The Connection Between Property Taxes and Pension Funding

A recent study from economist Evgenia Gorina, published in the journal State and Local Government Review, found a positive relationship between a local government’s reliance on property taxes as a revenue source and how well-funded their pensions are. In other words, local governments that rely heavily on property taxes as funding sources tend to have better-funded pension programs. On the other hand, local governments that rely on intergovernmental aid (usually from state and federal governments) as a revenue source have more precariously-funded pensions.

Is this true in Massachusetts?

Pioneer Institute’s MassWatch program provides citizens with transparent information on public programs, and how local governments raise and spend their money. When considering questions of pensions and taxes, the relevant databases are MassAnalysis and MassPensions. MassAnalysis features local public finance data for every municipality in Massachusetts, along with data about education, transportation, and demographics. MassPensions, as the name indicates, grades all 105 public pension systems in the Bay State based on how well-funded they are.

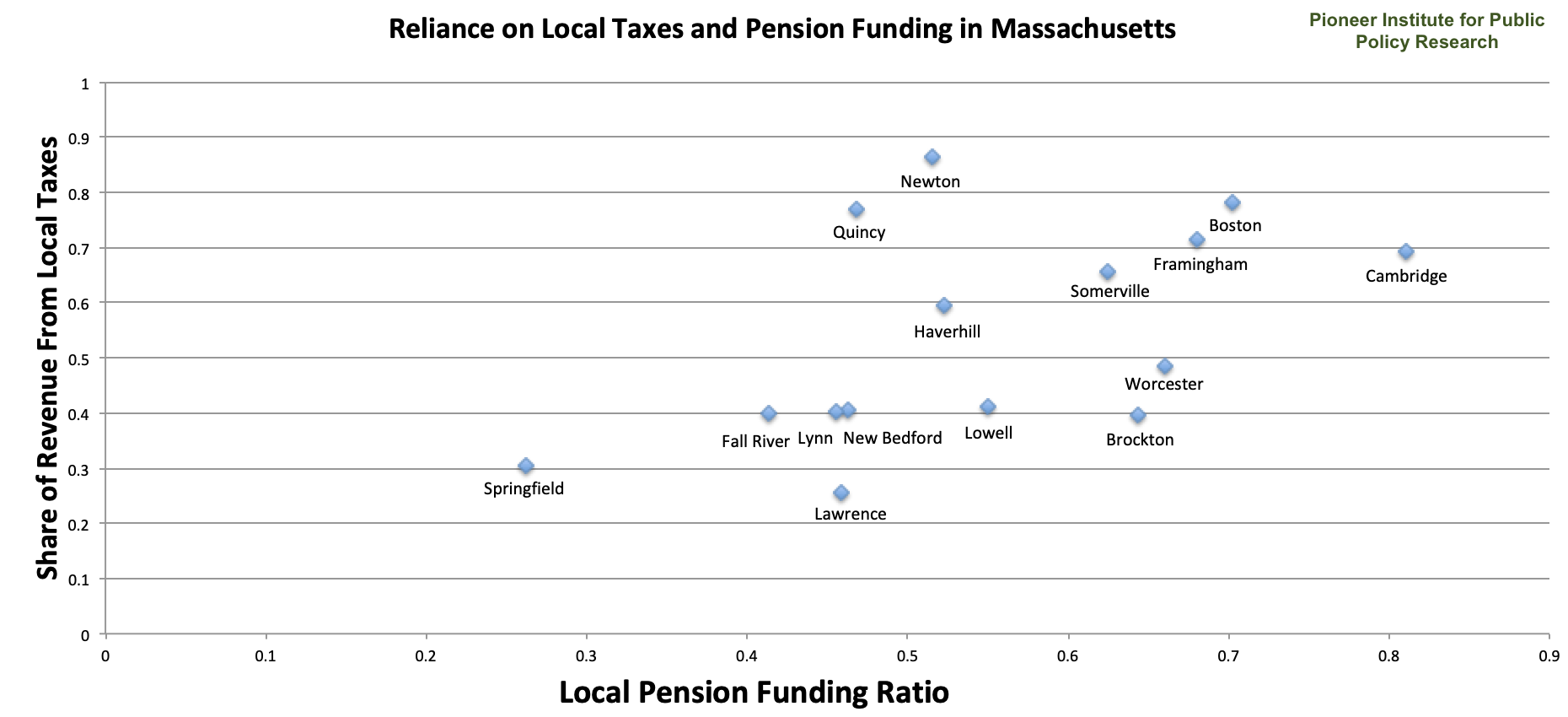

To see how Massachusetts cities compare to the recent study’s findings, I decided to sample the 15 largest municipalities by population in Massachusetts. Using MassAnalysis, one can find what percentage of a city’s revenue comes from local taxes. It’s worth noting that “local taxes” in MassAnalysis does not include revenue from service charges, fines and forfeitures, or licensing fees, so it is a decent proxy for just property taxes. And using MassPensions, one can find what share of a municipality’s pension is currently funded.

Sources: MassAnalysis, MassPensions. Share of Revenue uses 2017 data from MassAnalysis. Pension funding ratios from MassPension’s 2016 data or 2015 data if 2016 data is unavailable.

Based on these data points, there is a positive correlation in Massachusetts between pension program funding and reliance on local taxes. That mimics the findings of the State and Local Government Review paper.