Why are health care costs rising every year in Massachusetts?

This op-ed originally appeared in The Boston Globe.

The largest driver is the increase in prices by health systems that have the clout to command higher payments and work to recruit more patients to their high-cost facilities.

By Josh Archambault and Barbara Anthony

Can you afford a new car every year? Massachusetts families now pay about $21,000 a year — more than the average cost of a new compact car — in health insurance premiums every year. And that doesn’t include out-of-pocket expenses before insurance kicks in. As a result, middle-class families are spending a record more than 30 percent of their budgets on health care.

Why are health care costs rising every year?

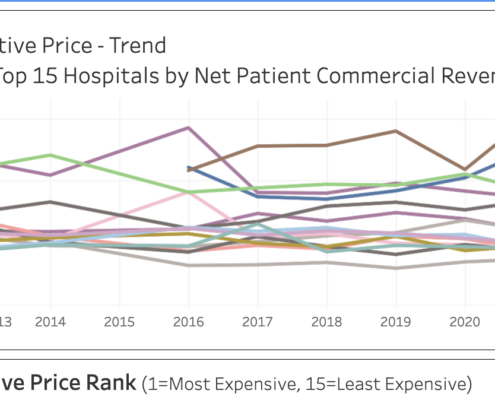

The largest driver is the increase in prices by health systems that have the clout to command higher payments and work to recruit more patients to their high-cost facilities. Unsurprisingly, recent proposals from Mass General Brigham (MGB, formerly Partners HealthCare) and Boston Children’s Hospital, two of the most expensive regional systems, to further expand their footprints outside of Boston have triggered controversy.

Both MGB and Children’s have a long history of charging significantly more for the same services than other hospitals. Both also have a history of buying up physician practices, raising prices, and directing patients into their high-cost facilities.

In 2014 the courts blocked Partners’ plan to expand through the acquisition of rivals. Now MGB appears determined to achieve its goals by constructing new capacity in suburban areas near lower-priced competitors.

MGB and Children’s have submitted paperwork to the state’s Determination of Need program, which determines whether the Commonwealth will grant a permission slip to open, expand, or renovate a facility.

For years, supporters have argued that DON regulations contain health care costs. That is a questionable claim given that a recent Health Policy Commission report highlighting that costs have exceeded the state’s benchmark for growth in the last two years.

A 2021 compact car costs roughly the same as the same model in 2001, and it is now packed with new safety features and technology. During that same period, average family insurance costs have tripled from $7,000 to over $21,000. The quality of outcomes is uneven, and prices vary wildly based on your insurance plan and provider.

A relatively small section of MGB’s plan, related to a proposed expansion of its ambulatory care presence in Westborough, Westwood, Woburn, and in New Hampshire, has garnered great attention. Of the 1,000 comments Massachusetts’ Department of Public Health received, 850 relate to these settings.

A close look at MGB’s massive $2.3 billion proposal shows, however, that 90 percent of the spending is on renovations and expansions at or around its Boston facilities, which sometimes charge rates three times higher than what Medicare pays. Oddly, there is little if any opposition to this grand proposal. So much for the DON process cutting costs.

No doubt, the much smaller MGB expansion into the suburbs has drawn significant political and business opposition.

Less expensive rivals, often community hospitals, fear that MGB will siphon off well-insured patients and potentially put them out of business. In a truly competitive market, less expensive providers that produce similar outcomes will prove to be more attractive to patients. However, our current health care market is anything but competitive, as is evidenced by the fact that the high-priced systems have cut special deals with the major insurers to pay them more.

The DON procedure is expensive, time-consuming, and opaque. New market entrants, who could provide competition and lower prices, lack the financial and political resources that big existing providers have, so seldom do they dare navigate the DON process. Regulators sit as judge and juror as proponents submit consultant reports and cost estimates to bolster their case, and existing providers lobby against their would-be competitors. Patients, who are not considered parties of record, have limited ability to comment on any of the “independent” consultant reports.

Because of potential conflicts of interest, several members of the Public Health Council, the body that will vote on the MGB proposals, are expected to recuse themselves.

The state Department of Public Health and the Health Policy Commission must take a hard look at the impact of these proposals. For far too long, Massachusetts has struggled to tame ever-escalating health care costs.

Determination of Need evaluations may not be a topic at Massachusetts dinner tables, but the state’s decisions will dictate how much money remains in residents’ paychecks, and where and when we receive care. These latest proposals are shining a spotlight on the DON procedure; if it fails to deliver on lowering costs, the process will highlight the need for reform.

Josh Archambault and Barbara Anthony are senior fellows at the Pioneer Institute.

Get Updates On Our Healthcare Cost Transparency Initiative!

Related Posts: