PFML v. FMLA: To Pay or Not to Pay Leave-Takers

In 1993, Congress enacted the The Family and Medical Leave Act (FMLA), which provided for “…up to 12 weeks of job-protected, unpaid leave in a calendar year for family or medical reasons, or up to 26 weeks of job-protected, unpaid leave in a calendar year to care for a family member in the armed services” (Mass.gov). So, while FMLA does protect an individual’s job should they need to leave for a family or medical reason, it does not provide any pay to supplement losses from being unable to work.

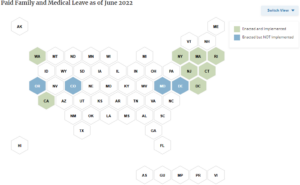

Since the federal FMLA law was enacted, 11 states and Washington D.C. have passed paid family and medical leave laws, including Massachusetts, which passed the Paid Family and Medical Leave Act (PFML) in 2018. This legislation required job protection much like the FMLA; however, it required the leave to be paid for up to 12 weeks for family reasons, up to 20 weeks for medical reasons, and up to 26 weeks for caring for a family member in the military.

Fig. 1. Source: NCSL (2022). Note: This graphic includes only states which provide both paid family and medical leave. The other states which require or provide paid sick leave include Vermont, Arizona, Maine, Michigan, New Hampshire, Nevada, and New Mexico.

The federal and state laws differ in terms of both employer and employee eligibility. A business must meet certain criteria to be required to provide family or medical leave under the federal statute, such as having more than 50 employees, being a public-sector entity, or a public or private school. Meanwhile, the Bay State’s PFML applies more broadly. Institutions can be required to provide both, and must make their employees aware of their rights.

In terms of eligibility, FMLA requires employees to have worked at the entity for at least 12 months and at least 1,250 hours. PFML bases eligibility on income earned, requiring earnings of $5,700 in the previous 12 months at the institution.

Both employers and employees contribute to the replacement of wages. As of 2022, employers who have 25 or more covered employees are required to contribute 0.68 percent of eligible wages to the Department of Family and Medical Leave (DFML). Of this, 0.56 percent of eligible wages contribute to medical leave while the remaining .12 percent go toward family leave.

Employers are required to contribute 0.336 percent of eligible wages, which are used to fund employees’ PFML, and are only allowed to withhold 0.224 percent of eligible wages for the medical leave contribution. However, employers are not required to contribute to family leave; they can withhold up to the whole 0.12 percent from employee wages.

Meanwhile, employers who have 25 or fewer covered employees must contribute only 0.224 percent of eligible wages for medical leave and 0.12 percent for family leave. Notably, this type of employer is not required to contribute to either the medical leave or family leave payments, and can instead withhold up to the required percentage from employees’ wages.

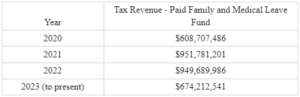

Massachusetts garnered over $608 million in tax revenue from PFML in 2020, which grew to over $951 million in 2021, then fell slightly to $949 million in 2022. Thus far in 2023, the PFML fund has amassed over $674 million.

Fig. 2. Source: MassOpen Books (2020-2023)

The PFML wage replacement maximum weekly benefit was increased to $1,129 in 2023. Calculating an individual’s weekly wage replacement is quite complicated in Massachusetts. It is equal to 80 percent of the employee’s base average weekly wage (AWW) up to 50 percent of the state’s AWW plus 50 percent of the amount of the employee’s AWW which exceeds half of the state’s average.

Notably, the IRS has not yet decided whether PFML benefits are taxable income. Massachusetts has followed their lead by allowing those receiving leave benefits to opt in to withholding taxes with rates set by the Department of Family and Medical Leave: 5 percent for the state and 10 percent for the federal government.

About the Author: Sarah Delano is a Roger Perry Government Transparency Intern at the Pioneer Institute for the summer of 2023. She is a senior studying Political Science at the University of Massachusetts-Amherst.