Tag Archive for: New Hampshire

Massachusetts is Losing Taxpayers to More Tax-Friendly States

This post explores the difference among tax policies in Massachusetts, New Hampshire, and Florida in order to explain the increasing amount of Massachusetts residents who are migrating from the state. Tax-friendly policies are very alluring to Massachusetts residents, seeing as the state is actually increasing the personal income tax rate rather than try to lower taxes, as both New Hampshire and Florida have done.

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

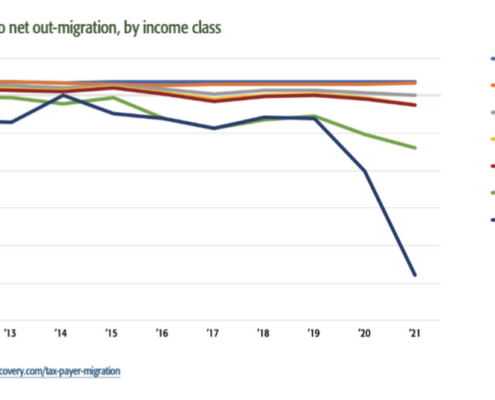

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

New Report: Massachusetts Maintains Reasonable Debt Relative to GSP

0 Comments

/

Massachusetts has more debt than any New England state. Can we afford to pay it off or will we hand it down to future generations?

New Hampshire Tax Burden Dramatically Less than Massachusetts

New Hampshire collects less than half the amount of taxes per capita as Massachusetts. How do they do it, and which strategy produces better outcomes?

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

Study Warns that New Hampshire Tax Policies Would Exacerbate Impacts of a Graduated Income Tax

Drawing on migration patterns between Massachusetts and states like Rhode Island and Tennessee, Pioneer Institute is releasing a study showing a direct correlation between personal income tax rates and household domestic migration patterns between 2004 and 2019. The study suggests that instituting a graduated income tax will shrink the tax base and deter talented workers and innovative employers from coming to and staying in the Bay State.

Interstate Legal Skirmish: New Hampshire Takes Massachusetts Telecommuter Tax to the Supreme Court

Host Joe Selvaggi talks with legal scholar and George Mason University Law Professor Ilya Somin about the details, the merits, and the likely implications of the Supreme Court case, New Hampshire v. Massachusetts, on state taxation power, federalism, and the power to vote with one’s feet.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.