Whistleblowers Were Proven Right: MBTARF Was Underreporting Its Unfunded Pension Liabilities

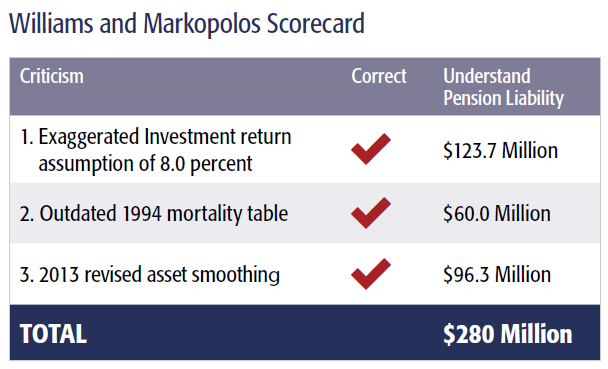

In a new brief, Pioneer shows that whistleblowers’ 2015 claim that the MBTA Retirement Fund (MBTARF) had been underreporting its unfunded pension liabilities has proven to have been accurate. In their study, Boston University Professor Mark T. Williams and Bernie Madoff whistleblower Harry Markopolos outlined three specific ways in which the T pension fund was underreporting its liability. Pioneer’s scorecard shows that they were right on all three counts, adding up to a total of $280 million in underreported pension liability.

At the time, MBTARF vigorously refuted the validity of the findings. Spokesman Steve Crawford said, “The fund stands by its reported investment returns and by its asset and liability calculations,” and that “MBTA retirees and beneficiaries can be confident that their futures are secure.” But a new Pioneer brief presents in-depth analysis of MBTARF’s subsequent financial disclosures that demonstrate the accuracy of Williams’ and Markopolos’s claims.

As Pioneer recommended in its recent public statement on the fare hike proposal, the MBTA must commit to reforms to its pension fund that will ensure its sustainability for T employees and reduce the financial burden on riders and taxpayers. As Mark Williams noted in a Boston Globe op-ed in January 2019, the MBTA’s contribution to MBTARF was $40 million a decade ago; by the time of the next fare increase, that amount will rise to $140 million. In a recent editorial, The Boston Globe cited the T’s projection that the unfunded liability would reach $1.5 billion, and echoed a Pioneer recommendation to shift control of the T’s pension system to the state’s well-run Pension Reserves Investment Trust. In reports and op-eds published since at least 2013, Pioneer has raised concerns about the MBTARF’s growing and unsustainable pension liability, and offered reform proposals that include, in addition to transferring T employees to the state pension fund, a legislative cap on employer contributions to the pension fund, a new pension benefit structure for all current MBTARF members, and hiring an independent actuary and auditor to conduct an independent review of the fund.