Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

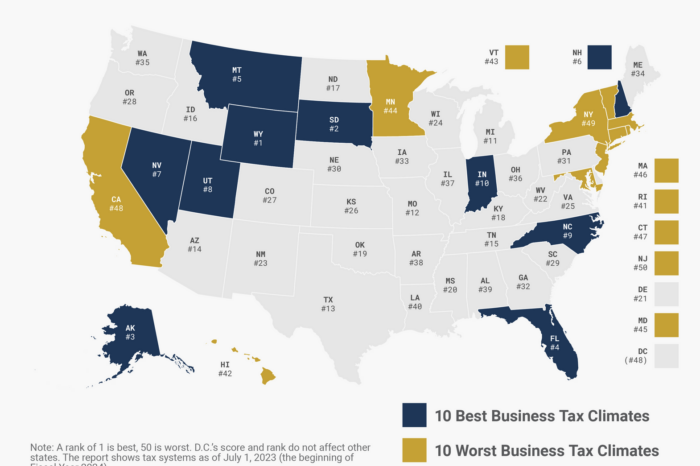

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

The biggest reason for the drop was voters’ adoption of a tax hike amendment to the state Constitution last November. In the Tax Foundation’s “Individual Income Tax” category, the Commonwealth’s ranking fell a stunning 33 places, from 11th to 44th.

The income tax rate for high earners will almost double (from 5% to 9%) for all income over $1 million — a stark contrast with the trend in two dozen other states that are reducing rates and consolidating brackets.

Massachusetts also ranked dead last in the “Unemployment Insurance Tax” category and 47th for property taxes.

The data are alarming, particularly when paired with the latest state migration numbers. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only three much larger states — California, New York, and Illinois. Those earning $200,000 or more annually are responsible for over 60 percent of lost wealth, and departures accelerated further beginning in 2020.

Massachusetts’ leaders should keep these alarming trends in mind as they discuss proposals that would further affect our competitiveness, including a proposed real estate transfer tax. More to the point, they need to articulate a policy vision that will improve state businesses’ ability to compete nationally and internationally.

State residents of a certain age will never forget the bad old days of “Taxachusetts,” when the state economy was choked by high taxes and stifling regulation. After a three-decade bipartisan effort lifted Massachusetts out of the quagmire, policymakers should take care to learn the lessons taught by the period of inconsistent and often lackluster growth in jobs and wealth that preceded the resurgence.

Pioneer Institute has done numerous reports on state taxation and its effect on out-migration. They have been compiled into a book, Back to Taxachusetts?