Pioneer Launches Report Series Highlighting Massachusetts Job Growth and Business Trends Since 1998

Report Provides Deeper Insight into Economic Impact of COVID-19

BOSTON – As we learn more about the spread of the COVID-19 pandemic and its impact on the Bay State’s workforce, it is becoming more important that we deepen our understanding of the state’s economy. Knowledge of local, regional, and state employment and business establishments will be critical for policymakers’ efforts to minimize long-term economic fallout.

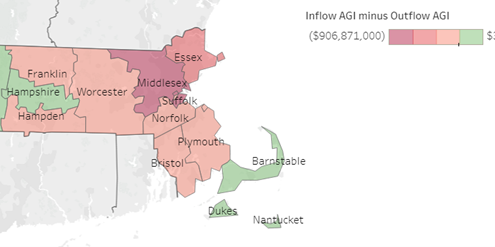

A new resource from Pioneer Institute, MassEconomix.org, equips users to take a much closer look at Massachusetts’ businesses by various levels of geography and industry, and explore job and business growth, from the local to the state level.

A new report from Pioneer Institute that draws on data from MassEconomix shows that levels of employment in Massachusetts had surpassed pre-Great Recession levels as of 2018.

In “Some Big, Broad Economic Trends in Massachusetts,” Pioneer analysis of two decades of data shows fluctuating employment changes across the state, as well as firm size information and the largest employers. While the number of jobs and businesses has risen over the years, the average size of Massachusetts firms has decreased.

“Having access to employment data down to the firm level allows us to view aggregated trends more accurately,” said Rebekah Paxton, a research analyst at Pioneer who has worked with the Business Dynamics Research Consortium (BDRC) data since 2018. “These data give us a unique picture of where growth is coming from in the state.”

“Some Big, Broad Economic Trends” analyzes the same Your-economy Time Series data that powers MassEconomix.org, including firm-level employment, industry code, and location information, to develop aggregated numbers for statewide growth. This data is recorded by Infogroup and compiled by the BDRC at the University of Wisconsin System Institute for Business and Entrepreneurship in Madison, Wisconsin.

This report is the first in a series that will present the general employment and business establishment trends in the Commonwealth that can be found using MassEconomix.

In the coming weeks and months, Pioneer will be providing analysis using this data to provide deeper insight on the Massachusetts economy, and specifically into how the COVID-19 pandemic is likely to affect communities and industries within the state.

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Get Updates on Our Economic Opportunity Research

Visit MassEconomix!

[ytp_video source=”YBmDed3jiwg”]