MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

We Have a Long Way to Go for Massachusetts Residents to Have the Government Transparency We Deserve

As Pioneer Institute observes Sunshine Week,?we are disappointed by the legislature’s attempts to deny what the vast majority of voters want: an audit of the legislature by our State Auditor. Trying to avoid an audit further exacerbates the loss of public trust. After all, what are we left to think? Do they have something to hide? That is not the government our founders intended; nor is it what 72 percent of Massachusetts voters wanted. This year, during Sunshine Week, we are entirely focused on the top three actions to bring sunlight to the state legislature. They are:

Massachusetts’s Debt and Liability in 2023

In the last decade, Massachusetts has accrued billions of dollars in debt. However, despite a large amount of debt, both overall and per capita, the state's debt as a percentage of GDP is normal amongst its neighbors.

The Largest Groups Driving Massachusetts’s Migration

With Massachusetts losing billions in taxable income every year due to out-of-state migration, it is important to understand the demographics causing the biggest losses.

Highest Paid State Employees in Massachusetts

Every year, Massachusetts spends billions on payroll. With some departments spending significantly more and some employees receiving salaries multiple times their peers', it is important to understand where this money is going.

Understanding the Trends in Massachusetts’ Sin Tax Revenues

Sin Taxes, which are taxes on goods and services that are considered harmful or immoral, have brought in a significant amount of revenue for Massachusetts.

Increasing Number of Retirees Driving Pension Expenditures

Pension expenditures in the two largest public pension systems are on the rise in Massachusetts, so it's important to understand the factors behind the growth in annual payouts, including an increasing average pension and an increasing number of retirees.

Where Does Massachusetts’ Pension Money Go?

Billions of dollars went to retirees in 2023 from the state's two largest pension funds. Not unexpectedly, the data show that the amount of money given to a specific retiree may depend on many factors outside of where the retiree used to work.

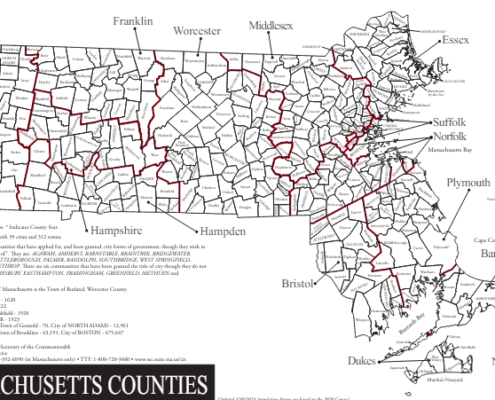

Average Weekly Wage Change for two Massachusetts Counties with Differing Densities

Each industry in a county varies differently in wage growth and decline. This blog analyzes how wages changed in major industries for the most urban and most rural economy in Massachusetts.

An Evaluation of 340B in Massachusetts

Despite the fact that the 340B Drug Pricing Program has expanded immensely in recent years, the amount of charity care that hospitals are providing has decreased. This points to several problems with the 340B program across the country and in Massachusetts, such as a lack of transparency and inaccessible care.

Migration to Massachusetts in 2022: Where Are People Going?

With thousands moving to Massachusetts every year, they bring income and assets that can affect the local economy. However, people from different regions of the country tend to favor different parts of Mass more or less, though the more urban area around Boston is al

Disparities in LIHTC Data Illuminate Difficulties in Housing Production

While disparities in LIHTC awards and issuances are to be expected, the mismatch points to inhibitors of housing production that are outside the scope of the program's impact.

Examining the New Massachusetts Estate Tax

The new Massachusetts estate tax may be correlated to lower estate tax revenues. However, the inclusion of out-of-state property in the estate tax calculation has brought about important legal questions.

Massachusetts is Losing Thousands of Taxpayers a Year. Where Are They Going?

Massachusetts is facing a net loss of taxpayers and AGI. Learn about where these taxpayers are migrating to, and potential reasons for that migration.

At a Glance: Who Moved to Massachusetts in 2022?

