Pioneer Report Underscores Wide Disparities in Economic Performance between Industry Sectors in Massachusetts

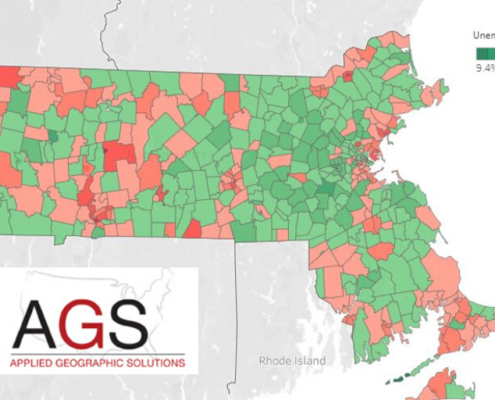

BOSTON – Service-based industries have significantly outperformed manufacturing and other traditional blue-collar economic sectors in Massachusetts since 2008, according to a new report from Pioneer Institute that draws on data from the MassEconomix web tool.

In “Broad Industry Sector Trends in Massachusetts, 1998-2018,” two decades of data show fluctuating employment changes across the state, as well as changes in firm size and the types of firms disproportionately headquartered in the Commonwealth.

Health Care tops the list of those industries that have added the most jobs in Massachusetts from 2008-2018, with “Other Services” (everything from funeral home directors to valet parking attendants) and Accommodation & Food also comfortably outpacing population growth. It’s unclear how COVID-19 will affect these trends in the long-term.

The report is the second in a series that presents employment and business establishment trends in the Commonwealth on both the state and municipal levels.

“While Health Care easily leads in job gains, Educational Services remains the most heavily concentrated industry in Massachusetts relative to the national average,” said Andrew Mikula, who co-authored the report with Rebekah Paxton. “The Education sector also has plenty of very large individual employers, notably Boston University.”

Despite nearly a decade of economic growth through 2018, several industries were still shedding jobs in Massachusetts. Manufacturing, Wholesale Trade, and Public Administration top the list of most jobs lost by sector.

Agriculture and Mining & Extraction have enjoyed some of the strongest rates of employment growth in the state since the Great Recession. Still, industry sectors that work to extract raw materials in Massachusetts constitute a minuscule fraction of the state’s overall workforce.

All of the reports in Pioneer’s MassEconomix series use the same Your-economy Time Series data to develop aggregated numbers for statewide growth. This data is recorded by Infogroup and compiled by the Business Dynamics Research Consortium (BDRC) at the University of Wisconsin System Institute for Business and Entrepreneurship in Madison, Wisconsin.

Following this report, Pioneer will use these data to release regular publications that document trends in individual cities and towns, and create “snapshots” of particular industries.

About the Authors

Andrew Mikula is a Research Assistant. Mr. Mikula was previously a Lovett & Ruth Peters Economic Opportunity Fellow at Pioneer Institute and studied economics at Bates College.

Rebekah Paxton is a Research Analyst at Pioneer Institute. She earned an M.A. in Political Science and a B.A. in Political Science and Economics, from Boston University, where she graduated summa cum laude.

About Pioneer

Mission

Pioneer Institute develops and communicates dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Vision

Success for Pioneer is when the citizens of our state and nation prosper and our society thrives because we enjoy world-class options in education, healthcare, transportation, and economic opportunity, and when our government is limited, accountable and transparent.

Values

Pioneer believes that America is at its best when our citizenry is well-educated, committed to liberty, personal responsibility, and free enterprise, and both willing and able to test their beliefs based on facts and the free exchange of ideas.

Get Updates on Our Economic Opportunity Research

Related Posts