Public Statement on Massachusetts High Technology Council’s Challenge to the Graduated Income Tax Ballot Language

In a letter released earlier this week, the Massachusetts High Technology Council called for Massachusetts Attorney General Maura Healey to ensure that the language of a tax hike amendment scheduled to appear on the state ballot next year is sufficiently transparent. The Attorney General is charged with presenting an accurate and transparent summary of all ballot initiatives.

If approved by voters, the ballot question would place a 4 percent surtax on households and thousands of Massachusetts businesses that in any one year have income exceeding $1 million. Proponents of the initiative claim the measure would raise an additional $2 billion annually for education and transportation.

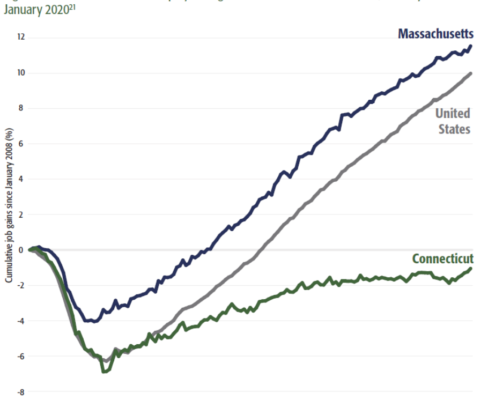

As the MHTC letter and a Pioneer report issued in March demonstrate, the reality isn’t that simple.

In 2018, the SJC struck down an identically worded version of the tax proposal. During oral argument, lawyers for the Attorney General and those arguing that the proposed amendment’s wording was unconstitutional responded affirmatively when the late Chief Justice Ralph Gants asked if, under the proposal, it was possible for legislators to divert current education and transportation funds to other purposes and simply make up the shortfalls with the revenues from the new tax.

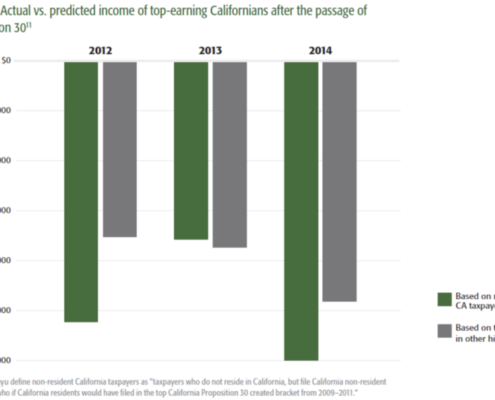

Tellingly, states that have passed new taxes ostensibly meant to increase investments in specific priority areas have done exactly that. In California, which approved a new tax in 2012 supposedly “dedicated” to education, overall education funding remained largely unchanged because funds previously dedicated to education were diverted to other purposes.

In Massachusetts attempts to require that new revenues associated with the tax amendment go to education and transportation have been rebuffed. In fact, state lawmakers have twice rejected proposals to direct all new tax revenues to education and transportation.

People deserve to know what they’re voting for. A description of next year’s ballot initiative that misleads voters into believing that a “yes” vote will automatically increase overall education and transportation funding in Massachusetts falls short of that basic standard.

Get Updates on Our Economic Opportunity Research

Related Posts: