Study: Methodology of Noted “Millionaire’s Tax” Researcher Excludes Vast Majority of Millionaires

The work of a Stanford University Professor whose research has formed the foundation of efforts, such as one scheduled to appear on the Massachusetts ballot in November, to impose surtaxes on high earners is flawed because it excludes the vast majority of millionaires, according to a new study published by Pioneer Institute.

Professor Cristobal Young’s research has found that no more than 2.4 percent of U.S.-based millionaires changed their state of residency in any given year. But his methodology, which he describes as “people who earned $1 million or more in year t and changed their state of residency between year t and t+1,” captures just a small fraction of U.S. millionaires.

The ballot measure, known as Proposition 80, would amend the state constitution to add a 4 percent surtax on all annual income over $1 million.

The Federal Reserve Board estimates that there were 14.7 million U.S. households with net worth of $1 million or more in 2016, but only 6.8 percent of them had incomes of $1 million or more that year. During the same year, 92.3 percent of the 4.43 million households with net worth between $2.5 million and $10 million had incomes of less than $1 million, and would therefore be excluded from Professor Young’s research.

“There were 14.7 million U.S. households with net worth of $1 million or more in 2016,” said Pioneer Executive Director Jim Stergios. “But in 2015, just 438,370 taxpayers fit Professor Young’s criteria.”

When high net worth individuals do earn $1 million or more in a year, they tend to do it on an irregular basis. According to IRS data, the majority of U.S. taxpayers who reported gross annual incomes of $1 million or more over a nine-year period did so just once during that time. Less than 6 percent earned $1 million or more in each of the nine years.

Pioneer Institute Research Director Greg Sullivan, author of Eight Reasons to Question Professor Cristobal Young’s Conclusions about Millionaire Migration, finds that Professor Young underestimates the cumulative effect of millionaire migration. If Proposition 80 is adopted and Massachusetts experiences a 1.5 percent annual net out-migration of millionaires, which is below Young’s 2.4 percent estimate, by 2038, the Commonwealth will receive less in total income and surcharge taxes from taxpayers with incomes of $1 million or more than it would have if the measure had not been adopted.

Florida, which has no income, capital gains or estate taxes, accounts for almost half the out-migration of adjusted gross income from Massachusetts, far more even than New Hampshire, which also has no income tax. Professor Young argues that the evidence for migration of millionaires is largely driven by the Sunshine State and has written that “When Florida is excluded, there is virtually no tax migration.”

“Saying there’s virtually no tax migration when you exclude Florida is like saying that if you exclude Muhammad Ali, Louisville hasn’t produced many great boxers,” said Sullivan.

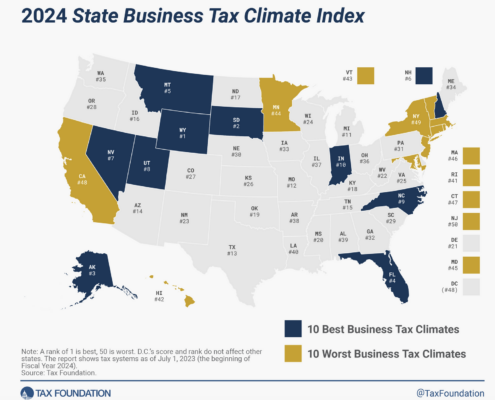

More evidence that Professor Young underestimates the impact of taxation on migration patterns of the wealthy is found in the fact that five jurisdictions with no capital gains taxes have the highest average capital gains income. One would hardly expect Wyoming, Nevada, Florida, Washington, and U.S. citizens living abroad to lead in this area, which is evidence that millionaires move to these jurisdictions to realize large capital gains distributions.

About the Author

Gregory W. Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts, and was a 17-year member of the Massachusetts House of Representatives. Greg holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

About Pioneer

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Get Updates on Our Economic Opportunity Research

Related Posts