimated, over a nine-year period, since the majority of “millionaires” only earn $1 million once during that time.

Study: Tax Up For A Vote In November Would Ensnare Over Three Times More Taxpayers Than Previously Estimated

Analyses from the Massachusetts Department of Revenue (MADOR, 2016) and Tufts University’s Center for State Policy Analysis (2022) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022, according to a new study from Pioneer Institute.

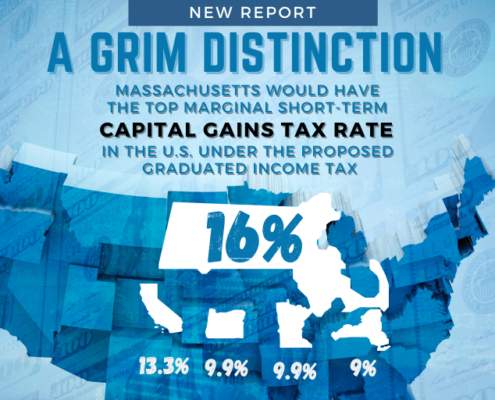

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

Tax Flight of the Wealthy: An Academic Literature Review

A new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets. The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal.

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

Are Massachusetts taxes regressive? A common argument for a graduated income tax relies on a deeply flawed and outdated study

Advocates of the proposed surtax paint a picture of the Massachusetts tax system as highly regressive. They fail to mention that ITEP, the organization that produced the data upon which they rely, rated Massachusetts as having a more progressive tax system than 29 other states. ITEP fails to adequately explain their model’s treatment of the tax incidence of sales, excise, and property taxes, and they exclude a number of other aspects of the tax code that make it seem artificially regressive.

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Proponents of a state constitutional amendment to add a 4 percent surtax on all households with annual income above $1 million frequently cite 2015 data from the Institute on Taxation and Economic Policy, which argues that the Massachusetts tax code is regressive, but a new study published by Pioneer Institute debunks many of the underlying assumptions used in ITEP’s 2015 report.

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs

Pioneer Institute's Statement before the Joint Committee on Revenue In Opposition to: HB 86 (Pages 1-4), a legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

Statement before the MA Joint Committee on Revenue in Opposition to HB 86 (Pages 1-4) A legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

Pioneer Institute's Jim Stergios submitted public testimony highlighting Pioneer’s very serious concerns about how the proposed graduated income tax amendment to the Massachusetts State Constitution would have a detrimental impact on the state’s economy as it begins to recover from the COVID-19 pandemic.

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

A state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union adding a 4 percent surtax to all annual income above $1 million could devastate innovative startups dependent on Boston’s financial services industry for funding, ultimately hampering the region’s recovery from the COVID-19 economic recession, according to a new study published by Pioneer Institute.

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

Study: Graduated Income Tax Proposal Fails to Protect Taxpayers from Bracket Creep

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to a new study published by Pioneer Institute.

The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to this report, "The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor."

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

The Graduated Income Tax Trap: A retirement tax on small business owners

This report finds that, if passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses. The study aims to help the public fully understand the impact of the proposed new tax.