How did tax hikes work out for Connecticut?

/in Blog, Blog: Economy, Economic Opportunity, Featured /by Editorial Staff Share on Facebook

Share on Twitter

Share on

LinkedIn

+

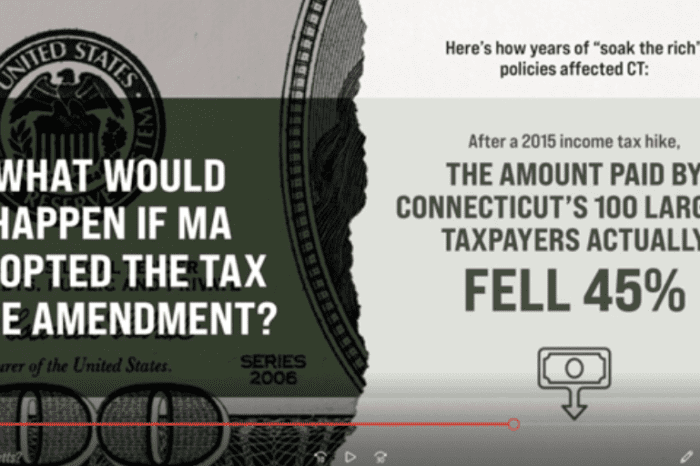

Watch: In our newest video, Pioneer Institute’s Charlie Chieppo shares data on the economic impact of tax increases in Connecticut – which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on the Mass. economy:

Related Posts

Municipal Benchmarks for Massachusetts’ Middle Cities: A Look at Economic Growth

Municipal Benchmarks for Massachusetts’ Middle Cities: A Look…

Municipal Benchmarks for Massachusetts Middle Cities: Educational Achievement

A Look at Educational Achievement Author(s): Dr. Robert D. Gaudet…

Municipal Benchmarks for Massachusetts Middle Cities: A Look at Educational Achievement

A Look at Educational Achievement Author(s): Dr. Robert D. Gaudet…

Unemployment Insurance: A Drag on Employment?

Unemployment Insurance in Massachusetts: Burdening Businesses and Hurting Job Creation, a new Pioneer Policy Brief, presents convincing evidence that UI’s problems are serious, but solvable.

Measuring Up? The Cost of Doing Business in Massachusetts

Author: Global Insight

This study shows that, on average,…

Measuring Up? The Cost of Doing Business in Massachusetts

Author: Global Insight

This study shows that, on average,…

The Elephant in the Room: Unfunded Public Employee Health Care Benefits and GASB 45

Authors: Eric S. Berman, CPA, Deputy Comptroller, Commonwealth…

Long-Term Leasing of State Skating Rinks: A Competitive Contracting Success Story

Author: Susan Frechette

This paper looks at the success of…

Getting Home: Overcoming Barriers to Housing in Greater Boston

Author: Charles C. Euchner, Rappaport Institute for Greater Boston,…

Build More or Manage Better? Subsidized Housing in Massachusetts

Authors: Howard Husock and David J. Bobb

Increases in the…

The Power To Take: The Use of Eminent Domain in Massachusetts

Author: Michael Malamut, Esq., New England Legal Foundation

This…

Toward a High-Performance Workplace: Fixing Civil Service in Massachusetts

Author: Jonathan Walters, Governing Magazine

This paper is…