Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

This report received coverage in The Boston Herald.

BOSTON – The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

If the surtax passes, it will apply to as many as 13,430 of the state’s pass-through entities. These are often small businesses structured as S corporations, sole proprietorships and partnerships, which pay taxes via their owners’ personal returns. Proponents claim the surtax would only affect Massachusetts’ highest-paid corporate executives, but in reality, many independent business owners will also be directly affected.

“The past year has been a historically difficult time for a lot of ‘Main Street’ business owners in Massachusetts,” said Nina Weiss, who authored “The Graduated Income Tax Trap – A Tax on Small Businesses,” with Greg Sullivan. “This is a time when we should be prioritizing the resilience of the state’s economy and getting people back to work, not raising taxes on small businesses.”

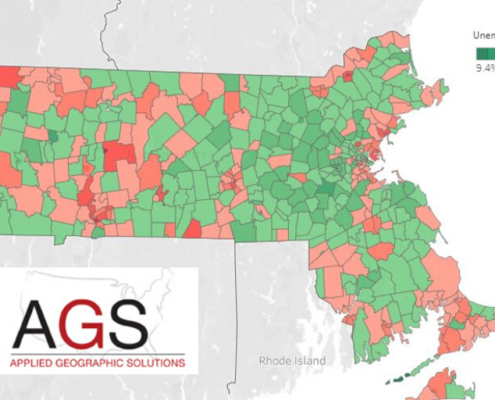

Before the pandemic, Massachusetts saw significant growth driven by pass-through entities. From 2010 to 2018, the number of pass-through employers in the Commonwealth grew by 11.3 percent. By 2018, they accounted for 57.1 percent of Massachusetts’ private sector workforce. Nationally, pass-through entities represent 95 percent of businesses.

Academic research has confirmed that business activity among pass-throughs is heavily influenced by tax policy. A 2000 National Bureau of Economic Research paper pointed to the federal Tax Reform Act of 1986 as a major factor in the modern renaissance of pass-through entities. A more recent study of several European countries found that greater tax progressivity is associated with lower rates of business formation among the wealthy.

Business groups in Connecticut and New Jersey have first-hand experience of the effects of higher income tax rates, which can deter business owners from hiring more employees or purchasing new equipment. Regarding the 2020 millionaires tax passed in New Jersey, the Tax Foundation suggests that “when many businesses are struggling to survive and meet payroll, cutting into the profits of businesses that are staying afloat is the opposite of an economic recovery strategy.” In 2019, Connecticut even tried to target only pass-through businesses for an income tax hike, stoking significant opposition from multiple trade groups, including the Connecticut Society of CPAs.

“Promoters of the surtax always point to its impact on some nebulous ‘millionaire,” said Pioneer Institute Executive Director Jim Stergios. “The tax will impact many more people and small businesses, and through them, tens of thousands of employees. The state economy is at a crossroads, and our elected leaders will either prioritize job creation and investments in our future, or at the expense of recovering small businesses, they will choose to prioritize public sector employment, which is a relatively small portion of the Massachusetts workforce.”

About the Authors

Nina Weiss is a Roger Perry Research Intern at the Pioneer Institute. Research areas of particular interest to Ms. Weiss include education and transportation. She is currently a student at Johns Hopkins University studying Sociology and International Relations.

Gregory Sullivan is Pioneer’s Research Director. Previously, he served as Inspector General of the Commonwealth of Massachusetts and was a 17-year member of the Massachusetts House of Representatives. Greg is a Certified Fraud Investigator, and holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

About Pioneer

Pioneer’s mission is to develop and communicate dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Pioneer’s vision of success is a state and nation where our people can prosper and our society thrive because we enjoy world-class options in education, healthcare, transportation and economic opportunity, and where our government is limited, accountable and transparent.

Pioneer values an America where our citizenry is well-educated and willing to test our beliefs based on facts and the free exchange of ideas, and committed to liberty, personal responsibility, and free enterprise.

Get Updates on Our Economic Opportunity Research

Related Posts