Tag Archive for: migration

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Massachusetts is Losing Thousands of Taxpayers a Year. Where Are They Going?

Massachusetts is facing a net loss of taxpayers and AGI. Learn about where these taxpayers are migrating to, and potential reasons for that migration.

At a Glance: Who Moved to Massachusetts in 2022?

State-to-state migration can have serious impacts on the local economy. Migrants to Massachusetts come from all over the country, but significant portions of both new taxpayers and new taxable income come from just a few sources, such as New England, New York, Florida, and California.

Harsh Tax Policies in NY Make MA Seem Palatable as Some Residents Look to Relocate

While many Massachusetts residents relocated to either New Hampshire or Florida in 2021, a considerable amount of New Yorkers migrated into Massachusetts. Their motivation to relocate seems largely tied to the harsh taxes in New York, which surpass the rates in Massachusetts.

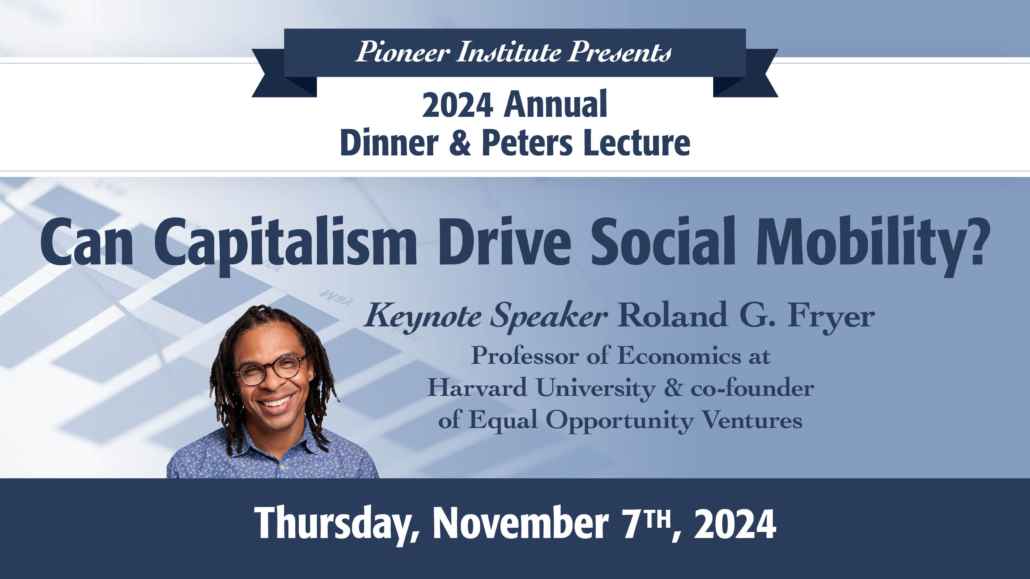

Losing Talent and Treasure: Uncompetitive Tax Regime Drives Upper-Income Exodus

Joe Selvaggi talks with Pioneer Institute's Economic Research Associate Aidan Enright about his new paper "Debunking Migration Myths." With this research, Aidan examines the link between Massachusetts' tax regime and the outflow of high earners to states with more competitive rates.

Emigration from Massachusetts is at a Decade High, Despite Booming Economy and High Standard of Living

The economy is doing great, so why are people leaving Massachusetts?

Where are Barnstable residents migrating to?

Using Pioneer Institute’s newest database, Massachusetts IRS…

Study: Graduated Income Tax Proponents Rely on Analyses That Exclude the Vast Majority Of “Millionaires” to Argue Their Case

Advocates for a state constitutional amendment that would apply a 4 percent surtax to households with annual earnings of more than $1 million rely heavily on the assumption that these proposed taxes will have little impact on the mobility of high earners. They cite analyses by Cornell University Associate Professor Cristobal Young, which exclude the vast majority of millionaires, according to a new study published by Pioneer Institute.

Missing the Mark on Wealth Migration: Past Studies Drastically Undercounted Millionaires

Advocates of a constitutional amendment that would apply a 4 percent tax on all annual individual income over $1 million argue that similar taxes in other states have had little impact on the migration of millionaires, citing the research of Cornell University Associate Professor Cristobal Young, which suggests that “millionaires’ taxes” enacted in other states similar to the one being proposed in Massachusetts have had little impact on millionaire mobility. This paper demonstrates that he drastically undercounts millionaires, and outlines several ways in which he and tax advocates underestimate the number of people who will at some point in their lives be subject to a so-called millionaire’s tax and tax flight trends.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.