Study: Tax Up For A Vote In November Would Ensnare Over Three Times More Taxpayers Than Previously Estimated

Surtax mainly impacts households and businesses whose income exceeds $1 million due to one-time business events, sales of long-held property and retirement

BOSTON – Analyses from the Massachusetts Department of Revenue (MADOR, 2016) and Tufts University’s Center for State Policy Analysis (2022) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022, according to a new study from Pioneer Institute.

A question scheduled to appear on the Massachusetts ballot next November would amend the state constitution and place a four-percent surtax on households and thousands of Massachusetts businesses that in any one year have income exceeding $1 million. In studying the effect of the proposed tax, MADOR found that 19,565 households and businesses would be impacted in the single year the tax took effect. The Tufts’ analysis estimates 26,000 would be affected in 2023.

MADOR and Tufts’ analyses focus on the impact in a single year and are therefore premised on a fundamental misunderstanding of the households and businesses affected by the tax. Those affected by the tax are primarily retirees and small businesses who have a one-time taxable event, often the sale of an asset—a home that will serve as a retirement nest-egg, a business location or subsidiary, a patent, or similar. The great majority are not “millionaires.”

A new Pioneer Institute study finds that the proposed tax would impact multiples of that amount over a nine-year period, since the majority of “millionaires” only earn $1 million once during that time.

“More than three times the number of unique individual Massachusetts taxpayers—mainly retirees and individuals who have a business pass-through—would be affected by the proposed surtax over nine years than found in these estimates,” said Greg Sullivan, author of “The Great Understatement: Far more taxpayers and businesses than previously estimated will be affected by the proposed surtax.” “The longitudinal data makes clear that a one-year analysis gives short shrift to the number of businesses and households who will be affected by this tax proposal.”

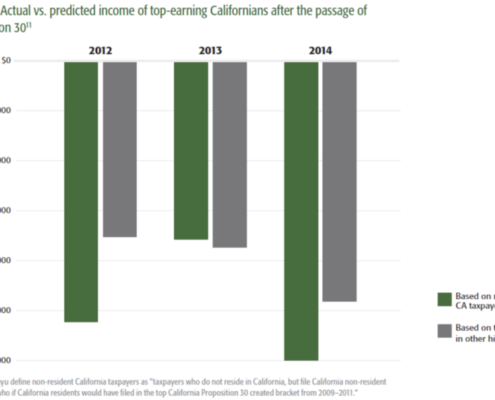

According to a 2010 Tax Foundation report, more than half the U.S. taxpayers who reported gross annual incomes of $1 million or more in any year from 1999 to 2007 did so only once during the period. Only 5.6 percent reported million-dollar incomes in each of the nine years and less than 20 percent earned $1 million or more in four or more of the years.

If the same persistence rate is applied to Massachusetts, the surtax would affect 64,843 state taxpayers – not 19,565 – over nine years. Of those, 32,470 would earn over $1 million just once in nine years. Only 3,650 would be expected to have income over $1 million each year during that period.

Because the tax proposal affects capital gains, it could sweep into thousands of retirees selling longtime homes and long-held assets.

The surtax would also impact Massachusetts businesses, since “pass throughs” such as sole proprietorships, partnerships, limited liability and S corporations are taxed via individual returns. Based on 2018 IRS data, there are over 13,000 Massachusetts businesses that had adjusted gross incomes of $1 million or more. It is not unreasonable to expect a similar multiplier effect for the number of businesses affected, but the precise impact will require more data from MADOR.

“Proponents like to call this a “millionaires tax” but at best 1 in 5 of the people affected are millionaires,” said Pioneer Executive Director Jim Stergios. “The great majority are retirees and small businesses, who aren’t millionaires hiding away in a mythical castle with a moat around it. That’s what proponents want you to believe – but the facts on this are very clear.”

About the Author

Gregory Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts and was a 17-year member of the Massachusetts House of Representatives. Greg holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

Pioneer’s mission is to develop and communicate dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Pioneer’s vision of success is a state and nation where our people can prosper and our society thrive because we enjoy world-class options in education, healthcare, transportation and economic opportunity, and where our government is limited, accountable and transparent.

Pioneer values an America where our citizenry is well-educated and willing to test our beliefs based on facts and the free exchange of ideas, and committed to liberty, personal responsibility, and free enterprise.

Get Updates on Our Economic Opportunity Research

Related Posts: