Public Statement: Extend Massachusetts’ Income Tax Filing Deadline

Being Consistent with the Extended Federal Deadline Is in the Public Interest

The consequences for the state budget may be significant, but the impact of not providing tax relief consistent with federal actions may be more severe. The Internal Revenue Service extended the income tax return filing deadline from April 15 to July 15.

Taxpayers already hit with declining paychecks and retirement accounts should not bear the additional interest and penalties stemming from an inability to meet the April 15 deadline, especially when their inability to make those filings in a timely way is largely due to compliance with Coronavirus containment strategies promoted by health officials and governments at all levels. Additionally, given the current economic crisis, money that would be going to the state could instead be used for life’s necessities and work to keep the local economy afloat during the extension period until payments are due in July.

Many rely on tax professionals, lawyers, and others to prepare or provide the information necessary to file their tax returns. Often, a taxpayer will compile a “shoebox” of receipts and cancelled checks, which s/he leaves with a local accountant to sort through and create the tax return. That physical process could actually be dangerous in present circumstances.

Massachusetts’ 2019 Form 1, the state’s income tax return form, includes five items that are drawn from the U.S. 2019 1040. Thus, if Massachusetts does not piggyback on the federal postponement, then taxpayers will effectively have to complete the federal return by April 15, which would be a huge disappointment at this point, although any additional federal taxes due could be postponed until July 15. Additionally, having different deadlines for federal and state taxes create significant inefficiencies for individuals and tax practitioners alike who for decades have filed both returns at the same time.

The Internal Revenue Service and the Treasury Department recognized this burden and extended the deadline. They took it a step further, saying first quarter estimated payments normally due on April 15, would be due on July 15th. Additionally, the agency urged those who would be seeking tax refunds to file as early as possible so they can receive the benefit of having more cash on hand as their paychecks erode.

We do not believe that Massachusetts should simply ask individuals to exercise the option of filing for extensions. To file an extension, one must have the means to estimate his or her liability and pay at least 80 percent of it by April 15, and many taxpayers rely on their accountants or other tax professionals to file their extensions, raising many of the same issues noted above.

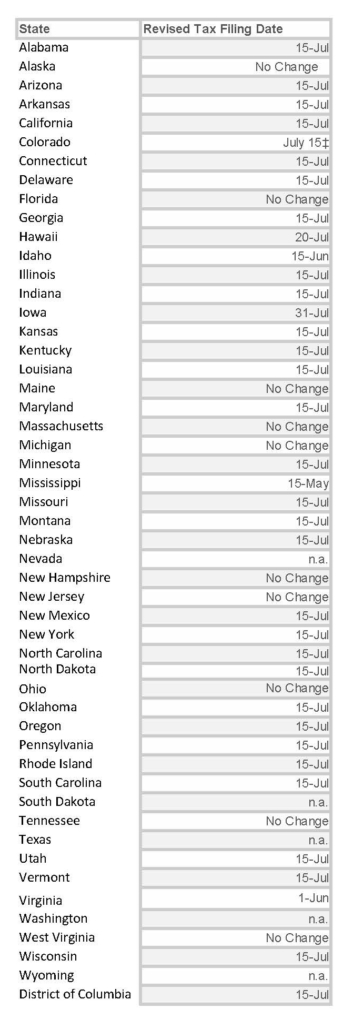

By not extending the filing deadline, Massachusetts is an anomaly. According to the Tax Foundation, 34 of the 41 states that tax income have extended their deadlines. The Commonwealth should be among them.

Below is a state-by-state guide as of March 25, 2020 courtesy of the Tax Foundation:

Get Our COVID-19 News, Tips & Resources!

Related Posts: