Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

Those earning $200,000 or more annually responsible for over 60 percent of lost wealth; departures accelerated beginning in 2020

BOSTON – 2021 IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

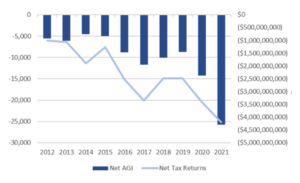

Annual net out-migration of adjusted gross income (AGI) rose from over $900 million in 2012 to $4.3 billion in 2021. The annual net loss in the number of state income tax filers increased at a similar rate.

“Net out-migration has nearly quintupled and the largest spike in departures occurred in 2020 and 2021, as remote work took hold and most other states were cutting taxes,” said Pioneer Executive Director Jim Stergios, who coauthored “Tax Reality Sets In” with Mary Connaughton and Eileen McAnneny. “Massachusetts’ inattention to tax and competitiveness policies is leading to a tsunami of departures.”

“For three decades political leaders prioritized tax stability, and the state shed the derisive ‘Taxachusetts’ label,” Connaughton said. “Now that we’ve strayed from that path, people and wealth are leaving in droves.”

The authors identify the socioeconomic phenomenon of remote work and a massive shift in tax policies enacted by the federal government and other states as key external factors in the dramatic increase in Massachusetts departures.

- A 2022 McKinsey survey showed that 58 percent of employees nationwide had substantial remote work options. Remote work is especially prevalent in knowledge-based sectors such as computer and mathematical, business and financial operations, architecture and engineering, legal, and life, physical, and social sciences. Employees are more likely to seek out places with a lower cost of living if they can still access the vibrant Boston-area job market.

- The 2017 Tax Cuts and Jobs Act placed a $10,000 limit on the federal deduction for state and local taxes paid, which laid bare states with non-competitive tax policies and highlighted the benefits of changing domicile.

- In 2021 and 2022, 43 states enacted some form of tax relief. While Massachusetts contemplated and ultimately raised income taxes during that time, 21 states reduced them.

“Migration is prompted by a broad set of tax and economic policies considered in the context of dozens of states and even more countries that are competing for employers, wealth and talent,” said McAnneny.

Massachusetts policymakers have ignored the new tax realities and the rise of remote work in two ways:

- Massachusetts and Oregon are the only states in which estate taxes are triggered at the $1 million threshold. In contrast, 33 states have no such tax. The federal threshold is just under $13 million.

- Adoption of a constitutional amendment hiking income taxes in November 2022 will likely further quicken the departure of residents and wealth. The top 1 percent of taxpayers paid 23 percent of state income taxes in 2019, and the amendment is likely to drive that number higher.

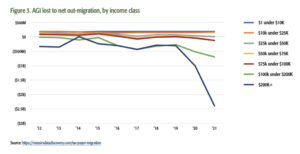

Of the wealth lost in 2021, about $2.6 billion—just over 60 percent—was from taxpayers earning $200,000 or more per year. This alarming acceleration of AGI loss among high-income earners began in 2020 and worsened in 2021.

Trends among age-groups that are leaving the state are also troubling. Massachusetts is seeing the biggest losses among residents aged 55-65, which may be exacerbated by the Commonwealth’s onerous estate tax. The second largest cohort in terms of lost wealth is 26-35-year-olds, which is disturbing because it translates to a loss of young talent, future innovation, economic growth, and revenue that will compound over decades.

In terms of location, more than 67 percent of 2021 AGI loss went to Florida and New Hampshire, two states with no income or estate taxes. From 2020 to 2021 alone, the number of income tax filers leaving for New Hampshire rose by more than 10 percent and the number moving to Florida jumped 44 percent.

Massachusetts’ rise to fourth place ranking among the states in net out-migration also occurred in 2020. The fact that Massachusetts now has a greater wealth out-migration than states with much larger populations, such as New Jersey, Pennsylvania, and Ohio, should trouble policymakers.

To stem the tide, the authors urge state leaders to focus on the areas where state tax policies are most onerous. They cite reducing capital gains taxes, the tax treatment of S corporations and other “pass through” entities that pay taxes via personal returns, and elimination of the estate tax or significantly raising the threshold at which it is triggered.

Policymakers, business leaders, scholars, media professionals, and interested citizens can use MassIRSDataDiscovery.com to conduct this and additional analyses using the latest available IRS data.