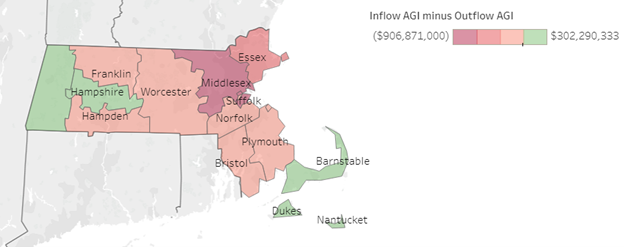

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

“Massachusetts is hemorrhaging money and talent to low-tax states,” said Pioneer Institute Executive Director Jim Stergios. “This is no time to go back to tax policies that will make the Bay State less attractive to businesses and families.”

Ten states have already passed tax cuts and 13 more are considering such changes, including Virginia, where Governor Youngkin has made no secret of his push to make Virginia more affordable to employers and families. Yesterday, Raytheon, one of Massachusetts’ largest employers, announced that it will move its headquarters to Virginia.

In 2020, Massachusetts lost over 10,000 income tax filers to two states with no income tax: 5,900 to Florida and 4,300 to New Hampshire, compared to 1,600 and 1,200, respectively, in 2010. The county with the largest 2020 net loss of wealth, amounting to more than $900 million in AGI, was Middlesex, which abuts no-income tax New Hampshire.

Get Updates on Our Economic Opportunity Research

Related Posts

Image by Freepik.com

Image by Freepik.com