New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

Read coverage of this report in The Boston Herald: “Study says Massachusetts “millionaires tax” wouldn’t just hit the mega rich“

BOSTON – If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

National data from the U.S. Treasury Department show that the majority of taxpayers earning more than $1 million in a year did so only once over a nine-year period. Data Pioneer Institute recently obtained from the Massachusetts Department of Revenue make it clear that this phenomenon hits close to home as well.

“A graduated income tax would be more of a raid on retirement nest eggs than a tax on super wealthy millionaires,” said Andrew Mikula, who co-authored the study with Greg Sullivan. “In Massachusetts, 46 percent of the people who would be affected by the tax — those who earned incomes over $1 million — did so only once in 10 years. Sixty percent did so only once or twice in the 10-year period that ended in 2017. These are likely people selling a business or a home.”

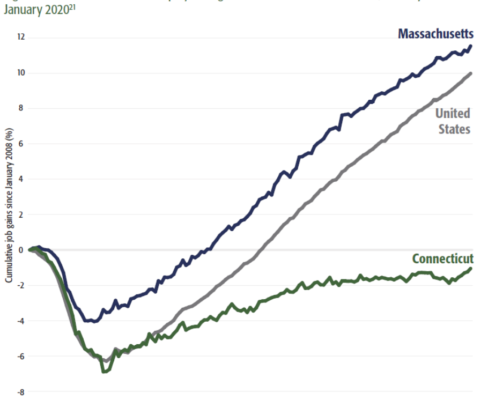

Evidence from other states heightens the concern that older adults are willing to move to protect their retirement nest eggs. After California passed an income tax hike in 2012 that had a similar impact on seniors, it witnessed a wave of out-migration among its more senior population the following year. In 2012, California lost about $87 million in taxable income from net out-migration of people aged 65 and older. That number exploded to $1.26 billion in 2013. Meanwhile, other amenity-rich Sunbelt states, notably Florida, have thrived by attracting wealthy retirees and other migrants with low taxes and a friendly business climate.

Data also show that nearly half of the capital gains earned in the U.S. from 2007-2012 were from pass-through businesses, another common source of retirement funding. Pass-through entities are usually small businesses that pay taxes via the personal income returns of their owners. Over the period 2007-2012, capital gains from U.S. pass-through businesses totaled more than double those from stocks, bonds, and mutual funds combined. Owners that sell these businesses to pay for their retirement could see their tax bills on those capital gains rise by 80 percent under the surtax.

The surtax could similarly affect long-time homeowners in areas with sharply rising home prices. In some communities in Massachusetts, such as Cambridge, the median single family home price rose by more than $1 million between 1995 and 2020. While a tax exclusion of up to $500,000 for joint filers would apply to sales of these homes, a graduated income tax could blindside elderly people relying on accrued real estate value to fund their retirement.

“This surtax would devastate the retirement plans of many Massachusetts residents,” said Pioneer Institute Executive Director Jim Stergios. “Proponents of the tax haven’t thought about the incentive it creates to change one’s domicile to low- or no-tax states as Massachusetts residents approach retirement, nor the deterrent it would create to investment.”

About the Authors

Gregory Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts and was a 17-year member of the Massachusetts House of Representatives. Greg is a Certified Fraud Investigator, and holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

Andrew Mikula is Economic Research Analyst at Pioneer Institute. Mr. Mikula was previously a Lovett & Ruth Peters Economic Opportunity Fellow at Pioneer Institute and studied economics at Bates College.

About Pioneer

Pioneer’s mission is to develop and communicate dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Pioneer’s vision of success is a state and nation where our people can prosper and our society thrive because we enjoy world-class options in education, healthcare, transportation, and economic opportunity, and where our government is limited, accountable and transparent.

Pioneer values an America where our citizenry is well-educated and willing to test our beliefs based on facts and the free exchange of ideas, and committed to liberty, personal responsibility, and free enterprise.

Get Updates on Our Economic Opportunity Research

Related Posts