Inadequate Inflation Adjustment Factor Will Subject Increasing Numbers of People to So-Called “Millionaires” Tax

Would take particular toll on those relying on home value appreciation to fund retirement

BOSTON – The tax hike on those with annual taxable incomes of $1 million or more that would result from a proposed amendment to the state constitution scheduled to appear on the Commonwealth’s November ballot will likely ensnare an ever-increasing number of taxpayers because the index used to adjust the million-dollar threshold has historically grown at a far slower rate than both the taxable income of Massachusetts taxpayers and increases in state home values, according to a new study published by Pioneer Institute.

“Those who are counting on decades of appreciation in the value of their homes in particular to fund retirement will be in for a shock if Proposition 80 passes,” said Pioneer Institute Research Director and former state Inspector General Greg Sullivan, the author of “Housing & Who’s a ‘Millionaire’ according to Proposition 80.”

Proposition 80 would amend the Massachusetts Constitution to impose a 4 percent surcharge on any annual taxable income over $1 million, creating a top state personal income tax rate of 9.1 percent. Unlike the federal government, which considers income and capital gains taxes separately, capital gains from sale of a home could push taxpayers into a different tax bracket and subject them to the higher rate.

Proposition 80 would use the Consumer Price Index for All Urban Consumers (CPI-U) to adjust the million-dollar threshold for inflation. But while the index rose by 47.1 percent from 1997 to 2015, the taxable income of Massachusetts taxpayers rose 105.7 percent.

The divergence is even greater when it comes to home values. Between 1977 and 2017 single-family home prices in Massachusetts increased more than nine-fold (935 percent). In Suffolk, Norfolk, Plymouth, Middlesex and Essex counties the increase was almost eleven-fold (1,072 percent). Over the same period, the CPI-U rose 304 percent.

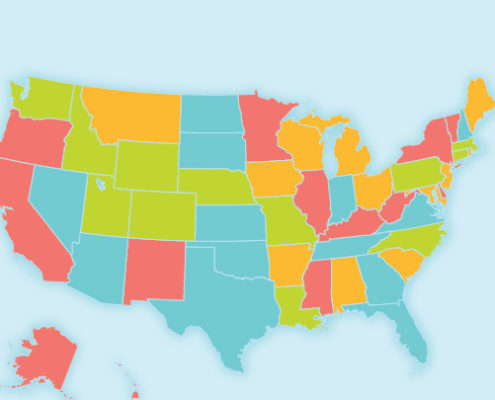

Assume that a taxpayer earning the average annual adjusted gross income for his or her municipality purchased the average-priced single-family home in the community in 1997. If the CPI-U and home price increases in that community both continued at the historical rate, taxpayers in 13 Massachusetts municipalities who sold their home in 2027 would be subject to the higher Proposition 80 tax. If you apply the same assumptions to a homeowner purchasing a home in 2017 and selling it in 2047, taxpayers in 52 communities would be forced to pay the higher tax.

The fact that the taxable income of Massachusetts taxpayers grew approximately twice as fast as the CPI-U rose between 1997 and 2015 would result in bracket creep if voters approve Proposition 80 and historical trends continue. A taxpayer with taxable income of $850,000 in 2019 would be subject to Proposition 80 taxes in 2028. One earning $700,000 in 2019 would have to pay in 2039.

“Over time, if passed, Proposition 80 will affect more and more taxpayers – it will be a state version of the Alternative Minimum Tax,” said Jim Stergios, Executive Director of Pioneer Institute. “It’s a bait and switch.”

Since Proposition 80 would amend the state constitution, the Legislature could not simply pass a law to abolish or amend it. Doing so would require another constitutional amendment, which would take a minimum of three years.

About the Author

Gregory Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts and was a 17-year member of the Massachusetts House of Representatives. Greg holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

About Pioneer

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Get Updates on Our Economic Opportunity Research

Related Posts: