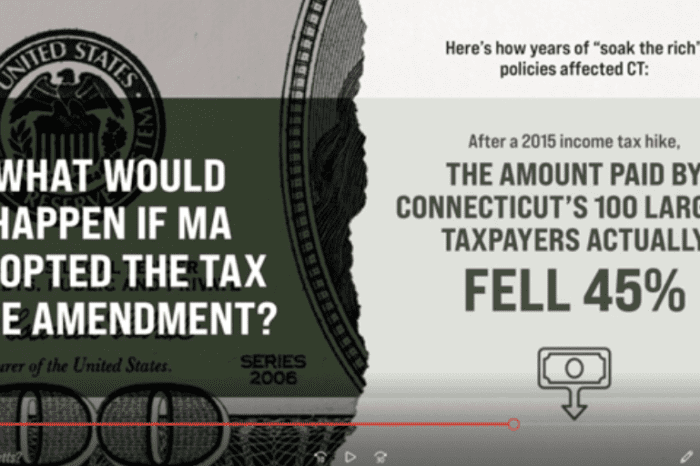

How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

Skill-based immigration could ease labor shortage

A recent Biden administration executive order that amends the Schedule A list, which identifies occupations experiencing labor shortages and allows immigrants in those occupations to expedite their employment in the U.S., could positively impact the hiring of skilled international workers for years to come — a welcome development as the country and Massachusetts struggle to attract talent amidst a worsening labor shortage.

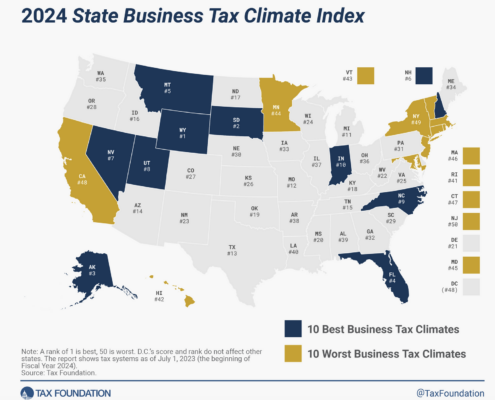

Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

Poll: MA Voters Oppose Legislative Proposals to Change Tax Rebate Law

A strong majority of registered Massachusetts voters oppose a plan recently announced by state legislative leaders that would change the way tax rebates are distributed in Massachusetts under a state law approved by voters in 1986, according to a new poll sponsored by Pioneer Institute and the Massachusetts High Technology Council.

Installing bike and bus lanes requires public debate

The problem isn’t with the concept of bike lanes but, rather, the lack of public conversation or transparency. Municipal governments are changing the infrastructure and character of entire neighborhoods and small commercial centers with little input from those most affected.

Study: Immigrant Entrepreneurs Benefit N.E. Economy, Despite Facing Obstacles to Growth

BOSTON – Immigrants in Massachusetts and New England are more likely to be self-employed, but the businesses they own tend to be in different industries than those owned by the U.S. born, according to a new study published by Pioneer Institute.

Public Statement on the House’s Proposed Tax Reform and Budget

Pioneer Institute applauds key tax reform provisions advanced by the Speaker and House leadership, including a reduced short-term capital gains tax rate and implementation of a single sales factor apportionment. But leadership must do more to bolster the state’s economic competitiveness and slow out-migration of wealth and business owners that endangers the commonwealth’s economic future.

Licensing burdens thwart economic growth in Massachusetts

Immigrants account for 17% of Massachusetts residents but start a quarter of the Commonwealth’s new businesses. These entrepreneurs could create even more jobs that further lift wages and standard of living if not for the unnecessary obstacle of restrictive state and local occupational licensing laws.

Report: Immigrant Entrepreneurs Provide Economic Benefits, but Face Significant Obstacles

Immigrants have started a quarter of all businesses in Massachusetts despite making up just 17 percent of the state workforce, and those establishments appear to be more innovative than those founded by native-born Americans. Despite these contributions, shrinking federal visa caps and red tape are among the factors making it more difficult for immigrants to come to the U.S., according to “Immigrant Entrepreneurs and the Barriers They Face: An Academic Literature Review,” published by Pioneer Institute.

Pioneer Institute Statement on Question 1

Yesterday, voters came closer than many expected to rejecting the largest tax increase in Massachusetts history, even though opponents were dramatically outspent by the unions that bankrolled the amendment to the state Constitution.

Taxachusetts Must Be Stopped

Going back to the bad old days of Taxachusetts would be an almost unfathomable mistake. Between the $3 billion bombshell that upended the recent legislative session, the ambiguity about how the tax revenue will actually be spent, and the contrasting examples of neighboring New Hampshire and Connecticut, Bay State voters have plenty of reasons to come back to reality and reject the ill-conceived proposal to amend the Massachusetts constitution this November.

Study: Legislators Must Answer Key Questions Before Setting Policy for App-Based Rideshare/Delivery Workers

After Massachusetts’ Supreme Judicial Court declared an initiative that was to appear on the November ballot unconstitutional, the issue of how to classify app-based rideshare/delivery workers is back in the hands of the state Legislature. A new study published by Pioneer Institute distills from the research literature eight questions legislators must answer before determining how to address this fast-growing industry.

WSJ op-ed: Don’t Make Massachusetts ‘Taxachusetts’ Again

Unlike many blue states, Massachusetts has resisted the temptation to raise taxes on high earners. That antitax fortitude is about to be tested. In November, state legislators will ask voters to approve an amendment to the Massachusetts constitution adding a 4% surcharge to annual income over $1 million.