Public Statement: Pioneer Institute Questions UMass Amherst’s Purchase of Mt. Ida Campus

Between September 2015 and the fall of 2017, Pioneer Institute released a series of reports on the University of Massachusetts that chronicled rising fees and tuition, a flood of new administrative hires, the high salaries of top university brass, the university’s out-of-control capital plans, shaky financial planning premised on recruiting an ever-increasing number of out-of-state students, and its enormous and growing debt load.

Political leaders should take pride in the university system’s hard-won improvements over the last two decades, but they should not ignore the mounting challenges UMass is facing and the reputation that it has earned for empire building. There is a huge bill coming due; one that is not necessary to the future stewardship of a high-quality public system.

Nothing could put the university’s debt challenge and empire building in starker relief than the UMass Trustees’ decision to advance the Amherst campus’s purchase of the 74-acre Newton campus of Mt. Ida College.

At least four questions need to be answered on this matter—and the answers should not come just from UMass. This is an issue where the legislature and the governor’s office must play a leadership role.

- Do the numbers add up?

UMass will be stepping in for an institution that has become insolvent. UMass Amherst’s in-state tuition is approximately half of Mt. Ida’s, and salaries for professors and staff will be higher. Given the increased costs and reduced revenue, it is reasonable to ask how UMass Amherst expects to make the finances work for its satellite campus when Mt. Ida could not. The fact pattern brings to mind the old joke about how “we lose money on every unit, but we make it up in volume.”

Mt Ida was sunk by debt. The real estate deal calls for UMass to assume between $55 million and $70 million of that debt, which would be in addition to the state university’s already skyrocketing debt load, about which rating agencies have already expressed concern. Mt. Ida’s 280 employees will be laid off and receive severance packages. It’s unclear whether UMass is also expected to take on that expense.

The situation bears more than a passing resemblance to UMass’ decision several years ago to merge with the failing Southern New England School of Law. In that case, the university claimed the law school would be self-supporting, but it continues to operate in the red.

- Is the Commonwealth on the hook?

It’s difficult to imagine a scenario other than UMass going to the legislature to seek an additional state subsidy to cover these added expenses. Employees at the satellite campus will be part of the state pension system, creating another expense for Massachusetts taxpayers.

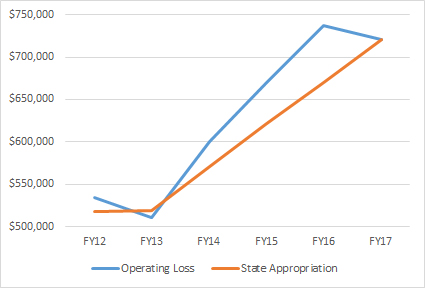

UMass operating loss, state appropriations FY2012-17 (000’s)

Providing discounted higher education is a noble and important mission, but finding the money to fund it could be very challenging when the Commonwealth faces an MBTA maintenance backlog of more than $7 billion, a host of other infrastructure needs, a growing gulf in K-12 funding between affluent and less affluent school districts, and massive pension and retiree health care liabilities.

One wonders if UMass has essentially “gone rogue” with this purchase, putting pressure on lawmakers to increase the university’s subsidy. UMass used to be required to get state permission to borrow for any project that wasn’t self-funded, but that has changed. In the wake of the university system’s rapid expansion and the fiscal crisis at the Boston campus, the Baker administration required UMass to submit its capital plans to the Governor’s Office.

The UMass board approved the Mt. Ida purchase and has presided over a series of irresponsible capital expansions that have driven up the university’s debt load. As the legislature and governor review the proposed purchase of Mt. Ida, they should consider ways to ensure that the board represents both the interests of the university and the Commonwealth. Currently, the board’s make-up is largely weighted toward UMass alumni. Alumni may look at decisions with a built-in bias toward supporting the staff’s evident penchant for empire building.

Political leaders must take stock of the fact that a real estate transaction of this size and financial impact does not require prior approval by the Commonwealth. The closure of Mt. Ida and the UMass Amherst plan to open a satellite campus are subject to approval from the Massachusetts Board of Higher Education, but the real estate deal requires none. It is hard to understand why UMass has the ability to make a unilateral decision on Mt. Ida when the law school deal and any new UMass campus site would come with the requirement of gaining state approval.

- Why is UMass expanding?

A threshold question is why UMass is expanding at a time when the number of college students is declining nationally and the number of high school graduates is expected to fall by 11.4 percent from 2015-16 to 2027-28, according to the Western Interstate Commission for Higher Education. According to Statista.com, U.S. college undergraduate enrollment in public and private colleges has declined from 21.02 million in 2010 to 20.18 million in 2016, a decline of 840,000 students, or 4 percent in six years.

As Pioneer has pointed out previously, UMass has become increasingly dependent on rising state appropriations and expanded revenue from tuition and fees to make up for growing operating losses that stem in large part from its aggressive expansion. The unprecedented number of capital additions over the last decade has resulted in escalating debt that threatens to compromise UMass’ fiscal stability. From FY2005-FY2016, UMass capital spending tripled the university’s outstanding debt from $946 million to $2.9 billion.

The Higher Education Finance Commission stated that the 10-year deferred maintenance needs of the Commonwealth’s 29 higher education campuses, state universities and community colleges—including UMass—is approximately $4.2 billion. In the same report, the commission called for the governor and legislature to enact a $4.2 billion bond bill to address the shortfall.

- What will ultimately happen to the Newton land?

In a bid to remain solvent, Mt. Ida sold a piece of its campus to the Mormon Church. The sale was completed before area residents could object, but they were pushing back against Mt. Ida’s subsequent attempt to sell another parcel to a real estate developer. Local residents were relieved to hear about the UMass purchase, but their relief may be premature.

In 2010, UMass purchased the former Bayside Expo Center at auction for $18.7 million, saying it would use the parcel to expand the Boston campus. But faced with a campus financial crisis and rapid appreciation in the land’s value, UMass has now put the parcel on the market.

The Mt. Ida land is zoned residential by the City of Newton, which could require UMass Amherst to obtain special permits to carry out their plans for the parcel. Given the experience with the Bayside, the value of this prime real estate and rising debt that has resulted from rapid expansion, area residents may ultimately find that UMass Amherst’s real estate purchase does not preclude a future sale to a real estate developer.

Related Research