Massachusetts is Losing Taxpayers to More Tax-Friendly States

Massachusetts has seen a staggering outflow of taxpayer returns to New Hampshire and Florida since 2019. In 2021, 6,527 taxpayers left Massachusetts to reside in New Hampshire, taking with them a net loss of nearly $1.13 billion in adjusted gross income (AGI). Meanwhile, 6,199 taxpayers relocated to Florida in the same year, which resulted in nearly $1.77 billion net AGI loss. Taken together, the net out-migration to New Hampshire and Florida account for 58.83 percent of the net loss in Massachusetts’ AGI for 2021.

Fig. 1. Source: Mass IRS Data Discovery (2021)

Both New Hampshire and Florida had higher than average AGI per outflow return from tax filers out-migrating from Massachusetts, with former Massachusetts filers in New Hampshire earning an average of $127,760 and $179,878 in Florida. Evidently, these states are very attractive to Massachusetts residents; especially to those making higher salaries.

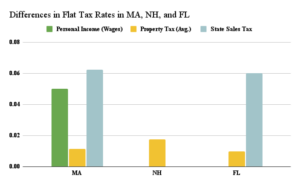

Differences in tax policy may explain why Massachusetts’ tax filers are drawn to New Hampshire and Florida, opposed to other states. In Massachusetts, the personal income tax is a flat rate of 5 percent; however, the following tax season will see an additional levy of 4 percent on earnings above $1 million. The Bay State has a 6.25 percent sales tax rate without a local option, and an average property tax of 1.14 percent of the home’s assessed value.

New Hampshire has no personal income tax on wages – only a 5 percent tax on interest and dividends that will be phased out by 2027, no sales tax, and an average 1.77 percent property tax rate. Similarly, Florida has no personal income tax, a 6 percent sales tax with up to an additional 2 percent allowed for local taxes, and an average property tax of 0.98 percent.

Further, Florida had a corporate tax of 3.535 percent for 2021, which has since increased to 5.5 percent. Massachusetts levies an 8 percent income tax on corporations as well as a $2.60 tax per $1,000 of personal property or net worth. Also, New Hampshire and Florida have no estate tax, unlike Massachusetts.

Fig. 2. MA Data Sourced from: AARP (2023). NH Data Sourced from: NHDRA (2023) and SmartAsset. FL Data Sourced from: AARP (2023) and FL Dept. of Revenue

Note: Local sales tax and corporate tax are not included above.

With these tax policies in mind, the allure of New Hampshire and Florida to Massachusetts residents become clear. While New Hampshire and Florida have no income taxes and have generally sought to reduce their tax burdens, Massachusetts recently voted to increase personal income taxes. Therefore, those in high-paying jobs in Massachusetts who are able to relocate to one of these states can benefit greatly from doing so, as they will likely be able to keep much more of their earned income than if they stay in Massachusetts.

New Hampshire’s lack of a sales tax and Florida’s lesser property tax are separate incentives for migrants to each state, not to mention Florida’s significantly lower corporate tax rate, which has likely been very attractive to business owners in Massachusetts.

Ultimately, money talks, so tax burdens can significantly impact an individual’s decision to relocate. By leveraging their tax-friendly policies, states like New Hampshire and Florida have become appealing to residents looking to move somewhere more affordable. Without reform, Massachusetts will continue to lose taxpayers as they seek greener pastures and fuller wallets.

About the Author: Sarah Delano is a Roger Perry Government Transparency Intern at the Pioneer Institute for the summer of 2023. She is a senior studying Political Science at the University of Massachusetts-Amherst.