Tag Archive for: tax policy

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

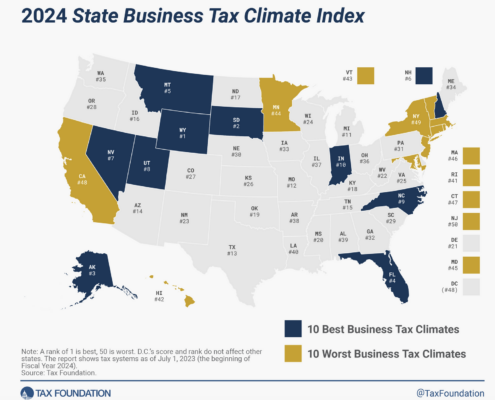

Statement on Massachusetts Falling from 34th to 46th on Tax Foundation’s 2024 Business Tax Climate Index

Massachusetts policymakers should pay close attention to the latest evidence of the Commonwealth’s declining competitiveness. Last week, the Tax Foundation published its 2024 State Business Tax Climate Index, which showed Massachusetts’ ranking falling more than any other state, from 34th to 46th.

Massachusetts is Losing Taxpayers to More Tax-Friendly States

This post explores the difference among tax policies in Massachusetts, New Hampshire, and Florida in order to explain the increasing amount of Massachusetts residents who are migrating from the state. Tax-friendly policies are very alluring to Massachusetts residents, seeing as the state is actually increasing the personal income tax rate rather than try to lower taxes, as both New Hampshire and Florida have done.

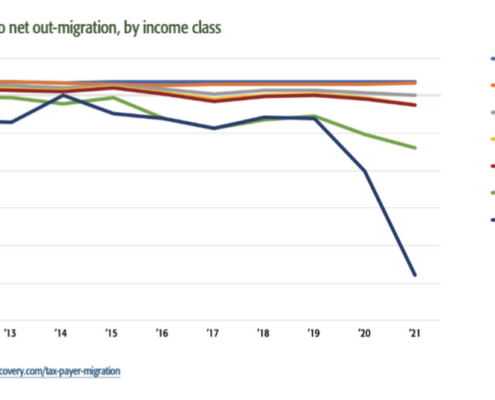

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

Debunking Tax Migration Myths

Provisions of Gov. Healey’s $876 million tax package targeted to higher-income earners — including revisions to the estate tax and a reduction in the tax rate for short-term capital gains — are important for encouraging taxpayers subject to them to remain in Massachusetts, according to a new analysis from Pioneer Institute.

Competition Amongst States: How Tax Policy Drives Residents to Seek Better Value

This week on Hubwonk (our debut video & audio edition), Host Joe Selvaggi talks with research analyst Andrew Mikula about the findings from his recent report, A Timely Tax Cut, in which he explored the relationship between state tax rates and policy and the direction of interstate migration.

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

Study Warns that New Hampshire Tax Policies Would Exacerbate Impacts of a Graduated Income Tax

Drawing on migration patterns between Massachusetts and states like Rhode Island and Tennessee, Pioneer Institute is releasing a study showing a direct correlation between personal income tax rates and household domestic migration patterns between 2004 and 2019. The study suggests that instituting a graduated income tax will shrink the tax base and deter talented workers and innovative employers from coming to and staying in the Bay State.

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.