How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

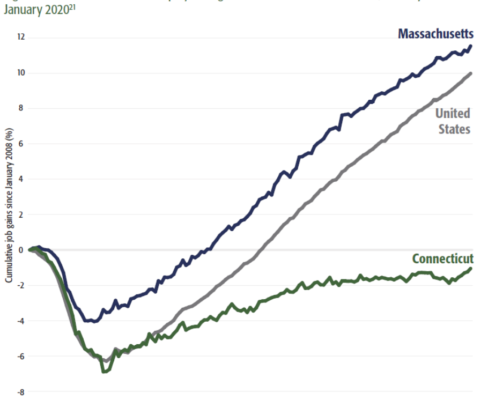

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

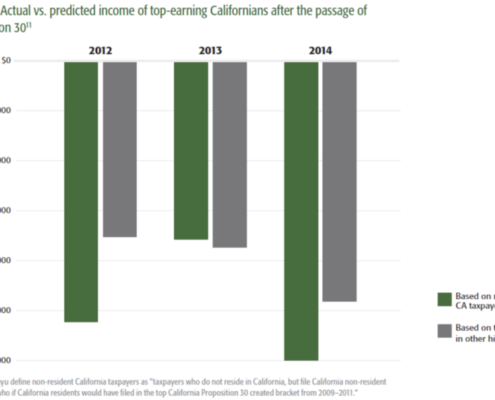

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

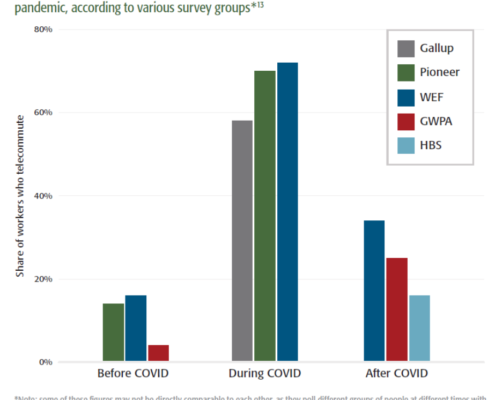

Wealth Migration Trends: Remote Work Technology Empowers Workers to Live Anywhere

Host Joe Selvaggi talks with Pioneer Institute’s Andrew Mikula about his recent research into migration trends of high-income individuals, how pandemic-related technologies may accelerate that movement, and what challenges these changes present for policy makers.

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work, according to a new study published by Pioneer Institute.

Interstate Legal Skirmish: New Hampshire Takes Massachusetts Telecommuter Tax to the Supreme Court

Host Joe Selvaggi talks with legal scholar and George Mason University Law Professor Ilya Somin about the details, the merits, and the likely implications of the Supreme Court case, New Hampshire v. Massachusetts, on state taxation power, federalism, and the power to vote with one’s feet.

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Intrepid Restauranteurs Endure: Passion for Community, Patrons, and Staff Mean Failure is Not on the Menu

Host Joe Selvaggi talks with Massachusetts Restaurant Association President and CEO Bob Luz about the devastating effects of the pandemic and lockdowns on restaurants. They discuss the industry's creative strategy for survival, plans for reaching beyond the crisis, and the many positive improvements for this vital sector that employs 10% of the workforce in the commonwealth.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Unemployment Insurance Rescue: Employer Advocate Seeks Relief to Catalyze Pandemic Recovery

Joe Selvaggi talks with John Regan, President and CEO of Associated Industries of Massachusetts, about the impact of higher UI rates on employers and what legislators can do to help mitigate the pain.

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

In the lead-up to the COVID-19 crisis, the Massachusetts construction industry enjoyed a boom in select subsectors, though employment numbers had yet to recover from the setbacks of the Great Recession, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool.

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries

Combining the recommendations of studies published earlier this year, Pioneer Institute has released “A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19.” The recommendations for policy makers are organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.