Pioneer Institute and the Tax Foundation File Amicus Brief in Graduated Income Tax Ballot Initiative Case

Brief argues that Proposition 80 violates the state constitution, would result in harmful fiscal policy

BOSTON – PioneerLegal, Pioneer Institute’s public-interest law initiative, together with the Tax Foundation, has filed an amicus brief with the Supreme Judicial Court in support of the Massachusetts High Technology Council and others, in the case Christopher Anderson et al. v. Maura Healey.

The plaintiffs assert that Proposition 80, a ballot initiative to install a graduated income tax for Massachusetts, violates the state constitution and should not be allowed to appear on the Commonwealth’s November ballot.

Proposition 80 calls for adding an additional 4 percent state tax on all annual taxable income above $1 million and earmarking the resulting revenue specifically for transportation and education.

The brief argues that Proposition 80 violates the state’s constitution, which forbids initiative petitions from bundling multiple, unrelated provisions and usurps the Legislature’s exclusive authority over the state treasury. It contends further that passage of the measure would result in poor and risky fiscal policy.

Proposition 80 combines three unrelated provisions: a tax increase, an appropriation for transportation, and an appropriation for education. Drafters of the state constitutional provision on initiative petitions sought to ensure that petitions express a single unified public policy statement that voters could accept or reject, and specifically sought to prevent the bundling of unpopular provisions like a tax increase with more popular ones such as increasing education and transportation funding.

The state constitution also forbids initiative petitions from including a “specific appropriation,” defined as seizing all revenue from a designated source and appropriating it for a specified use – in this case, transportation and education. The provision is designed to ensure that special interests don’t usurp legislative control of the state treasury.

In 2014, a computer and software services tax was enacted to help balance the state budget. When it was shown to negatively impact the Commonwealth’s economy, the Legislature quickly repealed it.

In 2000, state voters approved a ballot initiative to reduce the state income tax to 5 percent by 2003. When the economy cratered soon after its passage, the Legislature stepped in and froze the rate at 5.3 percent.

Since Proposition 80 would amend the state constitution, such swift action would be impossible. The process of amending the constitution again to change or repeal Proposition 80 would take a minimum of three years. This form of budgeting by ballot initiative is a textbook example of depriving the government of the flexibility required to efficiently address changed circumstances and unexpected crises.

“There’s a reason why setting fiscal policy by constitutional amendment is almost universally condemned,” said Pioneer Executive Director Jim Stergios.

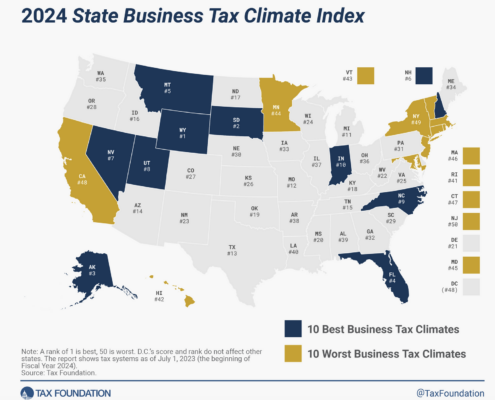

The brief also cites research by Pioneer and other entities showing that states like Connecticut and New Jersey that enacted similar policies actually saw adverse economic consequences within just a few years.

“This tax increase would catapult Massachusetts from the middle of the pack to among states with the highest capital gains rate in the nation. It would also significantly increase the taxes paid by many small pass-through businesses and encourage ‘tax flight’ by individual taxpayers,” said John Sivolella, Senior Fellow in Law and Policy at Pioneer, who leads PioneerLegal. “The overall effect would be to inhibit financial growth in the Commonwealth, and adversely affect state revenues.”

About Pioneer

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Get Updates on Our Economic Opportunity Research

Related Research