State-to-state migration can have serious impacts on the local economy. Migrants to Massachusetts come from all over the country, but significant portions of both new taxpayers and new taxable income come from just a few sources, such as New England, New York, Florida, and California.

How Public Transportation’s Efficiency Changed During Covid

The MBTA's efficiency plummeted during Covid; as people chose either personal transportation or personal work, the MBTA lost significant ridership. However, it maintained its vehicle fleet and the depth of its services even as its operating cost per passenger mile increased dramatically.

Unemployment in Massachusetts by Race

Unemployment rates vary based on racial groups. Most minority groups face higher unemployment rates in Massachusetts than the majority White population.

Cape Cod Restricts Fourth of July Parties: What’s the Economic Impact?

With Fourth of July parties getting out of hand in recent years, Dennis Police established measures to limit the number of beachgoers this year. This may have an impact on Dennis economically, but it is a choice Dennis feels is worth making.

What makes these five so-called “W” towns so appealing?

Learn about what makes these five Massachusetts "W" towns so desirable to live in, but also the costs associated with them.

Part II: Push and Pull Factors for Massachusetts Businesses

High UI tax rates make it expensive for businesses to operate in Massachusetts. Learn what affects a company's decision to operate in Massachusetts.

Northwest Massachusetts’ Reliance on Industry Levies

Some towns in NW Massachusetts spend significantly more per capita than their neighbors, without using methods such as large state funding, deficit spending, and high taxes. These towns gain significant portions of their revenue from industry tax levies.

Puzzling “Relationship” Between Police Expenses and Crime Rates in Middlesex County

Some people may assume that there is a correlation between how much a town spends on their police and the crime rates in that town. But for certain towns in Middlesex County, there does not seem to be a clear connection between police expenses and crime rates. When stacked up against other towns in the county, there is a mismatch between how much money these towns spend on their police and their crime rates.

Why The Best Public Schools Are The Best

Massachusetts’ education system is famously excellent,…

Statement: Pioneer Institute in Support of Accessory Dwelling Units

Pioneer Institute Statement in Support of Accessory Dwelling…

The Necessity of Transparent Tax Revenue Reporting: MA Provides a Shining Example

Revenue collections, predicted revenue, and expenditures are among the most important data points states report. Without accurate predictions and regular reporting, the legislature and governor's office may go over or under budget, potentially leaving citizens and policymakers in the dark about the fiscal health of the state.

For this reason, all states regularly report those numbers and update estimates based on trends, overall economic conditions, and expected changes as a result of new state policies. However, even among the New England states, the transparency and accessibility of such reporting varies greatly and, as a result, limits analysts’ ability to meaningfully compare state revenues and judge performance in real time.

Changes to the Confounding Massachusetts Estate Tax

Policymakers on Beacon Hill have many visions of tax relief for this fiscal year, and all of them include changing the estate taxes. What are those changes, and what would their impact be?

An Examination of the Commonwealth Rainy Day Fund

Established in 1987, the Commonwealth Stabilization Fund has been a key component of the financial stability of Massachusetts. As of recently, it's seen spectacular growth. Why?

The Curious Case of the Missing Stabilization Funds

Stabilization funds are a key component of a municipality's financial strength, yet many towns (including Boston!) report no stabilization funds. Why is this?

The Confounding Massachusetts Estate Tax

The estate tax has become an increasingly significant source of revenue for the Bay State in recent years. Why is this: and is it a good thing?

Massachusetts Needs a Comprehensive Performance Management Framework

Many states have made promoted government efficiency and effectiveness by setting goals and tracking their progress. Massachusetts tried making a performance structure, but in 2014 it was discontinued. Today, the state lacks a comprehensive structure to track progress.

Is a Universal Basic Income the Future? You Decide.

With a rising cost of living, higher inflation, and an economy that generates fierce debates about inequality and poverty, many have called for systemic reforms and even more radical changes, including a universal basic income. What is UBI? How does it work? What do researchers think?