California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

/0 Comments/in COVID Economy, Economic Opportunity, Featured, Graduated Income Tax, Podcast Hubwonk /by Editorial StaffHost Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

Related: New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Guest:

Joshua Rauh, originally from Newton, MA., is a Professor of Finance at the Stanford Graduate School of Business, a Senior Fellow at the Hoover Institution, and a Research Associate at the National Bureau of Economic Research (NBER). Professor Rauh’s research on state and local pension systems in the United States has received national media coverage in outlets such as the Wall Street Journal, the New York Times, the Financial Times, and The Economist. He is an Associate Editor of the Journal of Finance and an editor of the Journal of Pension Economics and Finance and the Review of Corporate Finance Studies. He holds a BA degree in economics, magna cum laude with distinction, from Yale University and a PhD in economics from the Massachusetts Institute of Technology.

Joshua Rauh, originally from Newton, MA., is a Professor of Finance at the Stanford Graduate School of Business, a Senior Fellow at the Hoover Institution, and a Research Associate at the National Bureau of Economic Research (NBER). Professor Rauh’s research on state and local pension systems in the United States has received national media coverage in outlets such as the Wall Street Journal, the New York Times, the Financial Times, and The Economist. He is an Associate Editor of the Journal of Finance and an editor of the Journal of Pension Economics and Finance and the Review of Corporate Finance Studies. He holds a BA degree in economics, magna cum laude with distinction, from Yale University and a PhD in economics from the Massachusetts Institute of Technology.

Get new episodes of Hubwonk in your inbox!

Related Posts:

A Model for Occupational Licensing Reform in the Bay State

Study Finds Massachusetts Workforce Has Become More Female, Older, More Diverse

New IRS Data Shows Out-Migration Worsening, Underscoring the Need for Massachusetts Leaders to Focus on State’s Competitiveness

Public Statement on the House’s Proposed Tax Reform and Budget

Debunking Tax Migration Myths

Image by Freepik.com

Image by Freepik.comA History of Rent Control Policy in Massachusetts

Corporate Ownership: A Threat to Housing Affordability?

Gov. Healey’s Tax Plan: Not Enough on Competitiveness

The Debate Over Rent Control Re-Emerges Amid Housing Crisis

Eight Billion Minds: Unsustainable Population Bomb or Infinite Resource?

MBTA Safety Overhaul: Retooling Teams For Trustworthy Transit

Julianne Zimmerman on the Inventive Legacies of Immigrants

Report: Immigrant Entrepreneurs Provide Economic Benefits, but Face Significant Obstacles

Joséphine Erni on Bringing Swiss Innovation to the U.S. Market

Josh Bedi on How Immigrants Boost Native Entrepreneurship

Pioneer Institute Statement on Question 1

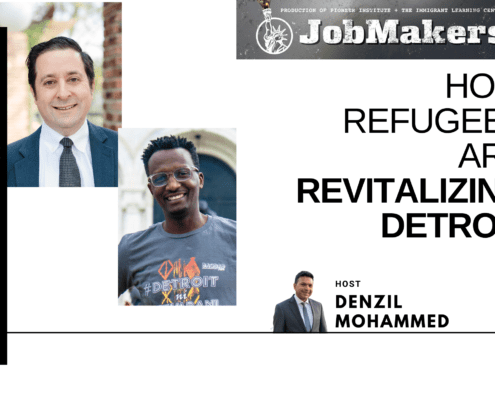

Steve Tobocman and Mamba Hamissi on How Refugees Are Revitalizing Detroit