Latest IRS Migration Data Show Exodus from Massachusetts Continues

Just-released IRS data show Massachusetts’ net loss of adjusted gross income to other states remained elevated in 2022, grew four-fold in a decade

Massachusetts shed more than double the amount of adjusted gross income (AGI) in 2022 than any year prior to 2020, making it fifth among states in net AGI out-migration behind only California, New York, Illinois and New Jersey, according to data released Thursday by the Internal Revenue Service.

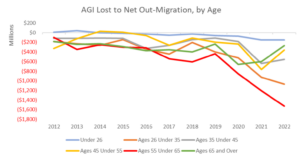

According to IRS data, Massachusetts’ net loss of AGI to other states grew from $900 million in 2012 to $3.9 billion in 2022, representing a four-fold increase. The loss in 2022, a small decline from $4.3 billion in 2021, portends headwinds for the state.

Florida and New Hampshire, two states without income or estate taxes, continue to be the top two destinations for people leaving Massachusetts. In 2022, roughly half of Massachusetts emigrants moved to one of those two states, accounting for 60 percent of total lost AGI.

The largest cohort in terms of flight is 26 to 35 year-olds, with 9,500 more filers leaving than coming into Massachusetts in 2022, more than five times the amount a decade earlier.

“This loss of young talent hinders the state’s future innovation and economic growth, which will compound over decades,” said Pioneer Institute’s Mary Connaughton. “The cost of housing is a leading factor and the recent housing bill is not enough to address this critical challenge. We need more innovative solutions at the local level to adequately boost the state’s housing supply.”

Massachusetts is seeing the biggest net AGI losses among residents aged 55-65. This trend, which is likely to continue as baby boomers reach retirement age, may be exacerbated by the Commonwealth’s onerous estate tax. On a net basis, 4,500 filers left the state, taking with them $1.5 billion in AGI. The net AGI loss from residents aged 55-64 has increased by nearly 15 times between 2012 and 2022.

The 2022 IRS data likely does not reflect the full impact of the income surtax that was approved by voters in November 2022 and went into effect on January 1, 2023. While some taxpayers may have relocated in anticipation of the tax increase and this could be a reason for the uptick in high-income earners leaving Massachusetts in recent years, the full effect of the tax change may not be realized until subsequent years.

Since 2020 there has been an alarming acceleration in AGI loss among high-income earners. Of the wealth lost in 2021, about $2.6 billion—just over 60 percent—was from taxpayers earning $200,000 or more. In 2022 the AGI loss for that income group was $2.2 billion, or 56 percent of total AGI loss.