New Study Looks to Connecticut as Cautionary Tale for Impact of Proposed Ballot Initiative Hiking Taxes

Hear Greg Sullivan discuss this report on Bloomberg Radio.

Raising taxes on companies and high earners has resulted in less revenue, exodus of large employers and wealthy individuals

BOSTON – Proponents of a 2018 statewide ballot initiative that would add a surcharge on the state taxes of those earning over $1 million annually should look at the experience of Connecticut, where multiple rounds of tax hikes aimed at high earners triggered an exodus of large employers and high-earning individuals that resulted in declining tax revenue, according to a new study published by Pioneer Institute.

“Before going to the polls next year, voters should take a close look at the impact that tax hikes similar to the ones being proposed have had on our neighbor to the south,” said Greg Sullivan, author of “Back to Taxachusetts? Lessons from Connecticut.”

The ballot initiative, Proposition 80, would add a four percentage-point surcharge on all taxable income above $1 million annually. It stipulates that the incremental revenue be used for education and transportation. If it passes, Massachusetts’ top income tax rate will rise to 9.1 percent and our top capital gains tax rate will be among the highest in the world.

Over the last quarter-century, Connecticut has endured a series of budget crises. To cover ballooning costs, the state enacted sharp tax hikes, including four income tax hikes in the last 14 years that caused the top rate to jump by 77 percent.

In recent years, Connecticut has increasingly turned to high earners and large companies to close budget gaps, doubling a surcharge on large firms, establishing and then increasing a tax on luxury goods, and raising the income tax for the state’s highest earners.

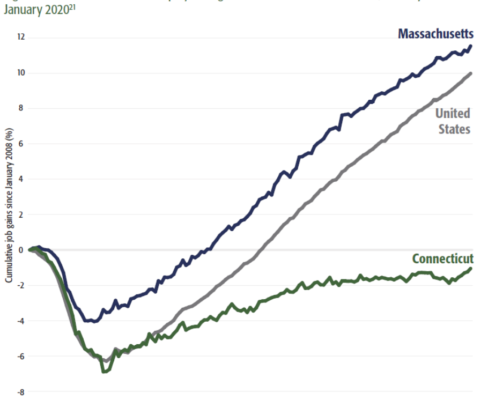

The results have been disastrous. From 2007 to 2016, the state placed 49th among the states and D.C. in private sector wage growth. In just the last couple of years, General Electric and Alexion Pharmaceuticals decided to move their headquarters to Massachusetts, while Aetna Insurance has announced plans to move to New York.

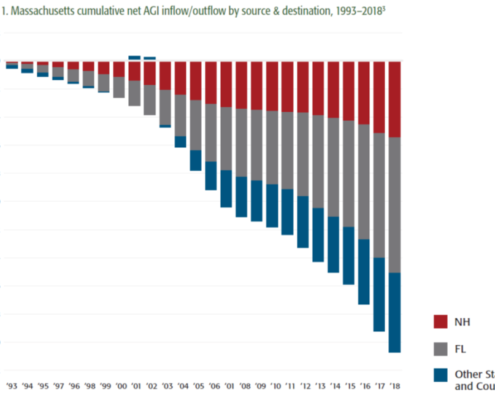

According to a 2014 Connecticut Department of Revenue study, the state’s 357 wealthiest families account for 11.7 percent of all income tax revenue. Between 2011-12 and 2014-15, Connecticut lost high earners at a rate that trailed only Washington, D.C., and those who fled earned more on average than high earners leaving other states.

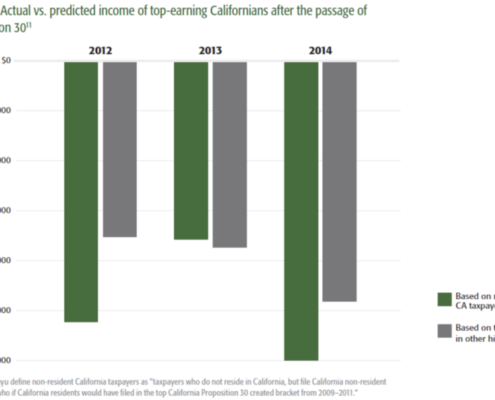

Despite rate increases, the amount of taxes paid by Connecticut’s 100 top taxpayers plummeted 45 percent between 2015 and 2016 alone.

Massachusetts took a very different approach in the wake of the 1990-91 recession. A state income tax that was once 6.25 percent now stands at 5.1 percent. Since the end of that recession, the commonwealth has attracted millionaires at more than twice the rate of Connecticut.

Since February 2010, Massachusetts has created more than three times the number of jobs it lost during the Great Recession. In contrast, Connecticut still hasn’t recovered all the jobs it lost and those it has created are, on average, lower paying.

Like Connecticut, Massachusetts relies on a relatively small number of wealthy taxpayers to foot a significant chunk of the commonwealth’s bills. If a third of those impacted by Proposition 80 decided to move, it would result in a loss of $750 million in annual tax revenue.

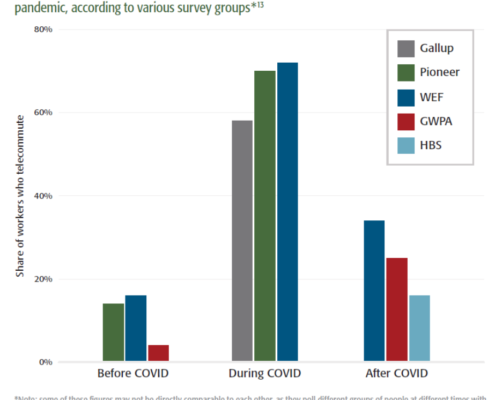

“‘Leaving’ has never been easier,” said Pioneer Institute Executive Director Jim Stergios. “In some cases, high earners can stay put and simply move money into trusts located in other states.”

About the Author

Gregory W. Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts, and was a 17-year member of the Massachusetts House of Representatives. Greg holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

About Pioneer

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Get Updates on Our Economic Opportunity Research

Related research: