Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

BOSTON – As Massachusetts voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

Many of the individual research papers described in the report focus on particular sub-groups of the wealthy, such as chief executive officers at major corporations and particularly innovative “star scientists.”

“The breadth of research covered in this paper really highlights the variety of ways in which income tax hikes can leave states vulnerable to wealth flight and fiscal and economic harm,” said Andrew Mikula, author of Tax Flight of the Wealthy: An Academic Literature Review. “Besides physical relocation out of Massachusetts, such policies are also deterring innovators from coming here to begin with, and encouraging stock-based salaries that are used to delay tax payments.”

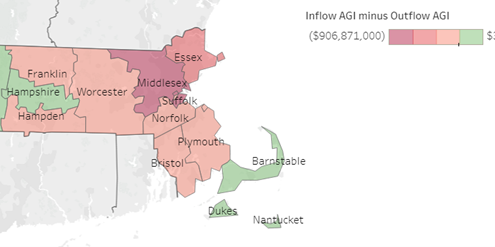

The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal. For example, a 2012 study from the University of Pennsylvania found that, for every 1 percent increase in the share of income retained after taxes, the total value of taxable income in a jurisdiction increases by between 0.12 percent and 0.40 percent in the long run. This would imply that Massachusetts’ proposed surtax would decrease the amount of taxable income in the state by between $606 million and $2.02 billion.

A 2008 study in the Journal of Urban Economics spoke to the interaction between the proposed surtax and a pending court case between New Hampshire and Massachusetts over whether remote workers in the Granite State are obligated to pay taxes in Massachusetts when their companies are based here. The study found that, in states without “reciprocity agreements” that would prevent such disputes, the impact of tax hikes on migration patterns is far stronger.

Pioneer’s new policy brief also highlights nuances in past studies that have downplayed the role of tax hikes in the migration decisions of the wealthy. For example, a 2016 paper by Cornell University Professor Cristobal Young claims that “when Florida is excluded, there is virtually no” correlation between income tax rates and migration patterns in the United States.

However, underpinning this headline-worthy line is that Young doesn’t rule out that there is an “especially appealing combination” of tax avoidance and geography driving the so-called Florida effect. In addition, the database used in Young’s paper only includes households that earned over $1 million in the year before they move, a severe limitation that misses households that migrate for the purpose of avoiding taxes on the anticipated sale of a valuable asset.

Other papers described in the report discuss the tax policy implications of the Tiebout hypothesis that people tend to “vote with their feet.” In the aftermath of the COVID-19 pandemic, taxpayers may be especially mobile as they are able to work from home in greater numbers than ever before. All but one of the papers described in the report predate the pandemic, and most of them predate the Tax Cuts and Jobs Act as well, whose limitation on the state and local tax deduction could also encourage increased migration among the wealthy.

“Research data allow us to put some hard numbers on the devastating and perhaps permanent impact of a graduated income tax – as much as $2 billion in lost taxable income,” said Pioneer Institute Executive Director Jim Stergios. “And calculating the impact on state tax revenues ignores the enormous human toll: lost jobs and less security for homeowners. The long-term effects may include, as is abundantly clear in the case of Connecticut, anemic growth in state tax receipts and therefore fewer resources for social programs and public investments.”

About the Author

Andrew Mikula is an Economic Research Analyst at Pioneer Institute. Mr. Mikula was previously a Lovett & Ruth Peters Economic Opportunity Fellow at Pioneer Institute and studied economics at Bates College.

Pioneer’s mission is to develop and communicate dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Pioneer’s vision of success is a state and nation where our people can prosper and our society thrive because we enjoy world-class options in education, healthcare, transportation and economic opportunity, and where our government is limited, accountable and transparent.

Pioneer values an America where our citizenry is well-educated and willing to test our beliefs based on facts and the free exchange of ideas, and committed to liberty, personal responsibility, and free enterprise.

Get Updates on Our Economic Opportunity Research

Related Posts: