Pioneer Statement on Decline in State Revenues

DOR: Massachusetts Revenues Slip Below Prior Year

The Commonwealth’s finances have stumbled hard in recent months, and based on a report the Department of Revenue (DOR) sent to the Legislature in January, the trend shows no signs of easing. Not only is the state staring at a $1 billion shortfall for fiscal year 2024, which ends on June 30, but total year-to-date tax collections through January 12 were nearly 1 percent lower than for the same period last year.

What is startling is that the state’s revenue woes are occurring after the passage and implementation of an amendment to the state Constitution that levies a 4 percent surtax on incomes over $1 million. We don’t yet know how much annual tax revenue the surtax will generate, but some of that tax money has already been collected in the form of quarterly estimated tax payments.

It’s astonishing how quickly the fiscal picture shifted. Just a little over a year ago, the state was so awash in revenue that it triggered a law requiring taxpayers to receive refund checks. The fiscal situation cannot be attributed to a soft economy. With a 3.2 percent unemployment rate that is lower than the national average of 3.7 percent, the state economy looks strong. Externally, the stock market has soared despite high interest rates.

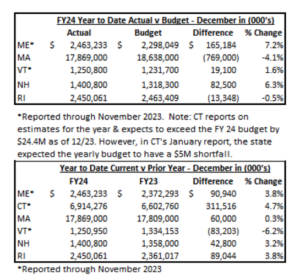

With the exception of Rhode Island, none of our neighboring states experienced shortfalls in revenue compared to budget through December 2023. Based on the most recently reported numbers, all the other New England states except Vermont have enjoyed revenue growth over the prior year. Massachusetts also saw year-over-year revenue growth during that period, but the recent DOR report shows that has changed.

The state’s budgetary woes are exacerbated by the spending side of the ledger. Regarding the current fiscal crisis, Pioneer’s Eileen McAnneny writes:

“The single biggest factor, however, is the unprecedented growth of the state budget since FY2021. The $15 billion increase in state spending contextualizes the seemingly modest projected revenue growth of 1.6 percent for FY2024 by highlighting that the base is very inflated. Budget writers also assumed that 1.6 percent growth rate rather than the median rate of 1.3 percent proffered at the consensus revenue hearing, further inflating tax collection estimates. The sizable growth in state spending makes clear that the spending adjustments required to get the budget in balance will not be ‘cutting to the bone.’”

Though some policy makers have only governed during a period of budget surpluses and the receipt of billions in federal aid, our collective memories cannot be that short. Massachusetts is at risk of returning to the runaway government spending of the 1980s that is fiscally unsustainable and harmful to the state’s economic vibrancy.

After a decade of tax and spend policies gave rise to the “Taxachusetts” moniker, state leaders pulled together to rein in taxes and spending. Tax reforms and pro-growth policies turned the Commonwealth’s economy and fiscal picture around in the mid-1990s. In contrast to Connecticut, Vermont, and Rhode Island, which enacted multiple tax hikes, these strategies propelled Massachusetts to become New England’s leader in economic and job growth.

We must take immediate steps to do that again. This time around the state faces several challenges it did not face back then. The aging of the state’s population is well documented. So too is the loss of prime working-age residents to lower-cost states.

In May 2023, Pioneer reported that between 2019 and 2021, Massachusetts rose from ninth to fourth among the states in net out-migration of wealth, behind only California, New York, and Illinois.

Annual net out-migration of adjusted gross income (AGI) rose almost five-fold, from over $900 million in 2012 to $4.3 billion in 2021. The annual net loss in the number of state income tax filers increased at a similar rate. While the largest age tranche to leave was 55-to-64-year-olds, alarmingly the second largest tranche to leave was 26-to-34-year-olds. While older folks tend to move for a variety of reasons, including high taxes, younger residents typically leave in search of more affordable housing. If we are unable to get our high cost structure under control, that out-migration is likely to continue.

State leaders must prioritize efforts to make Massachusetts more competitive in many areas. Adding to residents’ tax burden to sustain a bloated budget certainly runs counter to that goal and cannot be the solution to closing the budget gap.

Revenue shortfalls may be just the latest harbinger that our long-term fiscal stability is jeopardized. We need a renewed emphasis on fiscal discipline and pro-growth policies to make the state economically competitive again.