Celebrating Leadership: Watch Pioneer’s video tribute to Stephen D. Fantone, former Board Chair

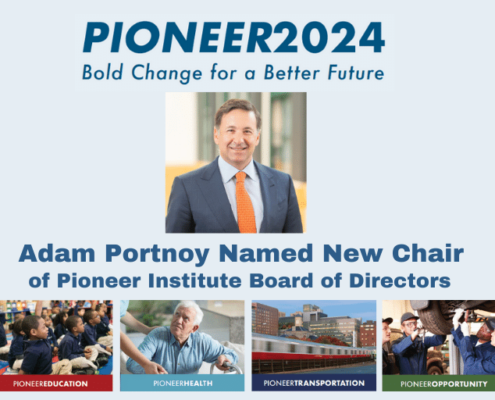

/in Featured, News /by Editorial StaffMany of you know that Pioneer Institute has recently announced a leadership transition regarding its Board of Directors. Stephen D. Fantone, who has served as Board Chair since 2012, has stepped down and passed the torch to Adam Portnoy, who will guide the Institute as it embarks on a new strategic plan, Pioneer2024. As we look forward to our future, we also reflect on our successes, and acknowledge the deep commitment and stewardship that Stephen has shown this organization for almost a decade as Chair and, for many years prior to that, as a Board member and supporter. Stephen will continue to be involved with Pioneer in a new capacity – stay tuned for more information!

We are proud to present a video tribute, below, in which we share with our community Stephen’s reflections on his involvement with Pioneer, along with heartfelt appreciation from an array of Pioneer Board directors and staff members. We hope you enjoy it!

Click on the image below to watch the video:

From all of us at Pioneer, and on behalf of our many supporters, thank you, Stephen, for your extraordinary commitment to this organization!

Learn about membership and giving opportunities with Pioneer!

Recent posts

Report Contrasts State Government and Private Sector Employment Changes During Pandemic

Study Finds Massachusetts Graduated Income Tax May Be a “Blank Check” and Not Increase Funding for Designated Priorities

Report: Proposed Graduated Income Tax Might Not Increase State Education and Transportation Spending

Key Madison Park Program Lags Other State Voc-Techs, but Shows Signs of Improvement

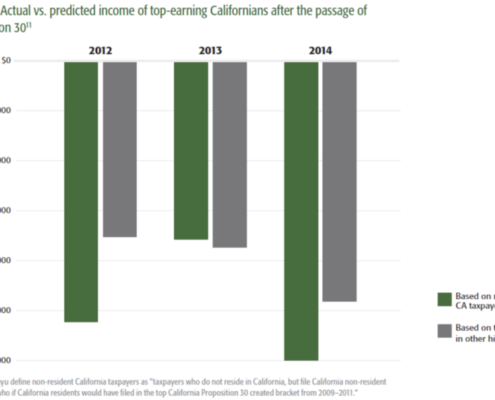

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

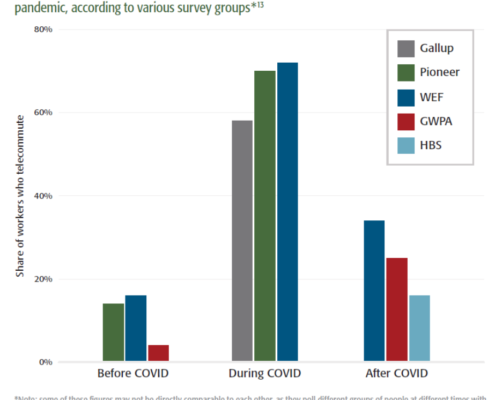

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

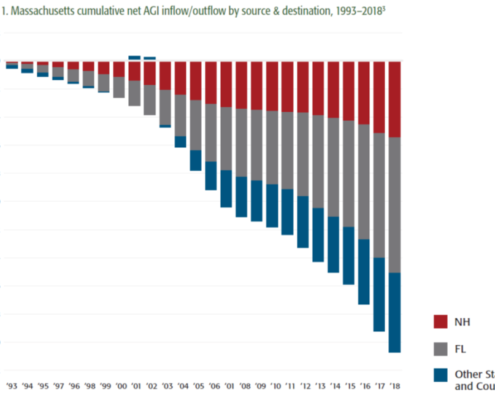

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

New Book Offers Roadmap to Sustainability for Massachusetts Catholic Schools

Study: Massachusetts Should Embrace Direct Healthcare Options

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

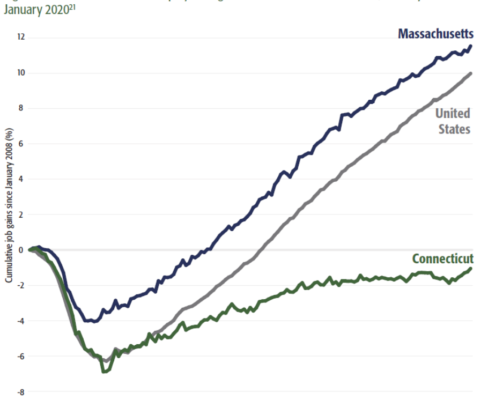

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

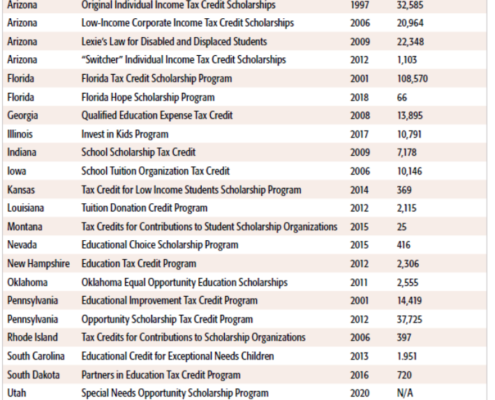

New Study Provides Toolkit for Crafting Education Tax-Credit Scholarship Programs

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

Pioneer Institute Statement on MBTA Service Cuts

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries

Pioneer Report Highlights Pre-Pandemic Employment Growth in Massachusetts’ Hospitality & Food Industry

Pioneer Institute Announces New Chair of the Board